Near-Term Forward Yield Spreads

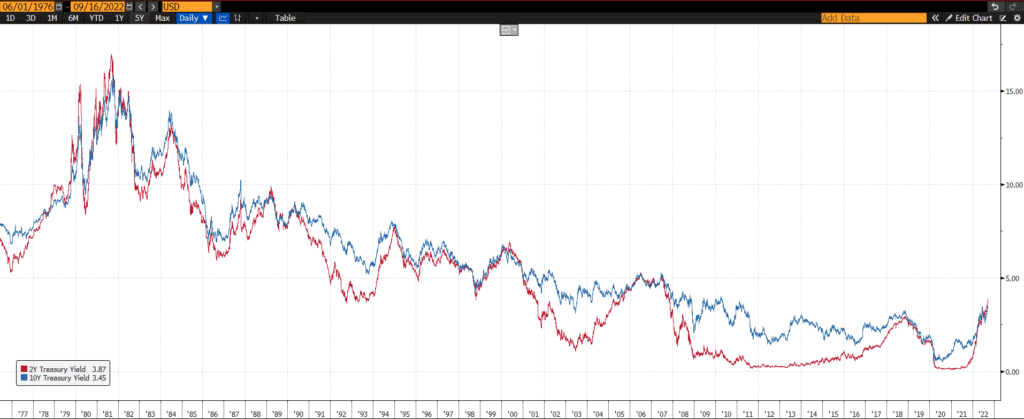

Near-term forward yield spreads are an important indicator and one that investors, economists, and policymakers monitor closely. Even the Federal Reserve Chair, Jerome Powell, has indicated that he considers near-term forward yield spreads to be better than traditional yield curve indicators (such as the 2s10s yield spread).

What is a near-term forward yield spread?

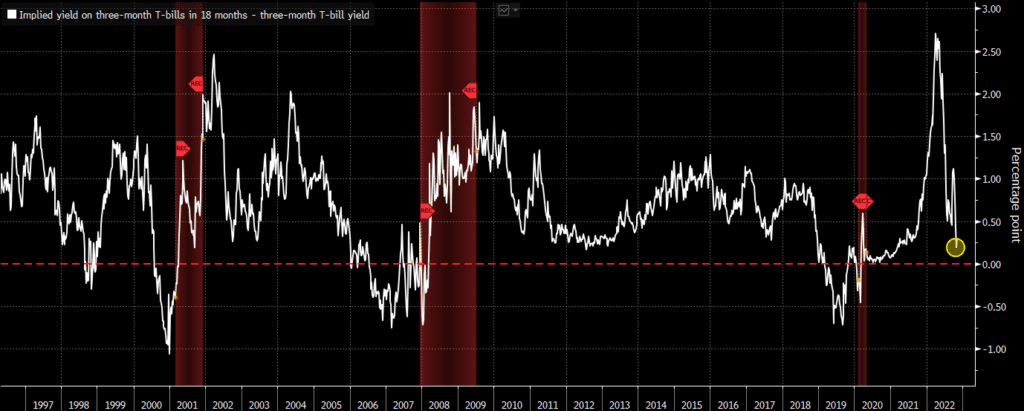

Near-term forward yield spreads are calculated by looking at what a short-term yield is expected to be minus what what the short-term yield is today. For example, the rate that a 3-month Treasury bill is expected to yield in 18 months minus the rate on a 3-month Treasury bill today. The “implied” future yield in the first half of the equation is made by extrapolating other Treasury and fixed-income data and yields.

Do near-term forward yield spreads predict recessions better?

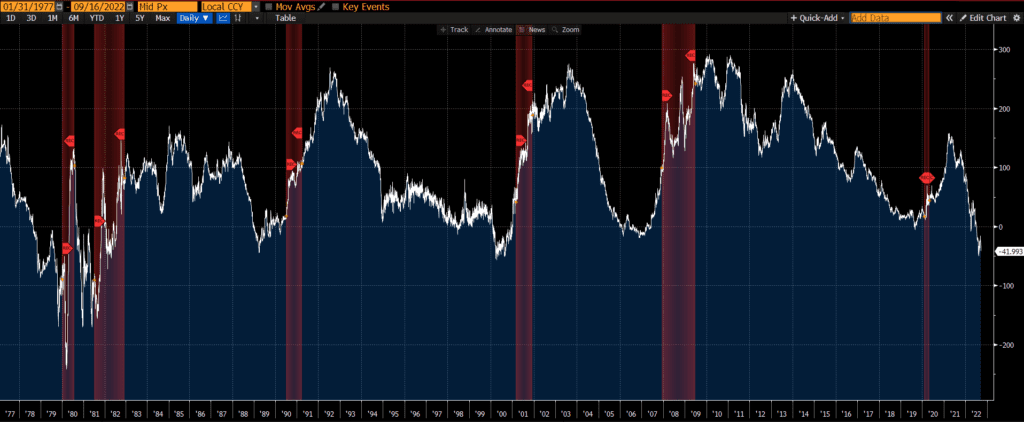

In a blog post and press conferences, members of the Federal Reserve have argued that near-term forward spreads may be better predictors of recessions and other economic indicators than more traditional yield curve spreads. If we focus on recessions, I do not think this is true.

