VTI vs SCHB: Which ETF is Better?

The Schwab US Broad Market ETF (SCHB) and the Vanguard Total Stock Market ETF (VTI) are two of the largest ETFs and are sponsored by Schwab and Vanguard respectively. SCHB and VTI are a core holding of many investor portfolios and many investors compare SCHB vs VTI in order to decide which should be the foundation of their portfolio.

The Short Answer

Although VTI and SCHB track different indices, the risk and return between these two funds is identical and I consider them interchangeable.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Long Answer

Historical Performance: VTI vs SCHB

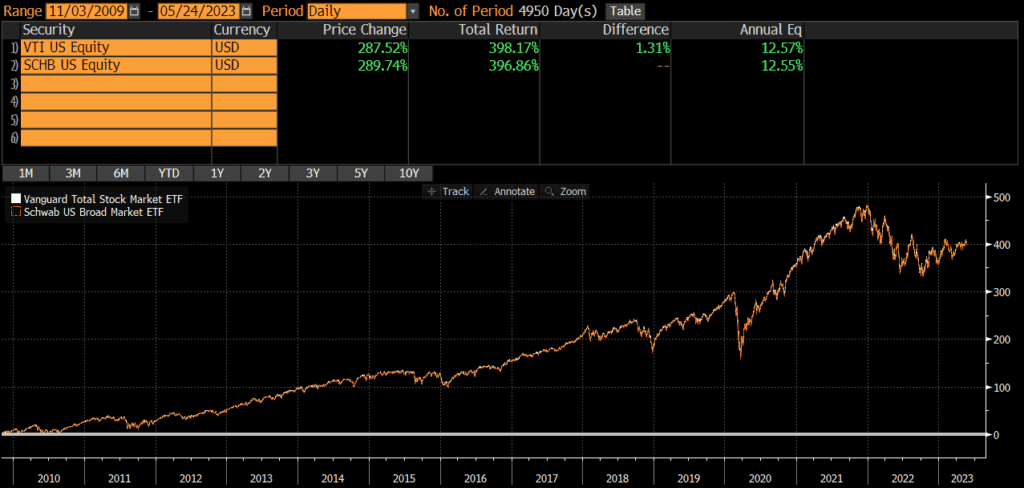

VTI was launched in 2001, while SCHB was launched nearly a decade later in 2009. Since then, performance has been identical (as the performance chart below illustrates). The annualized difference in returns is just .02%, which speaks to the similarities in holdings and exposures. The cumulative performance differential over the past two decades is about 1.5%.

Differences between VTI vs SCHB

SCHB tracks the Dow Jones US Broad Market Index, while VTI tracks the CRSP US Total Market Index. However these two indices are basically identical.

Geographic Exposure

Both SCHB and VTI hold essentially 100% US stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical exposures.

Market Cap Exposure

As the below table shows, the market cap exposure of these two “total market” (meaning they hold large, mid, and small-caps) is identical.

| SCHB | VTI | |

| Large-Cap | 73% | 72% |

| Mid-Cap | 19% | 20% |

| Small-Cap | 8% | 9% |

Sector Weights

The sector weights between SCHB and VTI are nearly identical, which is to be expected given the identical performance.

| SCHB | VTI | |

| Basic Materials | 2.47% | 2.56% |

| Consumer Cyclical | 10.61% | 10.39% |

| Financial Services | 12.53% | 12.79% |

| Real Estate | 3.14% | 3.29% |

| Communication Services | 8.04% | 7.61% |

| Energy | 4.40% | 4.58% |

| Industrials | 8.98% | 9.34% |

| Technology | 26.69% | 25.46% |

| Consumer Defensive | 6.49% | 6.73% |

| Healthcare | 14.01% | 14.44% |

| Utilities | 2.65% | 2.80% |

Expenses

The expense ratio for both funds is .03%, which extremely low.

Transaction Costs

ETFs are free to trade at many brokers and custodians, so both SCHB and VTI should be free to trade in most cases. Additionally, these funds are among the largest ETFs and are very liquid. The bid-ask spread of both SCHB and VTI is about .01%, so individual investor trades will not generally be large enough to “move” the market.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). Neither VTI nor SCHB has never made a capital gains distribution (and I do not expect them to moving forward). Thus, these funds are about as tax-efficient as any fund can be and either fund is appropriate in taxable accounts.

Final Thoughts: VTI vs SCHB

Both SCHB and VTI are large, core funds sponsored and managed by two of the largest investment sponsors in the world. Performance has been extremely similar.

I view these two funds as essentially interchangeable and would not spend any energy splitting hairs to decide which one is “better.” In my opinion, both funds are among the best ETFs out there and investors cannot really go wrong with either.