FXAIX vs VOO (updated 2023)

The Fidelity S&P 500 Index Fund (FXAIX) and the Vanguard S&P 500 Index Fund (VOO) are two of the largest index mutual funds in existence and easily two of the most popular among individual investors. Both FXAIX and VOO track the well-known S&P 500 index and form the core of many investor portfolios. Many investors compare FXAIX vs VOO in order to decide which should be the foundation of their portfolio.

The Short Answer

There are not many differences between FXAIX and VOO, besides the fact that FXAIX is a mutual fund and VOO is an ETF. Therefore, investors should consider factors beyond the underlying portfolios (which are essentially identical) in order to decide which fund is best for them.

A quick reminder that this site does NOT provide investment recommendations.

The Long Answer

Historical Performance: FXAIX vs VOO

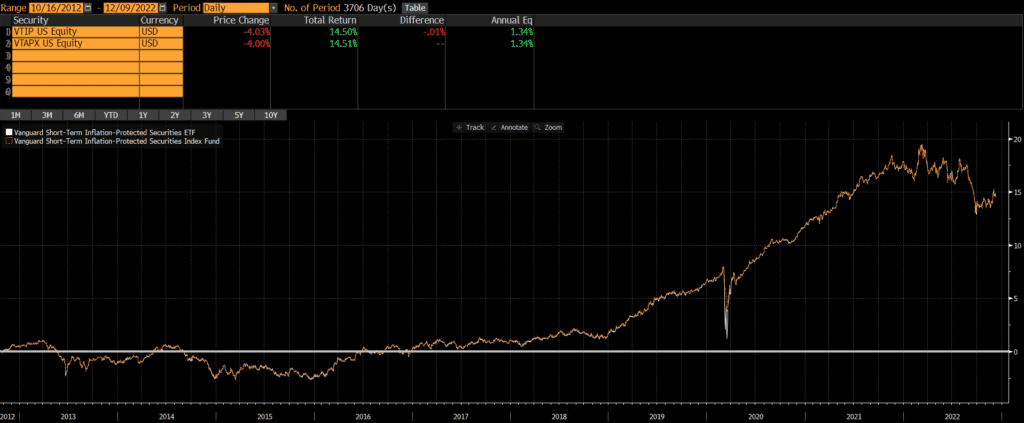

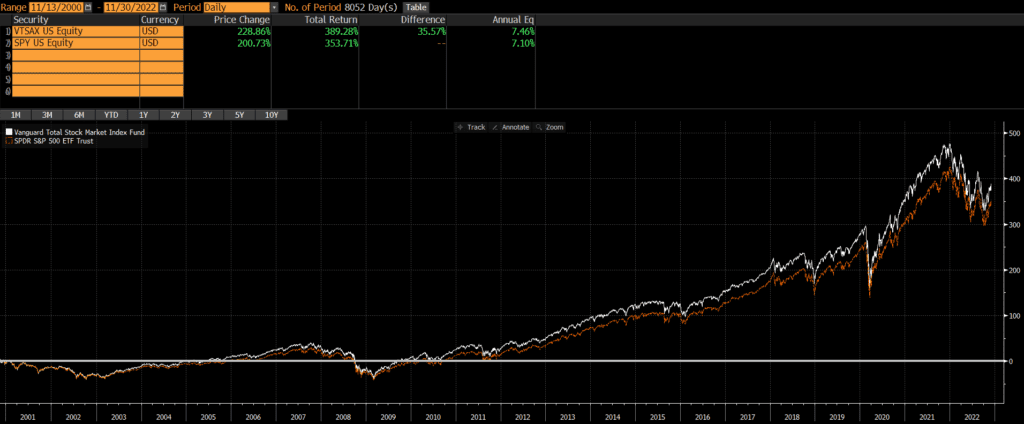

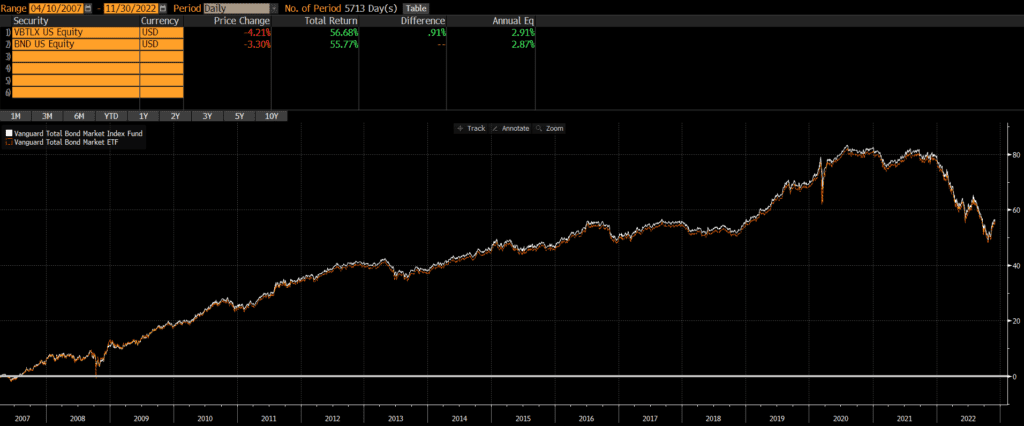

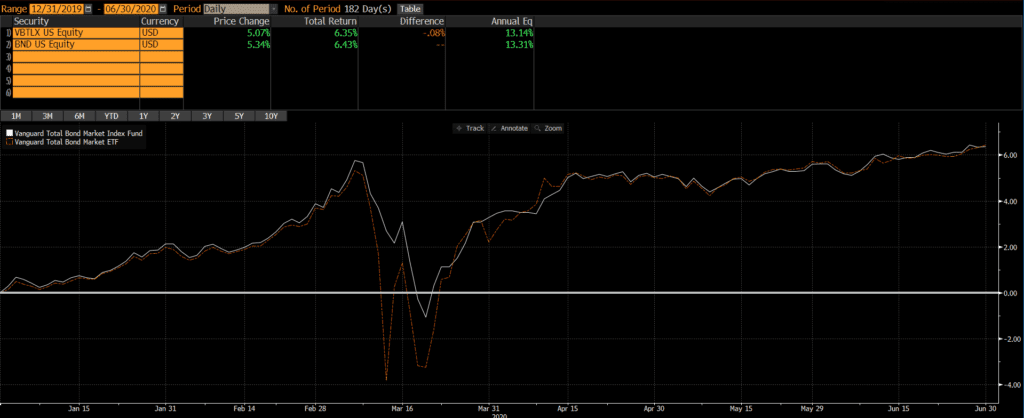

FXAIX was launched on February 17, 1988, while VOO was launched on September 7, 2010. Since then the two funds have performed identically, with a difference of just .03% annually! The cumulative performance difference between these two funds has been just over 1.3% (over a dozen year timeframe)! Thus, from a performance perspective, I would consider these two funds interchangeable.

Differences between FXAIX vs VOO

Both FXAIX and VOO track the S&P 500, so I will not delve into differences in geographic exposures, sector weights, or market cap coverage. For all intents and purposes, the portfolios are identical with 504 stocks each. The S&P 500 has more than 500 stocks because of the index constituents have multiple share classes of stock (such as GOOG and GOOGL).

Factors to Consider

Transaction Costs

ETFs are free to trade at many brokers and custodians, including Fidelity. However, many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements (with their competitor custodians) that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is generally free to trade FXAIX or VOO. However, only VOO is free to trade in many non-Fidelity accounts.

There is a bid-ask spread when trading ETFs, but this spread is typically less than .01% for VOO and individual investor trades will not generally be large enough to “move” the market. In the case of VOO, individual investors should not have a problem trading.