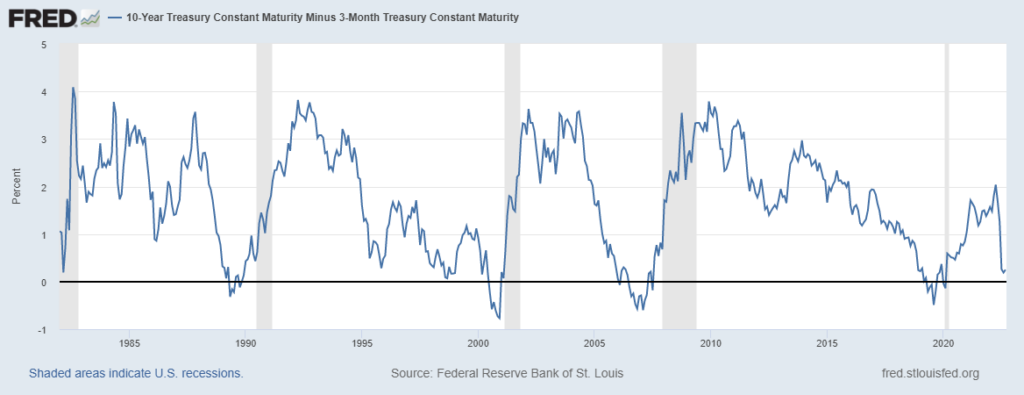

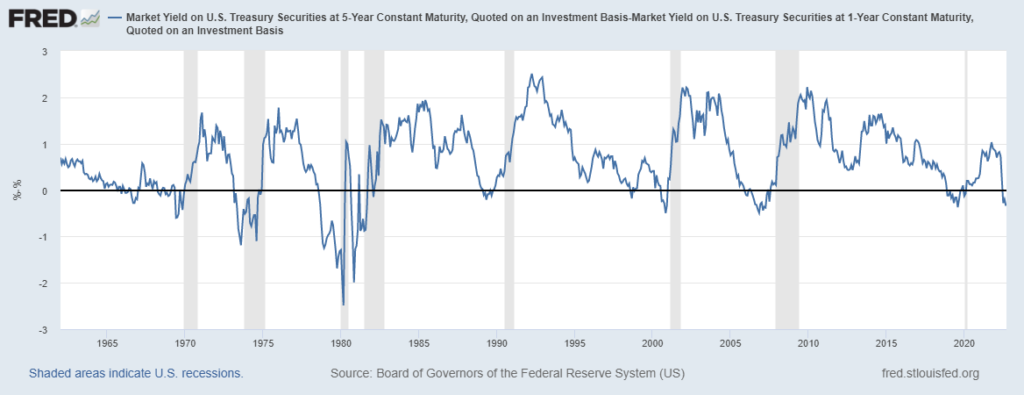

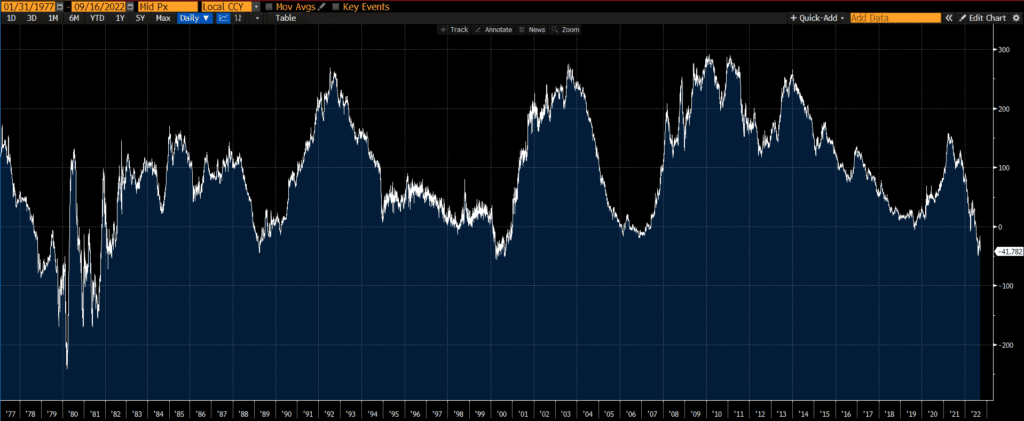

The 3m forward spread has a decent record of predicting recessions. It has inverted just before the last three recessions, although it also inverted in 1998 (a few years before any recession). So it does have one false positive recession signal since inception.

