Selling covered calls is a popular options strategy pursued by many individual investors, who often believe it is a good strategy to generate additional income from their stock portfolio. While this is true in certain circumstances, individual investors often misunderstand aspects of covered calls strategies and/or ignore covered call risks.

In their paper “Covered Call Strategies: One Fact and Eight Myths”, Roni Israelov and Lars N. Nielsen provide valuable insights on these risks and debunk several common misconceptions about covered calls. Much of the below is a summary of their seminal paper. It is worth noting that Israelov and Nielsen were both Principals at AQR, one of the most esteemed quantitative asset managers.

I believe it is crucial for covered call investors to understand the underlying risks, differentiate between facts and myths, and assess the potential impact on their portfolios. With accurate information and a clear understanding of the strategy, investors can make informed decisions on whether to incorporate covered calls into their overall investment approach.

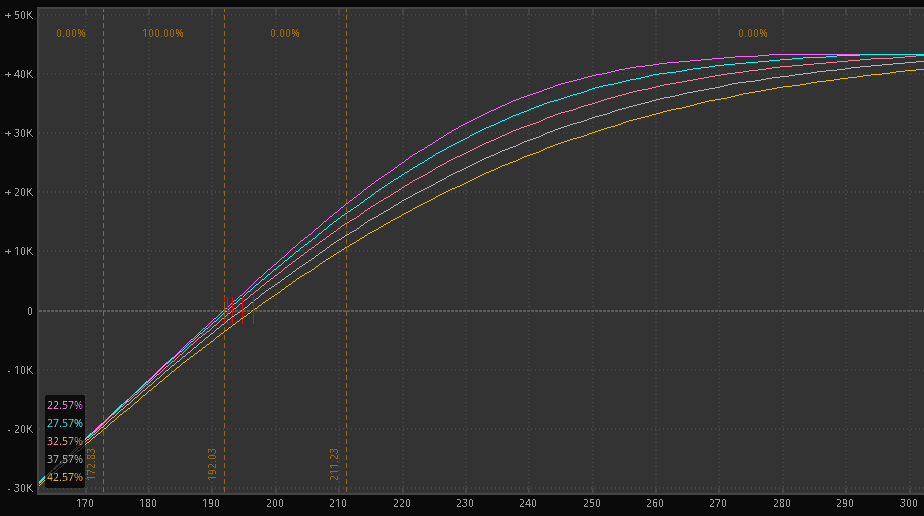

Risk Cannot Be Expressed in a Payoff Diagram

Many investors mistakenly believe that risk exposure in covered call strategies can be easily expressed in a payoff diagram. However, these payoff diagrams typically only represents the potential gains and losses from an options position at expiration. Although informative, these diagrams have limitations when it comes to illustrating the true risk exposure of covered call strategies.

As mentioned above, options values and strategies are path-dependent, so the point-in-time payoff diagrams are not necessarily that helpful. There is software and online tools that can model risk and generate payoff diagrams at different points in time though.

Covered call strategies also involve the interplay between the underlying stock and the written call option, which requires the simultaneous management of both the stock and the option. This relationship is dynamic, and risk exposure can change significantly as market conditions evolve. Payoff diagrams are unable to capture these intricacies and fluctuations in risk, although there is software that can model these relationships and diagrams at different levels of prices and volatilities.

While payoff diagrams are useful in understanding the basic structure of an options position, they cannot fully express the risk exposure in covered call strategies. Investors should be aware of these limitations and rely on more comprehensive tools and analysis to manage risk effectively in their portfolios.

Covered Calls Do Not Provide Downside Protection

One misconception regarding covered calls is that they provide investors with some downside risk. While that is technically true, the protection is limited to the premium received from selling the call option. If the stock’s price suffers a severe decline, the premium from the call option will likely not be enough to cover the losses incurred by the stock’s decline. Moreover, the call option seller would still be exposed to any further losses beyond the initial premium collected.

A primary benefit of a covered call strategy is the additional income generated by selling the call option contract. This income can act as a buffer against minor stock price fluctuations; in other words, this income is the same as the downside risk protection. However, this minimal amount of downside protection comes with a potential cost. The potential cost/risk is that covered calls may cap potential gains on the underlying stock. When an investor writes a call option, they agree to sell the stock at the strike price, even if the stock price soars beyond that. In such cases, the call option seller would miss out on the full extent of the stock’s growth potential.

It is important to remember that covered call strategies should be employed thoughtfully, as they marginally help in downside scenarios and can really hinder performance in upside scenarios.

Covered Calls Do Not Generate Income

Covered calls are a popular options strategy used by investors to generate income in the form of options premiums. However, there is a misconception that premium received is actually income.

Income is revenue minus cost, as Israelov and Nielsen note. The options premium received is revenue, not income. If and/or when the call is bought back, that cost must be subtracted from the revenue. If the underlying stock moves up in price, that the income is likely to decrease and may even flip to negative number. In those cases, the income is actually negative as costs exceed the original premium received.

Additionally, the tax implications of generating income from options premiums can be complex, further complicating the income generation aspect of this strategy.

While covered calls can be a useful tool for generating income, investors must recognize the inherent risks and limitations associated with this strategy. As noted, it is essential to approach covered calls with a comprehensive understanding of the strategy and its potential outcomes to maximize its benefits and minimize potential losses.

Covered Calls on High Volatility Stocks and Shorter-Dated Options Do Not Provide Higher Yields

Investors often assume that writing covered calls on high volatility stocks and opting for shorter-dated options result in higher yields. This is not always the case.

