VUG vs VTI: Which ETF is Better?

VTI is one of the largest ETFs and is a core holding of many portfolios, while VUG is a popular “factor” ETF. In this context, factors are quantitative characteristics that index providers assign to stocks. In this case, VUG targets growth stocks (as they are defined by the index provider). Even though VTI and VUG play different roles in a portfolio, many investors compare the two funds in order to determine whether they should tilt their portfolio towards a factor or to benchmark a factor’s performance. Please read on for a comparison of VUG vs VTI.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

VUG only owns large-cap stocks that are classified as growth stocks. VTI owns a more diverse portfolio of all market caps and investment styles. Historical performance has been similar, but will depend on how the growth factor performs moving forward.

The Long Answer

Historical Performance: VUG vs VTI

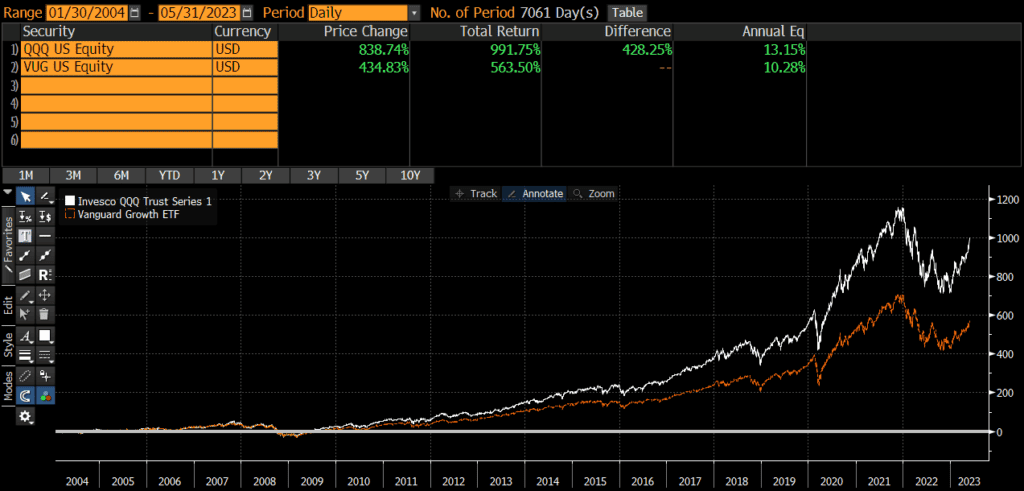

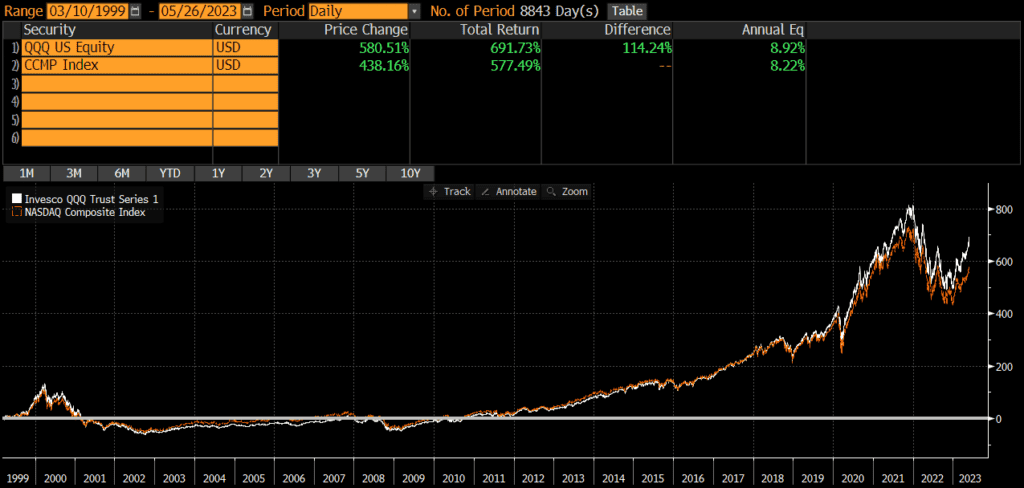

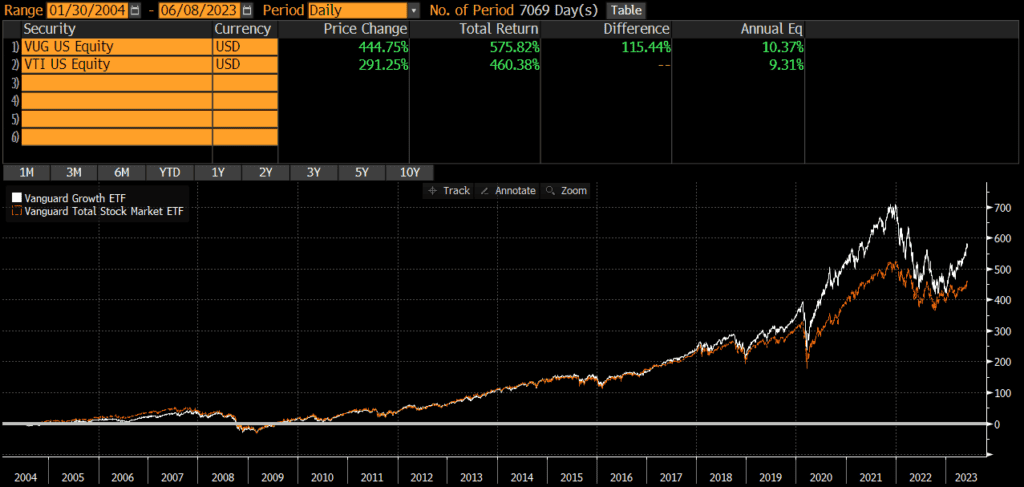

Since their common inception in 2004, performance has been relatively similar with an annualized difference of roughly 1%. This has compounded over time though and the cumulative performance differential is about 115%!

As the VUG vs VTI chart shows, the growth factor has really outperformed the broader market since their common inception. However, this did change in 2022 as lines begin to converge again. It is anyone’s guess whether growth or value will perform better in the future.

Differences Between VUG and VTI

The primary difference between these two funds is that VUG tracks the CRSP US Large Cap Growth Index, while VTI tracks the broader CRSP US Total Market Index.

Geographic Exposure

Both VUG and VTI hold essentially 100% US stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical country exposures.

Market Cap Exposure

Overall, the market cap exposures of VUG and VTI are relatively similar.

| VUG | VTI | |

| Large Cap | 87% | 72% |

| Mid Cap | 13% | 20% |

| Small Cap | 0% | 9% |

Sector Weights