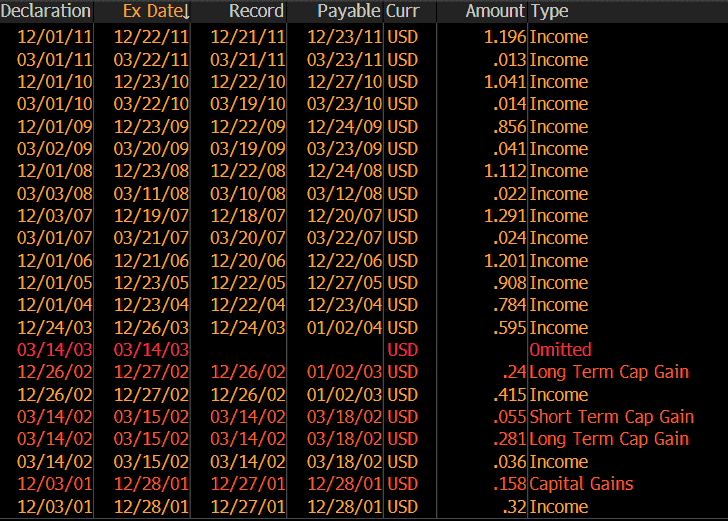

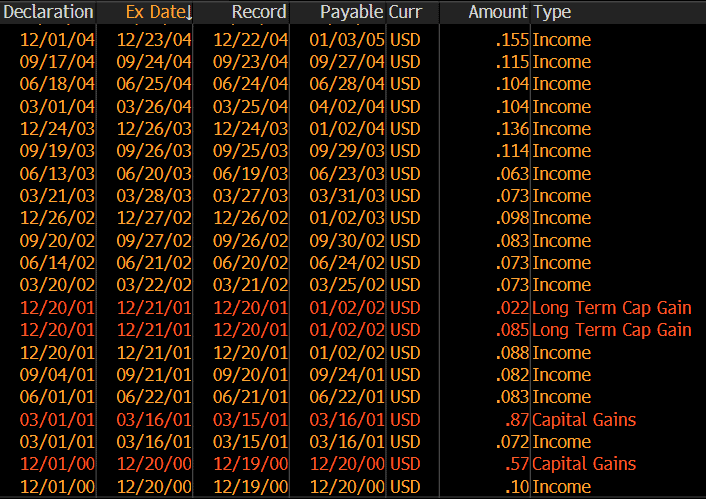

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). As expected, VOO is more tax-efficient.

FXAIX has made capital gains distributions in the past and I would expect this to continue in future. VOO has never paid out a capital gain distribution, nor do I expect it to in the future. Thus, tax-sensitive investors may want to consider whether ETFs make more sense for them.

Tax Loss Harvesting

My personal preference is to keep a portfolio entirely mutual funds or entirely ETFs, due to the mechanics of settlement during tax loss harvesting. If an ETF has declined in value and an investor sells it, the trade and cash proceeds will not settle for two business days (T+2). That investor may want to “replace” the sold ETF immediately and attempt to buy another ETF or mutual fund simultaneously.

However, mutual funds settle on T+1 basis, so cash for the mutual purchase would be due in one business day (which is one day earlier than the cash from the ETF sale is received). This can obviously cause problems and (even though this issue can be addressed with careful planning) I find it easier to keep accounts invested in similar vehicles. In this case, if a portfolio is all mutual funds, I might lean more towards FXAIX. If all ETFs, I might lean more towards VOO.

On this topic, investors may want to avoid using these two funds as tax loss harvesting substitutes for one another since they could be considered “substantially identical.”

Tradability

FXAIX does not have a stated minimum for purchases, although some brokerages (especially competitors of Fidelity) impose minimums. The minimum purchase size for VOO is typically one share, although fractional shares are becoming more common.Investors can trade ETFs intraday, as well as in the pre-market and after-hours trading sessions. Investors can only buy/sell mutual funds once per day. This is not necessarily a major factor for long-term investors however.

Final Thoughts: FXAIX vs VOO

Both FXAIX and VOO are large, core funds sponsored and managed by Fidelity and Vanguard respectively. Performance has been nearly identical. I view these two funds as essentially interchangeable and would not spend too much energy trying to decide which one is “better.”

However, there are some situations that may call for one fund versus another. For instance, many custodians offer free ETF trades, but charge trading fees or redemption fees for mutual funds. So I might select FXAIX or VOO solely based on where my account is held or whether I’m investing taxable vs retirement dollars. Despite these considerations, these two funds are very similar for all intents and purposes. For further reading, check out my review of VOO.