Many US investors allocate to international stocks, but there is no clear consensus on whether it is better to allocate to developed markets vs emerging markets or in what proportions. Below is some data and some thoughts on this question.

The term “international” often refers to the developed market stocks, while “emerging” refers to stocks from emerging markets. Our analysis will focus on the MSCI EAFE Index (since it is the most popular, even though there are other indices with arguably better coverage) for developed markets and the MSCI Emerging Markets Index for emerging markets.

Performance: Developed Markets vs Emerging Markets

Since inception, emerging markets have outperformed developed markets by a wide margin. The annualized performance of 8.78% is nearly double developed markets’ annualized performance of 4.87%. However, the past 35 years is a story in two acts.

The first 20 years of performance

For the first 20 years, returns for both developed and emerging stocks were elevated with emerging markets returning 15.04% annually versus developed markets 7.19% annually.

Recent historical performance

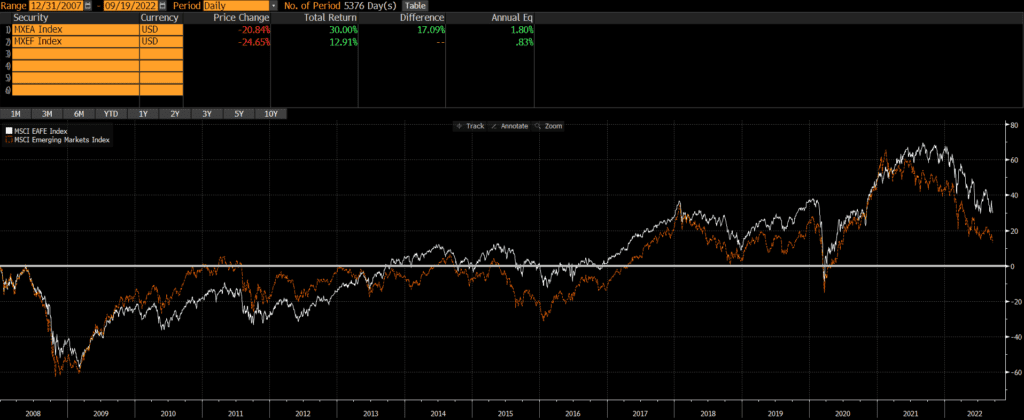

Both developed and emerging markets were hammered from 2007 to 2009 and both have exhibited low annualized returns since. Developed markets have returned an annualized 1.8% since the end of 2007, while the emerging markets have only returned an annualized .83% since. So developed has actually outperformed emerging markets in the second act.

Risks

In my (and many others’) analysis, most of the volatility (for US investors) in international stocks comes from the currency risk. As the above chart shows, the volatility and drawdowns in emerging markets are not that much more than in developed markets.

Composition

When looking at the global market cap, developed markets typically account for 25-30% and emerging markets often range from 10-15%. The percentages fluctuate due to the relative performance of the regions. Each of these indices also is primarily composed or large-caps, so we are comparing apples to apples.

Verdict

It is clear that investing in emerging markets stocks would have been more beneficial over the long-term. Recent performance complicates that decision a bit. Just as stock market returns are “lumpy” and factor returns are lumpy, the outperformance and underperformance of international stocks is lumpy and time dependent. Of course, it is anyone’s guess about what the future holds. My personal opinion is that since emerging markets has had periods of massive outperformance without much additional volatility, I personally overweight emerging market exposure and underweight developed market exposure.

FAQs

Do emerging markets outperform developed markets?

As the charts show, emerging markets have outperformed by a wide margin since inception. This was primarily driven by emerging market outperformance in the first 20 years, even though developed markets have slightly outperformed recently.

Do emerging markets have higher returns?

Emerging markets have had higher returns historically, relative to developed markets outside the US. However, this dynamic may or may not continue in the future. Emerging markets had higher returns than developed international markets from 1987 through 2007, but they have had lower returns since then.

Why are emerging markets riskier than developed markets?

Emerging market stocks tends to be more volatile due to less liquidity and more extreme currency fluctuations, among other factors. There is an additional factors that emerging markets are more vulnerable to various geopolitical and economic shocks and a lower degree of rule of law. This is why diversification is very important when investing in emerging markets.

What are the 5 biggest emerging markets?

The five largest emerging markets by market cap are:

- China

- Taiwan

- India

- South Korea

- Brazil

Do emerging markets benefit from inflation?

Some emerging markets benefit from inflation, while others do not. It depends on what is inflating and whether that market is a producer or consumer of that good or service. For instance, if oil prices rise, it may be good for Saudi Arabia (an oil producer) and bad for India (an oil importer).