MSCI ACWI vs MSCI ACWI IMI (Investable Market Index)

The MSCI ACWI Index and the MSCI ACWI IMI (Index Investable Market Index) are two of the most followed global stock indices. Many portfolios and investment vehicles are benchmarked to each index.

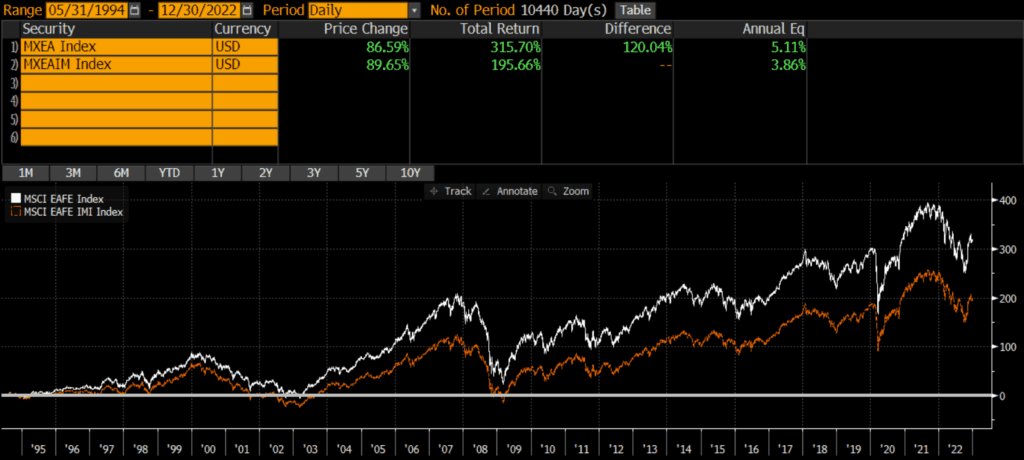

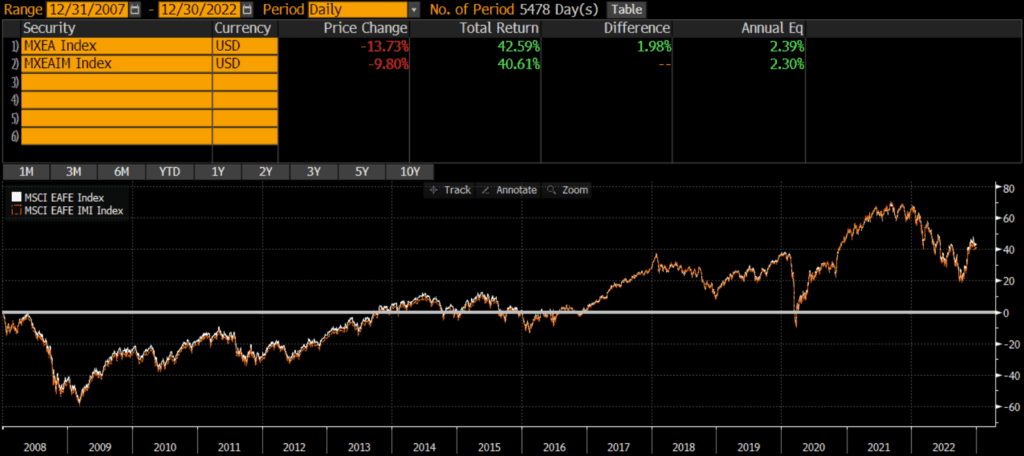

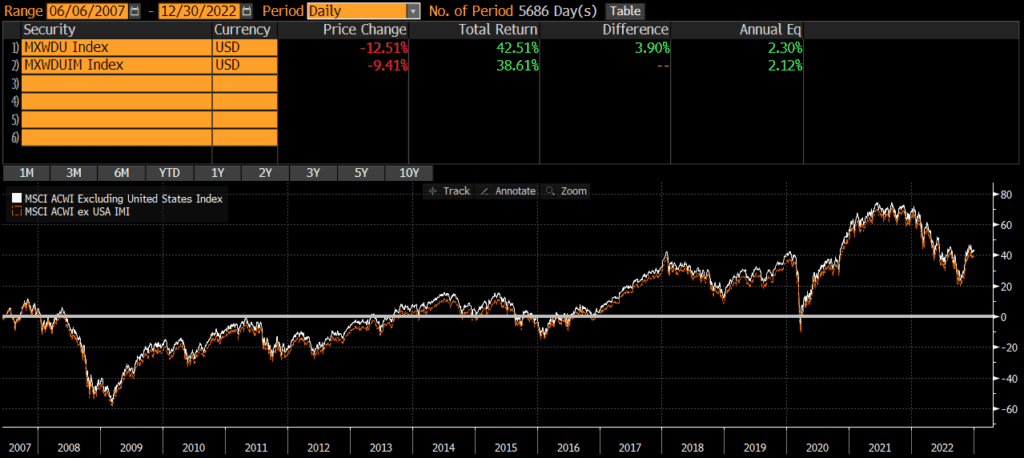

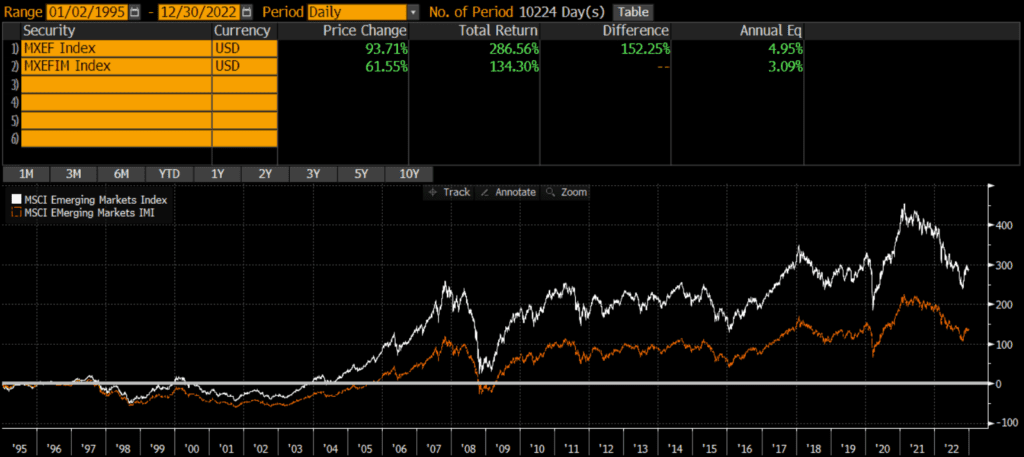

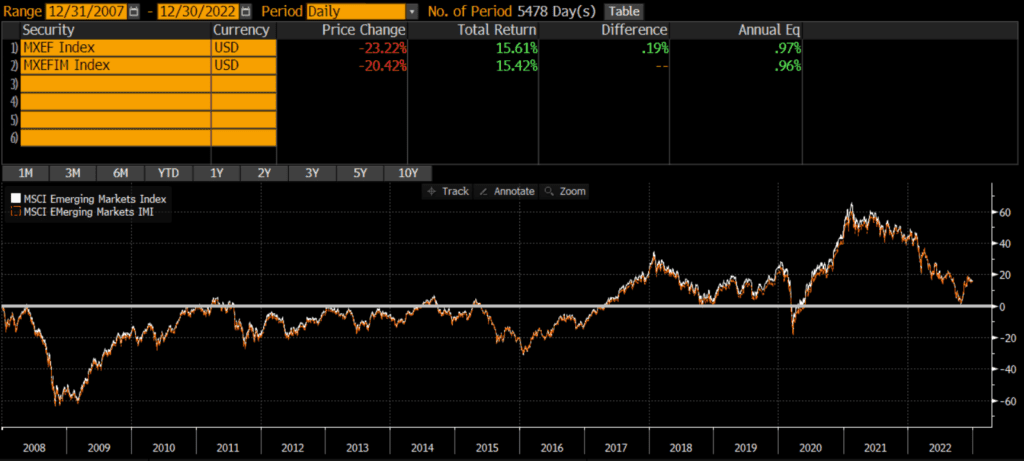

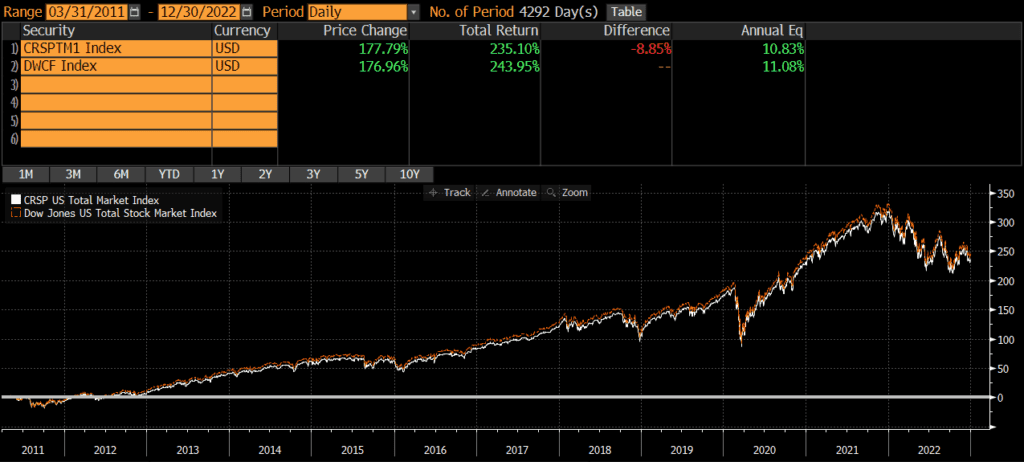

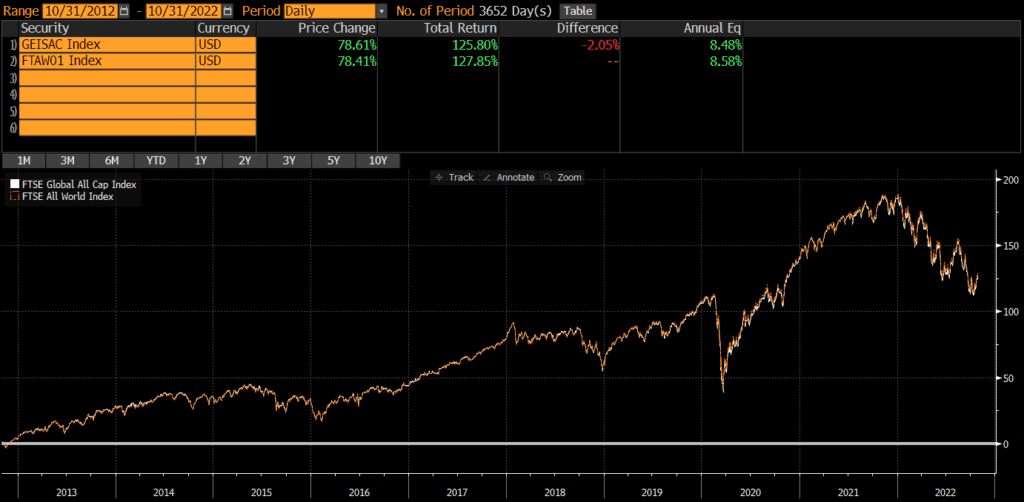

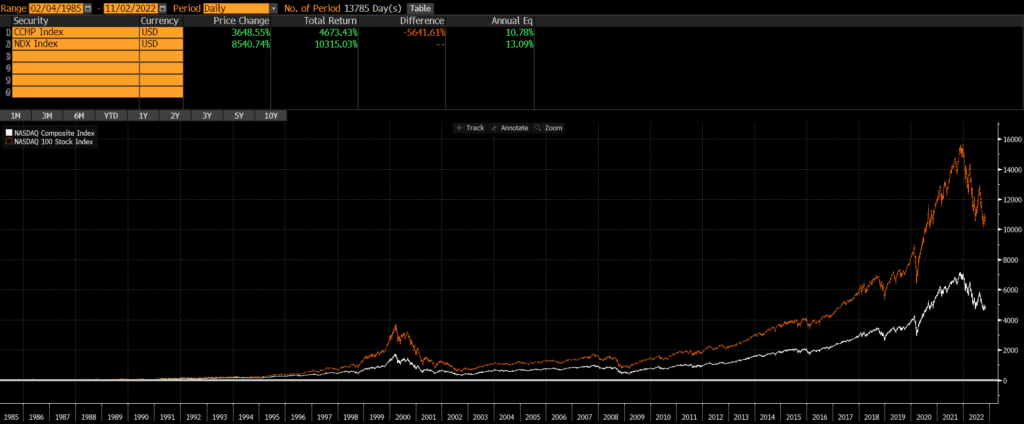

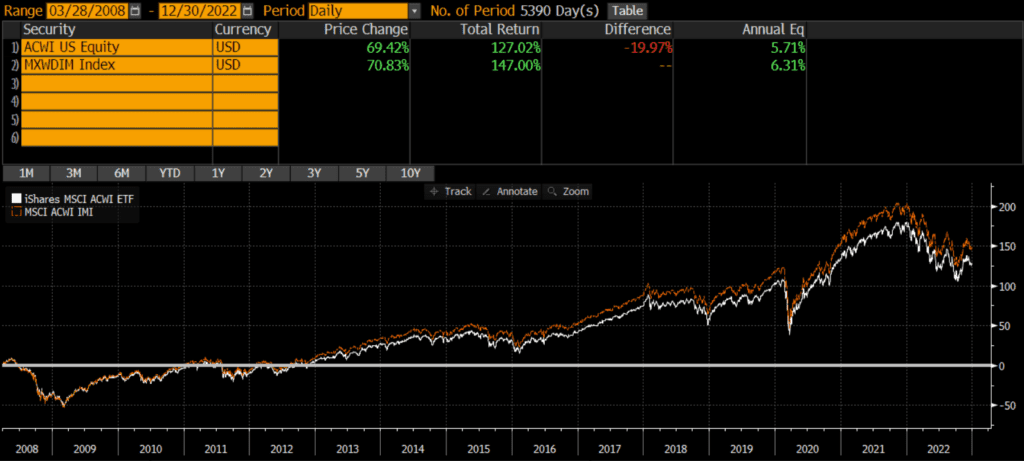

The MSCI ACWI Index and the MSCI ACWI IMI have some slight differences, but performance has been nearly identical. The