The iShares MSCI ACWI ETF (symbol: ACWI) is one of the largest exchange-traded funds (ETFs) in the market and widely used by investors for exposure to global stocks. ACWI is a low-cost index fund, which tracks the MSCI ACWI (All Country World Index) Index. As its name implies, it seeks to provide exposure to the global stock market in a single vehicle. The fund is the core of many portfolios and the below review of ACWI will evaluate why that is.

A quick reminder that this site does NOT provide investment recommendations. Fund reviews (such as this one) are for educational purposes only and are not advice or recommendations.

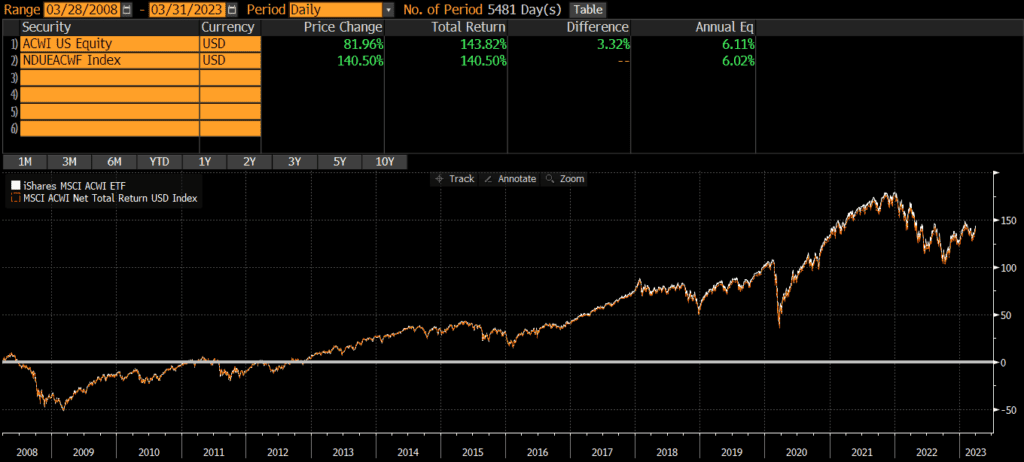

ACWI Performance

The first thing most investors want to know about is performance, so we will start there. According to Bloomberg, since the fund’s inception 15 years ago, ACWI has returned over 6% per year. Of course, this figure can go up or down and the returns in any single year are unlikely to be 6%. From 2009 through 2022 (14 years), ACWI was up in 10 years and down in 4 years. The average return in the up years was 18.2%, while the average return in the down years was -9.4%.

ACWI Risks

ACWI owns stocks which are more volatile than cash or bonds. While the returns are higher than cash or bonds, investors need to be prepared to stomach volatility and be able to hold for the longer-term. ACWI was down over 55% during the global financial crisis in 2007-2009 and dropped by a third during the covid pandemic. This is not necessarily worse than other similar funds, but it is a characteristic of stocks that investors need to be aware of.

ACWI Portfolio

Fund performance is ultimately driven by a fund’s holdings and exposures, so our ACWI review will examine these items.

ACWI Holdings

ACWI (and its underlying index) is incredibly diversified, holding over 2,000 stocks. This represents quite a bit of the global investable market.

| ACWI | CRSP US Total Market Index | |

| Number of Stocks | 2,375 | 2,884 |

ACWI Country Exposures

ACWI only stocks in dozens of countries, including both developed and emerging markets. Below are the top 10 country exposures, which is consistent with global market capitalizations.

| United States | 60.25% |

| Japan | 5.45% |

| UK | 3.74% |

| China | 3.57% |

| France | 3.19% |

| Canada | 2.95% |

| Switzerland | 2.53% |

| Germany | 2.17% |

| Australia | 1.90% |

| Taiwan | 1.67% |

ACWI Market Cap Exposure

ACWI is a global fund which seeks to represent the global stock market, which is predominantly composed of large-caps. Even though the fund holds mid-caps, performance is primarily driven by the large-cap exposure.

