Donating appreciated assets to charity can provide economic benefits to charities, while also providing tax benefits to donors. The benefits to both charities and donors is amplified for donations of appreciated assets.

Non-Cash Charitable Donations

What types of non-cash assets can be donated to charity?

There are many types of non-cash assets that can be donated to charitable organizations. Below are several types and examples.

- Liquid securities such as stocks, bonds, mutual funds, ETFs, listed options, crypto and so on. This is the focus of this post, although the below principals apply to any many of the below.

- Illiquid assets such as insurance contracts, restricted stock, employer stock options, business interests.

- Real assets such as real estate or commodities.

- Other complex assets.

- Depreciated Assets such as clothes, cars, and so on. These items are beyond the scope of this post since they do not provide the same tax benefits as appreciated assets.

What charities accept non-cash financial assets?

Not all charities can accept non-cash donations.

Many charities are setup to accept liquid securities, but most do not have the resources to accept illiquid and/or complex assets. Typically, these can only be donated to (larger) well-resourced organizations. Ultra high net worth donors often establish a foundation to handle their charitable donations and grants.

Unfortunately, many donors only donate cash because they believe that is the only way to fund the charities they support. Donors wishing to donate liquid or illiquid assets to charities that cannot accept them should consider donor-advised funds.

Tax Benefits of Donating Appreciated Assets to Charity

Fortunately for US taxpayers, the IRS provides income tax benefits for cash and non-cash charitable contributions. Additionally, donating appreciated non-cash assets can generate additional capital gains tax benefits.

Income Tax Benefits of Donating Non-Cash Assets to Charity

The value of cash or non-cash donations can generally be deducted from a donor’s income on their tax return, thus lowering their income tax liability.

- For cash donations, the value of the donation is straightforward.

- For non-cash assets that have been held more than one year, donors can deduct the market value (or estimated/appraised value if there is no market value).

- For non-cash assets held less than one year, then the deduction is the lower of the cost basis or value (so donating “short-term” assets rarely, if ever, makes sense).

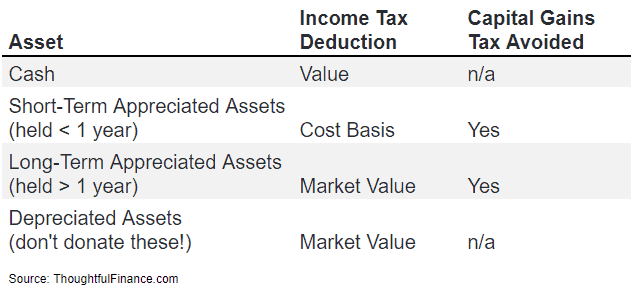

The above bullet points are summarized in the table below.

Capital Gains Tax Benefits of Donating Appreciated Assets to Charity

While donating non-cash assets can provide an income tax benefit, donating appreciated non-cash assets can provide a capital gains tax benefit.

The reason that donating appreciated assets is often more attractive than donating cash is because donating an appreciated asset allows donors to avoid long-term capital gains tax on the donated asset.

Appreciated assets generally have an embedded tax liability which must be paid when the gain is realized. For instance, if someone buys a stock at $10 and it rises to $100, there is a capital gains tax that is owed on the $90 gain. It may not be paid until the stock is sold, but that tax liability exists nonetheless and is embedded in the position until it is sold. However, if the stock is donated to charity, then the investor will never have to pay capital gains tax on the $90 gain (and neither will the charity since it is a non-profit organization that does not pay taxes)!

The below table shows the income tax and capital gains tax benefits of donating appreciated assets with various holding periods:

Benefits of Donating Appreciated Non-Cash Assets

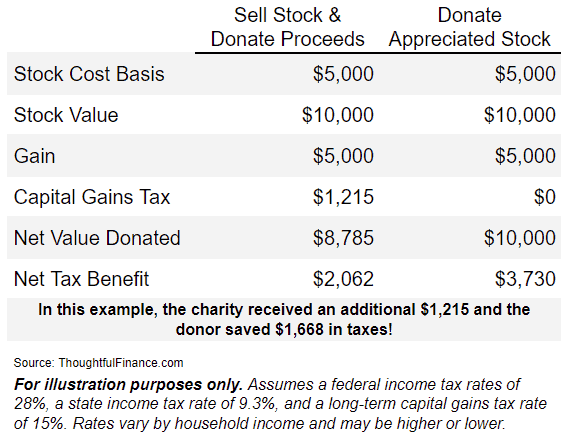

Donating appreciated assets provides donors with tax benefits, but it can also benefit charities. Below is an example of the benefits of donating appreciated stock:

Assume a donor buys $5,000 of stock which appreciates to $10,000 over several years. If the donor sells the stock, they will realize a $5,000 gain which will be subject to capital gains tax. Assuming a 15% long-term capital gains tax and a 9.3% state income tax, the donor will pay $1,215 in taxes. The charity will receive $8,785 ($10,000 minus the $1,215 of taxes). Assuming a 28% federal tax rate (and 9.3% state tax rate still), the donor will receive a $3,276 deduction. But the net tax benefit to the donor will only be $2,062 ($3,276 deduction minus $1,215 capital gains tax paid, rounded).

Alternatively, if the donor donated the stock directly to the charity, they would have received a larger tax benefit AND the charity would have received more. The donor could send the entire $10,000 position to the charity and deduct the $10,000 on their tax return. The charity would receive $1,215 more AND the donor would have saved $1,668 in taxes (because they could deduct $3,730 without subtracting any capital gains, assuming the same tax rates).

The below table illustrates the benefits from the above example of donating stock to charity.

Obviously, the dual impacts of receiving an income tax deduction and avoiding capital gains tax are beneficial.

The above methods can be used to dispose of assets and/or reallocate/rebalance portfolios in a tax-efficient way. For instance, some investors hold stocks (that they wouldn’t otherwise hold) due to tax constraints. Donating shares of stock eliminates this constraint. This would also apply to mutual funds, ETFs, and other portfolio positions that donors wish to exit.

I should note that the above is a high-level overview and there are additional tax issues to consider, so donors should consult with their tax adviser before making any donations. As readers know, this site is designed to provide education rather than recommendations.