The Vanguard Short-Term Inflation-Protected Securities Index Fund (Admiral Shares) (symbol VTAPX) and the Vanguard Short-Term Inflation-Protected Securities ETF (symbol VTIP) are two of the largest and most popular Treasury inflation-protected securities (TIPS) funds. Some compare VTAPX vs VTIP not realizing that they are just two different share classes of the same portfolio.

A quick reminder that this site does NOT provide investment recommendations.

The Short Answer

VTAPX and VTIP are different share classes of the same portfolio. The decision to buy one or the other depends on investor-specific factors (some of which are listed below).

The Longer Answer

Vanguard ETFs are structured as share classes of their mutual funds. This is a patented structure that is scheduled to expire in 2023, so we may see this structure more frequently in the near future. In other words, VTAPX and VTIP are not two funds pursuing an identical strategy; they are the same fund!

Historical Performance: VTAPX vs VTIP

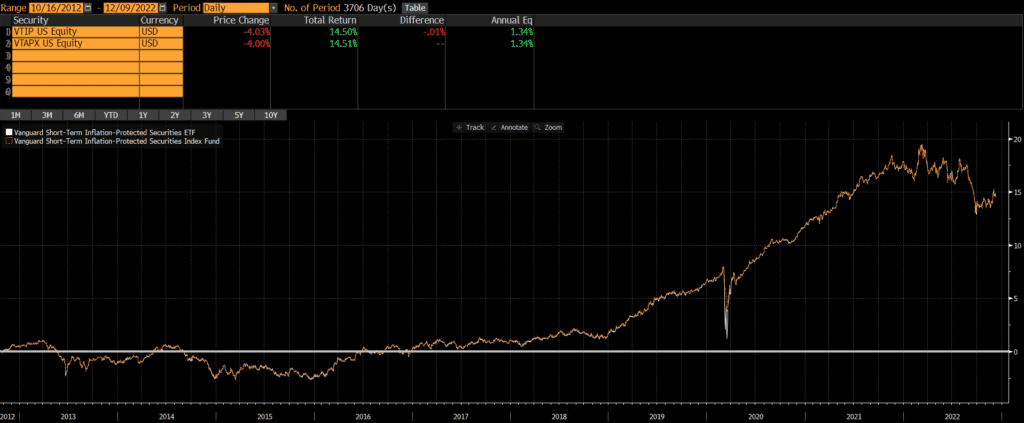

VTIP was launched on October 12, 2012, and VTAPX was launched a few days later on October 16, 2012. Since that time, performance has been identical! Both funds have returned 1.34% annually. Despite changes in fees and expenses over the past 10 years, there has been no cumulative difference in performance over that time period! Looking at the chart of VTAPX vs VTIP below, it is obvious that they are identical.

Risks of Fixed-Income ETFs

One of the risks of fixed-income ETFs is that they trade well below their net asset value (NAV) in times of distress. This is clear if we chart VTAPX vs VTIP during the first half of 2020. VTIP declined about 6.5% (from +1.5% to -5%), while VTAPX “only” declined 4% (peak-to-trough). Remember, these are simply different share classes of the exact same fund! However, VTIP trades at a market price and VTAPX is traded at a NAV.

This is caused by the fact that fixed-income typically trades at wide bid-ask spreads, which widen even further during market volatility. Sometimes the bids will disappear altogether. Mutual funds generally publish a NAV based on market prices (or estimated values for fixed-income), so estimating a NAV is difficult if the market freezes or bids disappear.

The consensus is that ETFs provide better “price discovery” than mutual funds, since ETFs represent actual market prices. In this example, it is widely assumed that the VTIP value was closer to value of the underlying portfolio than the VTAPX NAV. Interestingly, holders of VTAPX could have sold their holdings and rotated into VTIP (which is the exact same portfolio) at a substantial discount.

This phenomenon is not limited to illiquid ETFs, as we saw a similar dynamic with Vanguard’s flagship bond funds BND and VBLTX, which are two of the largest funds in existence and mostly invest in the most liquid fixed-income asset classes.

Differences Between VTAPX and VTIP

Since the two funds are actually two share classes of the same fund, I will skip the usual comparisons here. The geographic exposures, sector weights, market cap coverage so on is identical because the two funds are shares in the same portfolio. There are some resources on the internet indicating otherwise, but these are incorrect.

Factors to Consider

Transaction Costs

ETFs are free to trade at many brokers and custodians, including Vanguard. However, many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Vanguard does not participate in the pay-to-play arrangements that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Vanguard, it is free to trade VTAPX or VTIP. However, only VTIP is free to trade in non-Vanguard accounts.

There is a bid-ask spread when trading ETFs, but this spread is typically less than .02% for VTIP and individual investor trades will not generally be large enough to “move” the market. In the case of VTIP, individual investors should not have a problem trading.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). However, since Vanguard ETFs are a share class of their mutual funds, the mutual funds are able to benefit from this feature of the ETF. In other words, VTIP is able to extend its tax benefits to VTAPX.

VTAPX has never paid out a capital gains distribution! I noticed some posts on the internet saying that VTIP is more tax-efficient than VTAPX, but this incorrect.

Tax Loss Harvesting

My personal preference is to keep a portfolio entirely mutual funds or entirely ETFs, due to the mechanics of settlement during tax loss harvesting. If an ETF has declined in value and an investor sells it, the trade and cash proceeds will not settle for two business days (T+2). That investor may want to “replace” the sold ETF immediately and attempt to buy another ETF or mutual fund simultaneously.

However, mutual funds settle on T+1 basis, so cash for the mutual purchase would be due in one business day (which is one day earlier than the cash from the ETF sale is received). This can obviously cause problems and (even though this issue can be addressed with careful planning) I find it easier to keep accounts invested in similar vehicles. In this case, if a portfolio is all mutual funds, I might lean more towards VTAPX. If all ETFs, I might lean more towards VTIP.

On this topic, investors should probably avoid using these two funds as tax loss harvesting substitutes for one another since they would likely be considered “substantially identical.”

Tradability

VTAPX does have a stated minimum initial purchase of $3,000, so that may be a factor for some investors looking to initiate a position. The minimum purchase size for VTIP is typically one share, although fractional shares are becoming more common.

Investors can trade ETFs intraday, as well as in the pre-market and after-hours trading sessions. Investors can only buy/sell mutual funds once per day. This is not necessarily a major factor for long-term investors however.

Final Thoughts: VTAPX vs VTIP

VTAPX and VTIP are literally the same portfolio. However, I personally shy away from fixed-income ETFs due to their tendency to trade below NAV during episodes of extreme volatility. If two options provide the same risk and return, but one does not have periodic blowups then I’ll go with that one. Of course, there are other factors to consider (such as the above) and long-term holders may not care about the short-term volatility as long as the ETF eventually trades back to NAV.