below performance chart of the MSCI ACWI and MSCI ACWI IMI illustrates that the MSCI ACWI Index has outperformed the IMI version on a backtested basis. However, returns since the MSCI EM IMI’s inception have been nearly identical. This similar to the findings in my analysis of the Russell 1000 vs S&P 500 and MSCI EM vs MSCI EM IMI.

A quick note that investors cannot invest directly in an index. These unmanaged indexes do not reflect management fees and transaction costs that are associated with an investable vehicle, such as the iShares ACWI ETF (symbol: ACWI) or the State Street SPDR Portfolio MSCI Global Stock ETF (symbol: SPGM). A reminder that these are simply examples as this site does NOT provide investment recommendations.

What is the difference between MSCI ACWI and MSCI ACWI IMI?

The MSCI ACWI IMI (Investable Market Index) is similar to the traditional MSCI ACWI Index (non-IMI), but it has many more constituent stocks and includes more exposure to mid-caps and small-caps.

What does MSCI ACWI IMI mean?

The IMI in “MSCI ACWI IMI” stands for “Investable Market Index” and connotes that it includes more stocks than the original ACWI index.

Historical Performance: MSCI ACWI vs MSCI ACWI IMI

The MSCI ACWI Index was launched in 2001, while the MSCI ACWI IMI Index was launched a few years later in 2007. Since inception, the MSCI ACWI IMI has outperformed the original MSCI ACWI Index by .60% per year (5.71% vs 6.31%, respectively). The cumulative performance differential over that time period has been over 20%!