When trading covered calls on stocks with high volatility, investors may perceive higher premiums as attractive, but the risks associated with these stocks can negate the potential rewards. High volatility means that the stock price is more likely to experience larger price swings, leading to a greater probability of the option being exercised and the investor losing out on potential gains beyond the strike price. Additionally, a high volatility environment might incentivize investors to write options with higher strike prices in the hopes of retaining their stocks if they rally, but this limits income from the covered call strategy.

Shorter-dated options are often assumed to provide higher yields due to the faster rate of time decay (Theta) as the options approach expiration. While it’s true that options with shorter time to expiration generally have higher time decay, this does not always translate to higher overall yields. The lower premiums of shorter-dated options often outweighs the benefits of faster time decay, leading to lower overall yields compared to longer-dated options.

Another factor to consider is transaction costs. When writing shorter-dated covered calls, investors may find themselves undertaking more frequent transactions. This can lead to higher costs, including commission fees and potential bid-ask spread slippage, all of which can eat into the overall return from the covered call strategy.

While high volatility stocks and shorter-dated options might seem attractive to investors looking to earn more from their covered call strategy, the risks and potential downsides can outweigh the benefits. It’s essential for investors to look beyond the perceived high yields and consider other factors, such as stock price movements, implied volatility, and transaction costs, when implementing a covered call strategy.

Time Decay of Written Options Do Not Work In Investors Favor

In the world of options trading, time decay can be a significant factor that affects the returns of investors implementing covered call strategies. Time decay, also known as theta decay, is the measure of the rate of decline in the value of an options contract due to the passage of time. For investors who write covered calls, this can sometimes work against them.

There can be various factors that affect the rate of time decay in options contracts, such as implied volatility (IV) and the proximity of the strike price to the current stock price. For instance, when an option is in-the-money or close to being in-the-money, the rate of time decay may slow down. This may result in a smaller decrease in the option’s value, ultimately working against the investor who has written the covered call. Investors often believe that time decay will consistently work in their favor when writing covered calls. However, this is not always true; the rate of decay depends on the initial price among other factors and selling options at too low of a price is risky.

In short, while time decay is an essential concept in options trading and covered call writing, it does not always work in favor of investors who write covered calls. Careful consideration of other factors such as strike price, stock price movement, and implied volatility should be taken into account to optimize the covered call strategy and manage its risks.

Covered Calls Are Not Appropriate If You Have a Neutral to Moderately Bullish View

Covered calls are a popular options strategy, but there are certain situations where utilizing this strategy may not be appropriate or may limit an investor’s upside potential.

One concern with using a covered call strategy is that it may cap potential gains. When an investor writes a covered call, they are selling the right to buy their shares at a specified price, known as the strike price, before the option expires. If the underlying stock price rises significantly above the strike price, the investor will have to sell their shares at the strike price and miss out on the potential gains above that level. This limits the upside potential of the investment, which may not be desirable for those who have a bullish view on the stock.

It’s also important to consider the risk of share ownership. Because a covered call involves owning the underlying stock, the investor is exposed to any potential decline in the stock’s value. While the premium received from selling the call option can help offset some of this risk, it may not fully protect against a significant drop in the stock price (as noted above). Another factor to consider is the possibility of early assignment. When an investor writes a covered call, they run the risk of the option being exercised before its expiration date. In some cases, investors may benefit from considering alternative strategies. For instance, a neutral view may call for a short straddle strategy rather than a covered call strategy.

In conclusion, while covered calls can be an effective strategy for some investors, they may not be appropriate for those with a neutral or bullish outlook on a stock. It’s essential for investors to carefully assess their goals, risk tolerance, and investment outlook before implementing a covered call strategy.

Covered Calls Are a Contractual Obligation, Not A Plan

It is essential to understand that covered calls are a contractual obligation for the option seller, not merely a plan or intention of the investor. Options are called options because they give the BUYER an option. The seller does NOT have an option though!

When an investor enters into a covered call position, they agree to sell their asset to the call option buyer if the option is exercised. This means the investor is contractually bound to fulfill their obligation, regardless of any change in circumstances or the investor’s financial position. This means that when selling a covered call, investors should be prepared for the possibility of having to sell their underlying asset if their call options are assigned.

Some investors sell covered calls with the thought that “if the stock goes up and gets called at $x price, that’s what I would have done anyways.” This is not true though, as investors often change course, especially based on price. We already discussed forfeiting the upside and other problems, but many investors are not considering the full range of outcomes when selling calls.

When selling covered calls, investors must keep in mind that they are entering into a contractual obligation with potential risks and limitations. It’s essential to approach covered calls with a clear understanding of the responsibilities involved and the potential outcomes of engaging in this strategy.

Covered Calls Do Not Allow You to Buy a Stock at a Discounted Price

A common misconception is that covered calls allow you to buy the underlying stock at a discounted price. The logic is that the stock can be bought at the current price minus the option premium received. This is not necessarily the case, and investors should be aware of the risks and potential drawbacks this strategy entails.

Like many of the above points, the issue here is that stock and option prices move! If the stock moves down (more than the value of the premium received), then investors are getting the stock at a premium rather than a discount (to the current price). Therefore, buying both legs of a covered call is not a great way to enter the stock position.

While covered calls can be a useful strategy for generating income in certain situations, it is a stretch to say that investors can buy a stock at a discounted price using covered calls. As with any investment strategy, investors should approach covered calls with a clear understanding of the associated risks and rewards.