There are some significant differences in sector weights, which makes sense based on the fact that VUG is targeting the growth factor and some sectors meet the growth factor criteria more easily.

| VUG | VTI | |

| Basic Materials | 1.88% | 2.56% |

| Consumer Cyclical | 16.93% | 10.39% |

| Financial Services | 6.53% | 12.79% |

| Real Estate | 2.20% | 3.29% |

| Communication Services | 11.34% | 7.61% |

| Energy | 1.40% | 5.06% |

| Industrials | 4.05% | 8.76% |

| Technology | 43.61% | 23.76% |

| Consumer Defensive | 2.65% | 7.13% |

| Health Care | 9.42% | 14.75% |

| Utilities | 0.00% | 2.94% |

Expenses

VUG’s expense ratio is .04%, while VTI’s expense ratio is .03%. Yes, VUG is .33% more expensive than VTI, but we’re talking about 1 basis point! This in an non-issue in my opinion.

Transaction Costs

ETFs are free to trade at many brokers and custodians, so both VUG and VTI should be free to trade in most cases. Additionally, these funds are among the largest ETFs and are very liquid. The bid-ask spread of both VUG and VTI is very low, so individual investor trades will not generally be large enough to “move” the market.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). Neither VUG nor VTI has ever made a capital gains distribution (nor do I expect them to moving forward). Thus, these funds are about as tax-efficient as any fund can be and either fund is appropriate in taxable accounts.

Final Thoughts: VUG vs VTI

Both funds are great ETFs that do what they are designed to do. Generally speaking, I do not think factor ETFs should be the core of a portfolio. For a core position, I would personally choose VTI every time. However, investors looking for a satellite position in order to tilt their portfolio towards growth could do a lot worse than using VUG (although some may get similar results with something like QQQ). At the end of the day, these two funds are not necessarily comparable because they play very different roles in a portfolio.

Curious readers who want to read about VUG value-oriented counterpart can read my comparison of VTV vs VTI here.