| ACWI | |

| Large-Cap | 84% |

| Mid-Cap | 16% |

| Small-Cap | 0% |

ACWI Sector Exposures

ACWI is extremely diversified across sectors and mirrors the approximate weights of the broad US stock market.

| ACWI | |

| Basic Materials | 4.67% |

| Consumer Cyclical | 10.63% |

| Financial Services | 15.23% |

| Real Estate | 2.53% |

| Communication Services | 7.33% |

| Energy | 4.93% |

| Industrials | 10.29% |

| Technology | 20.95% |

| Consumer Defensive | 7.79% |

| Healthcare | 12.70% |

| Utilities | 2.94% |

Expenses

No review of ACWI would be complete without an in-depth look at the explicit and implicit costs of trading and holding ACWI.

ACWI Expense Ratio

ACWI’s expense ratio of .32% is not especially low for an index ETF, but it is a global fund (and ETFs with international holdings generally cost more) and has very few competitors. Of course, it may be difficult to get global exposure in a single ETF for much cheaper.

ACWI Transaction Costs

ETFs are free to trade at many brokers and custodians, so ACWI should be free to trade in most cases. Additionally, it is among the largest ETFs and is very liquid. The bid-ask spread of ACWI is about .01%, so individual investor trades will not generally be large enough to impact or move the market.

ACWI Tax Efficiency

Like most index funds, ACWI is very tax-efficient. Unlike actively-managed funds, passively-managed index funds typically have less trading and lower turnover. This results in fewer taxable events and higher tax efficiency.

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). ACWI has never made a capital gains distribution, so ACWI is about as tax-efficient as any fund can be.

Investors in a high tax bracket with at least $250,000 may consider direct indexing rather than ACWI, as direct indexing can potentially generate even more tax savings.

ACWI Review: A Recap

The above review of ACWI illustrates that ACWI is a well-constructed, low-cost and tax-efficient index fund that provides diversified exposure to the global stock market. Investors looking to own the global stock market in a single ETF should consider ACWI.

FAQ’s

Is ACWI a good investment?

Whether ACWI is a good investment or not depends on the definition of “good investment.” If the definition is something that goes up in value, then nobody knows if it is a good investment. If the definition is a well-constructed portfolio that is low-cost and will likely do what it is supposed to do (mirror the global stock market), then yes it is a good investment.

Is ACWI safe long-term?

There is no way to say whether ACWI or any other investment is safe long-term. ACWI owns stocks, which are more volatile than cash or bonds. However, stocks have generated stronger long-term returns than cash or bonds. However, the future may unfold differently than the past, so it is impossible to say whether ACWI is safe in the long-term.

Is ACWI a risky investment?

ACWI owns stocks, which are more volatile than cash or bonds. Some of this risk is diversified away since ACWI owns thousands of stocks, so there is not too much risk or concentration in any single stock. ACWI is a well-diversified, low-cost index fund, so it is not any more risky than most stock funds.

Is ACWI a buy or sell right now?

Nobody knows the future nor whether ACWI is a buy or sell. ACWI is an index fund and many investors use index funds because they do not believe that investors can consistently time the market or predict the ideal times to buy and sell.

Is ACWI a good ETF to invest in?

The answer to this question depends on each investors’ goals. Investors looking for well-diversified, low-cost, tax-efficient exposure to the global stock market will find a lot to like in ACWI. However, ACWI is not a good ETF to invest in for those looking for something totally different.

Is ACWI good for beginners?

For investors looking for exposure to the broad global stock market, ACWI is not a bad choice. It can be the core position of a portfolio and provides instant diversification to investors who are building a portfolio.

Does ACWI pay dividends?

Yes, ACWI pays dividends. It is not necessarily a dividend-oriented fund and I would advise investors to focus on total return since dividends reduce a fund’s net asset value. In my view, receiving a dividend is equivalent to selling a small amount of the position. Investors should not focus on ACWI’s dividends or dividend yield.