Composition Differences: MSCI ACWI vs MSCI ACWI IMI

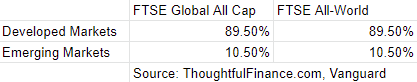

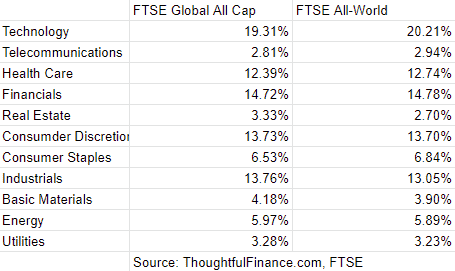

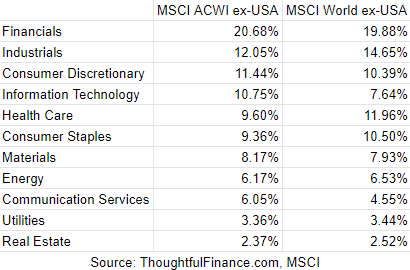

Both the MSCI ACWI vs MSCI ACWI IMI indices are broad-based indices that represent the equity markets of developed nations. As of 12/31/2022, the indices have similar geographic exposures, similar sector weights, and slightly different market cap exposures.

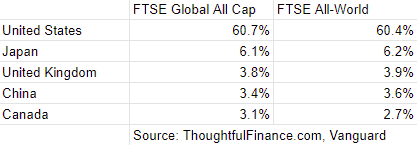

Geography

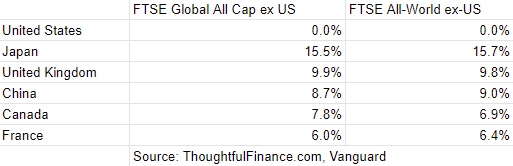

The MSCI ACWI index and the ACWI IMI have identical country constituents, although the weight vary ever so slightly. Below are the weights of the top five countries.