Below is a near-term forward spread chart from a couple of months ago:

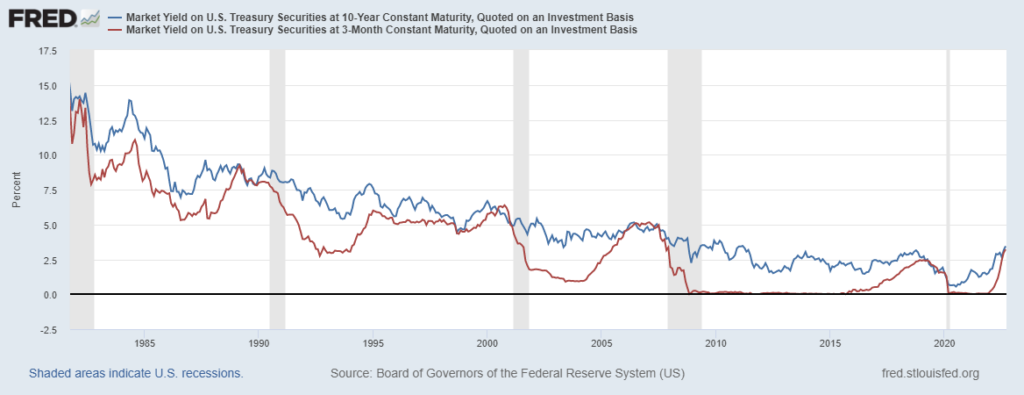

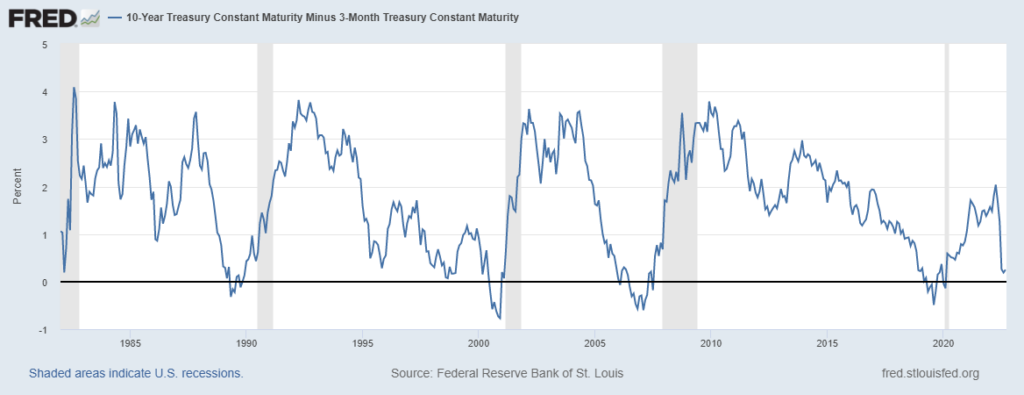

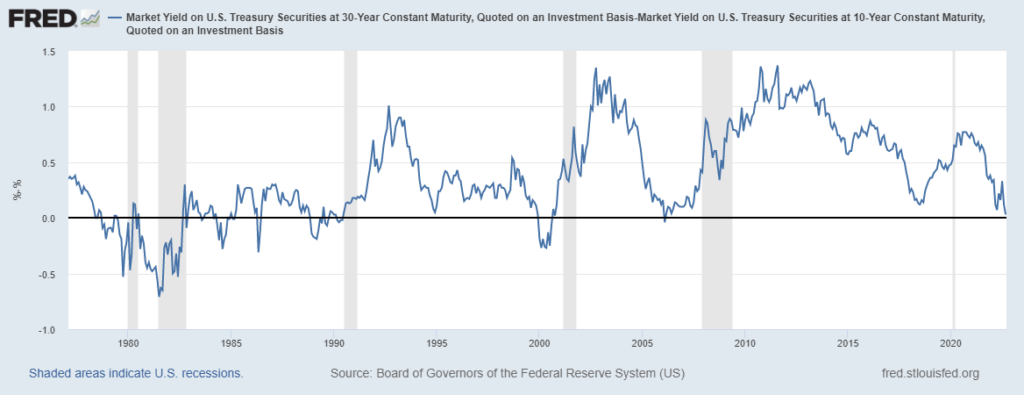

However, the next chart (below) of the 3-month 10-year yield spread shows no false positives. This curve has only inverted just before the onset of a recession. Thus, I continue to believe that the 3m10y curve is the best recession indicator.

At the moment, the near-term forward spreads are not inverted, while the traditional yield curve spreads are. If the near-term spreads do not invert in the next years, we’ll have one more data point in the battle for best recession indicator!