QQQ vs QQQM

The Invesco QQQ Trust (QQQ) and the Invesco Nasdaq 100 ETF (QQQM) are two of the largest ETFs in existence and both are sponsored by Invesco. As their names suggest, QQQ and QQQM are a core holding of many portfolios. Many investors compare QQQ vs QQQM in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

QQQ and QQQM are nearly identical is almost every way, although QQQM is slightly less expensive. In my opinion, 5 basis points is not material and I consider these two funds identical and interchangeable. The only exception would be if someone is utilizing options, as QQQ has a much more active options market.

The Longer Answer

These funds are identical in nearly every way, except QQQ is just slightly more expensive.

History of QQQ and QQQM

QQQ was the first Nasdaq 100 ETF (as well as the first tech-oriented ETF) to launch, back in 1999. This first mover advantage gave it an edge in accumulating assets under management (AUM) and became the liquid vehicle of choice for traders. Even as other Nasdaq and tech-oriented ETFs launched and competitors engaged in cutting fees, QQQ was able to command premium fees due its size and liquidity. However, other sponsors were able to begin capturing market share with ever decreasing costs. Invesco needed to respond with a lower cost option, but did not want to sacrifice their golden goose QQQ. So rather than cut QQQ’s fees, they launched QQQM at a lower fee level. Essentially, they created QQQM to compete with QQQ’s competitors without giving up the higher fees that QQQ was collecting. This is similar to what iShares did with EEM and IEMG or EFA and IEFA.

Investors looking for Nasdaq Composite exposure rather than Nasdaq 100 exposure may interested in my post comparing ONEQ vs FNCMX.

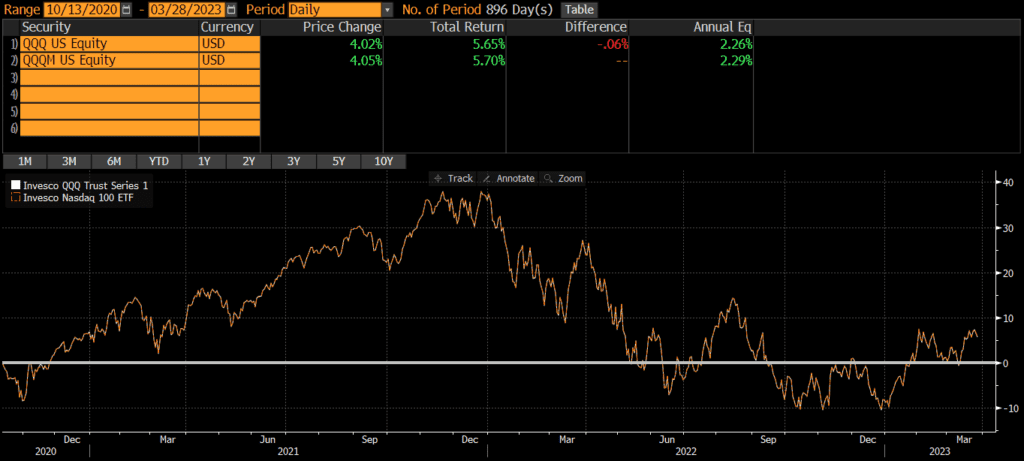

Historical Performance: QQQ vs QQQM

Since QQQM’s launch in October 2020, it has outperformed QQQ by .03% annually. This has mostly been driven by the fee differential of .05%. Again, I view these two funds are identical.

Differences Between QQQ and QQQM

These two funds are identical in nearly every way.

Geographic Exposure

QQQ and QQQM track the same Nasdaq 100 index and substantially all of the holdings are US-based companies.

Market Cap Exposure

The market cap exposures of QQQ and QQQM are identical, which is not surprising since they track the same index.

| QQQ & QQQM | |

| Large Cap | 94% |

| Mid Cap | 6% |

| Small Cap | 0% |

Sector Weights

The sector weights between QQQ and QQQM are identical as well.

| QQQ & QQQM | |

| Basic Materials | 0.00% |

| Consumer Cyclical | 14.89% |

| Financial Services | 0.66% |

| Real Estate | 0.22% |

| Communication Services | 16.51% |

| Energy | 0.41% |

| Industrials | 3.89% |

| Technology | 49.80% |

| Consumer Defensive | 5.89% |

| Healthcare | 6.57% |

| Utilities | 1.16% |

Transaction Costs

Both QQQ and QQQM are free to trade on many platforms. These are two of the largest and most liquid ETFs, so the bid-ask spreads are extremely low too.

Expenses

QQQ sports an .20% expense ratio, while QQQM has a slightly lower expense ratio at .15%. In other words, QQQ is 33% more expensive or 5 basis points more expensive than QQQM. That being said, I do consider 5 basis points to be a material cost or difference in this case.

Tax Efficiency & Capital Gain Distributions

As with most equity ETFs, neither QQQ nor QQQM makes capital gains distributions. Therefore, both funds are about as tax-efficient as can be.

Options Strategies

QQQ has a much more liquid options market, so any options-related strategies may call for QQQ rather than QQQM.

Final Thoughts: QQQ vs QQQM

Both QQQ and QQQM are large, core funds sponsored and managed by one of the largest asset managers in the world. Additionally, their underlying portfolios are identical and the two funds move in sync. Unless an investor is utilizing an options strategy, I do not think it matters whether someone chooses QQQ or QQQM.

Further Reading

Investors looking for a Nasdaq Composite index vehicle (rather than a Nasdaq 100 index fund) should read my post comparing QQQ and ONEQ or the lower-cost version QQQM vs ONEQ.