| MSCI ACWI Index | MSCI ACWI Investable Market Index | |

| US | 60.37% | 59.35% |

| Japan | 5.56% | 6.1% |

| United Kingdom | 3.87% | 3.98% |

| China | 3.63% | 3.35% |

| Canada | 3.06% | 3.12% |

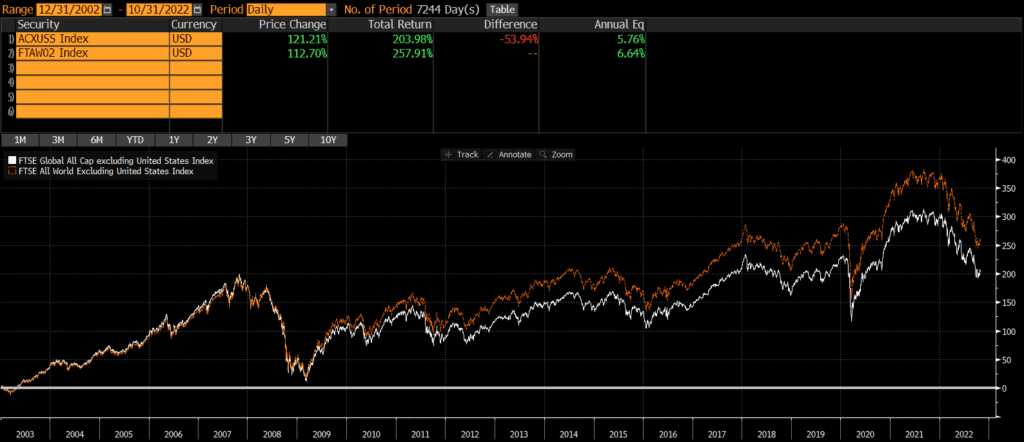

Both indices include both developed and emerging markets, which helpful since each have had periods of outperformance.

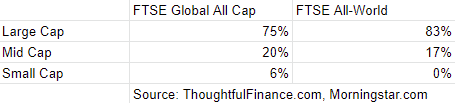

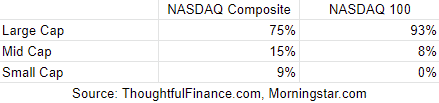

Market Capitalization

One of the main differences between the two indices is that the MSCI ACWI Investable Market Index (IMI) has many more constituents that the original MSCI ACWI Index. According to MSCI, the number of constituents is as follows:

| MSCI ACWI Index | MSCI ACWI IMI Index | |

| Constituent Stocks | 2,885 | 9,154 |

Additionally, the two indices have slightly different market cap exposures. Using the iShares ACWI ETF (which tracks the MSCI ACWI Index) (symbol ACWI) and the State Street SPDR Portfolio MSCI Global Stock ETF (which tracks the MSCI ACWI IMI Index) (symbol SPGM) as proxies, we can infer the below market cap weights of each index.

| MSCI ACWI Index | MSCI ACWI IMI Index | |

| Large Cap | 85% | 81% |

| Mid Cap | 16% | 14% |

| Small Cap | 0% | 6% |

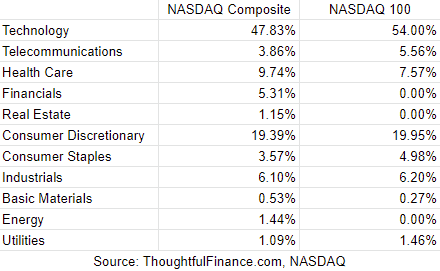

Sector Weights

Again, using ACWI and SPGM as proxies, we can infer the index weights are very similar.

| MSCI ACWI IMI | MSCI ACWI Index | |

| Basic Materials | 5.01% | 4.86% |

| Consumer Cyclical | 10.50% | 10.43% |

| Financial Services | 16.50% | 15.49% |

| Real Estate | 2.74% | 3.28% |

| Communication Services | 7.14% | 7.25% |

| Energy | 5.49% | 5.62% |

| Industrials | 10.19% | 12.21% |

| Technology | 18.81% | 18.46% |

| Consumer Defensive | 7.67% | 7.18% |

| Healthcare | 12.93% | 12.90% |

| Utilities | 3.02% | 2.32% |

Final Thoughts on MSCI ACWI Index vs ACWI IMI

Investors cannot invest in indices directly and should do their own research before deciding to invest in a fund that tracks either index. That being said, these two indices appear nearly identical in terms of geographic, market cap, and sector exposure. For all intents and purposes, I would argue that these two benchmarks are interchangeable.

With such a small performance difference, the costs of actual investment strategies/vehicles may be a larger consideration than which benchmark to select. Sometimes benchmark selection matters quite a bit, although that does not appear to be the case between these two indices. Interested readers may want to read my review of ACWI, the best known MSCI ACWI index fund.