The Vanguard S&P 500 ETF (VOO) is one of the largest ETFs and is a core holding of many portfolios, while the Vanguard S&P 500 Growth ETF is a popular “factor” ETF. In this context, factors are quantitative characteristics that index providers assign to stocks. In this case, VOOG targets growth stocks (as they are defined by the index provider). Even though VOO and VOOG play different roles in a portfolio, many investors compare the two funds in order to determine whether they should tilt their portfolio towards a factor or to benchmark a factor’s performance.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

VOOG essentially owns the subset of VOO’s holdings that are considered growth stocks. VOO owns a more diverse portfolio including growth stocks. Historical performance has been similar, but will depend on how the growth factor performs moving forward.

The Long Answer

Historical Performance: VOOG vs VOO

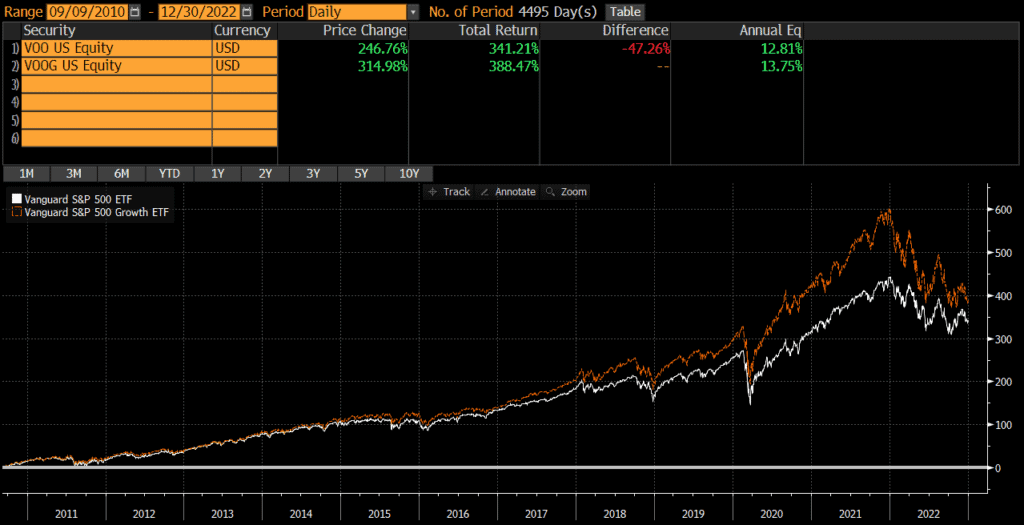

Both VOO and VOOG were launched in September 2010. Since then, performance has been relatively similar with an annualized difference of only .94%. This has compounded over time though and the cumulative performance differential is about 47%.

As the VOOG vs VOO chart shows, the growth factor has really outperformed the broader market since their common inception. However, this did change in 2022 as lines begin to converge again. It is anyone’s guess whether growth or value will perform better in the future.

Differences Between VOOG and VOO

The primary difference between these two funds is that VOOG tracks a growth-oriented index, while VOO tracks a broader index.

Geographic Exposure

Both VOOG and VOO hold essentially 100% US stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical country exposures.

Market Cap Exposure

Overall, the market cap exposures of VOOG and VOO are relatively similar.

| VOOG | VOO | |

| Large Cap | 91% | 85% |

| Mid Cap | 9% | 16% |

| Small Cap | 0% | 0% |

Sector Weights

There are some significant differences in sector weights, which makes sense based on the fact that VOOG is targeting the growth factor and some sectors meet the growth factor criteria more easily.

| VOOG | VOO | |

| Basic Materials | 2.42% | 2.52% |

| Consumer Cyclical | 9.87% | 10.38% |

| Financial Services | 7.56% | 13.99% |

| Real Estate | 1.07% | 2.88% |

| Communication Services | 7.00% | 7.83% |

| Energy | 8.22% | 5.06% |

| Industrials | 5.25% | 8.76% |

| Technology | 31.06% | 23.76% |

| Consumer Defensive | 7.19% | 7.13% |

| Health Care | 19.82% | 14.75% |

| Utilities | 0.54% | 2.94% |

Expenses

VOOG’s expense ratio is .10%, while VOO’s expense ratio is .03%. Yes, VOOG is 3x+ more expensive than VOO, but we’re talking about 7 basis points! This in an non-issue in my opinion. Those looking for a lower expense vehicle, may want to consider Vanguard’s Growth ETF VUG (read my comparison of VUG vs VOO or VOOG vs VUG).

Transaction Costs

ETFs are free to trade at many brokers and custodians, so both VOOG and VOO should be free to trade in most cases. Additionally, these funds are among the largest ETFs and are very liquid. The bid-ask spread of both VOOG and VOO is very low, so individual investor trades will not generally be large enough to “move” the market.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). Neither VOOG nor VOO has ever made a capital gains distribution (nor do I expect them to moving forward). Thus, these funds are about as tax-efficient as any fund can be and either fund is appropriate in taxable accounts.

Final Thoughts: VOOG vs VOO

Both funds are great ETFs that do what they are designed to do. Generally speaking, I do not think factor ETFs should be the core of a portfolio. For a core position, I would personally choose VOO every time. However, investors looking for a satellite position in order to tilt their portfolio towards growth could do a lot worse than using VOOG. At the end of the day, these two funds are not necessarily comparable because they play very different roles in a portfolio.

Investors interested in evaluating an ETF like VOOG, but with a value tilt should check out our comparison of VOO vs VTV. Readers may also be interested in reading about VOOG vs QQQ.