IVV and QQQ are two of the most popular ETFs in the market. Given their popularity, many people compare IVV vs QQQ and/or ask which fund is a better investment.

My answer to these types of questions is that IVV and QQQ are very different and not necessarily comparable. So rather than write a long post about similarities and differences between IVV and QQQ, I’ll provide a framework for thinking about IVV vs QQQ.

My goal here at ThoughtfulFinance.com is to educate investors and that sometimes includes not answering the exact question that was asked, reframing questions, or providing a different type of answer. As always though, a quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors).

Types of Investors

There are a few reasons that someone might want to know whether IVV or QQQ is a better investment and I think it has a lot to do with who they are. Different types of investors have varying levels of knowledge, differing goals, and so on.

New Investors

Even though IVV and QQQ are not necessarily comparable, individual investors may not necessarily understand that the funds are different or what differences really matter. New investors may want to just skip to the bottom of this post.

Average Investors

Some investors may understand that IVV and QQQ are quite different, but may be interested in selecting the one that they believe will perform the best. My response to these investors is that portfolio construction should be based on a target asset allocation (based on risk tolerance, time horizon, liquidity needs, and so on). Once an allocation is selected, then investors can select the best vehicle for each slice of the portfolio allocation. If an investor decides on an asset allocation before selecting investments (as they should!), then the question of IVV vs QQQ will never come up since they fill different roles in a portfolio.

Day Traders

There are some people who think that they can trade in and out of IVV, QQQ, and other investments profitably. To those people, I’d say the research, evidence, and odds are stacked against you but good luck!

IVV vs QQQ: Holdings & Exposures

IVV and QQQ are not comparable because their underlying holdings are so different. An investor’s preference for IVV or QQQ will depend on its role in the portfolio.

Both funds primarily hold stocks, but the composition and exposures of their holdings is very different. Although both IVV and QQQ are large-cap funds, QQQ is much more concentrated in terms of number of companies (100 vs 500) and sectors. This sector concentration results in higher risk, which has resulted in much higher volatility and returns (relative to IVV).

Given the above, I believe any investor can use IVV as a core (or even only) portfolio holding. However, I would never recommend that for QQQ. At best, it could be a satellite or complementary position.

IVV vs QQQ: Performance, Expenses, & Risk

I could compare IVV and QQQ’s historical performance, expense ratios, tax-efficiency, and so on as many sites do. However, these details are only important points of comparison if the funds are comparable, so this post doesn’t include a bunch of meaningless data. Those who are still interested can check out ETF.com’s comparison tool.

Historical Performance

Since IVV and QQQ have very different holdings and exposures, comparing historical performance is meaningless. One fund will outperform over certain time periods and the other will outperform over other time periods. I am not going to delve into a performance comparison and attribution, since we already know that the funds are very different. Readers who really want this information can check out tools like Morningstar.com.

Expenses

Again, any performance difference caused by the expense ratios of IVV and QQQ will be dwarfed by larger differences like holdings, exposures, risk factors, etc. Expenses are very important when all else is equal, but IVV and QQQ are not equal at all!

Risk & Volatility

The two funds are very different, but I will comment on risk and volatility since it informs my view on how these funds should be used.

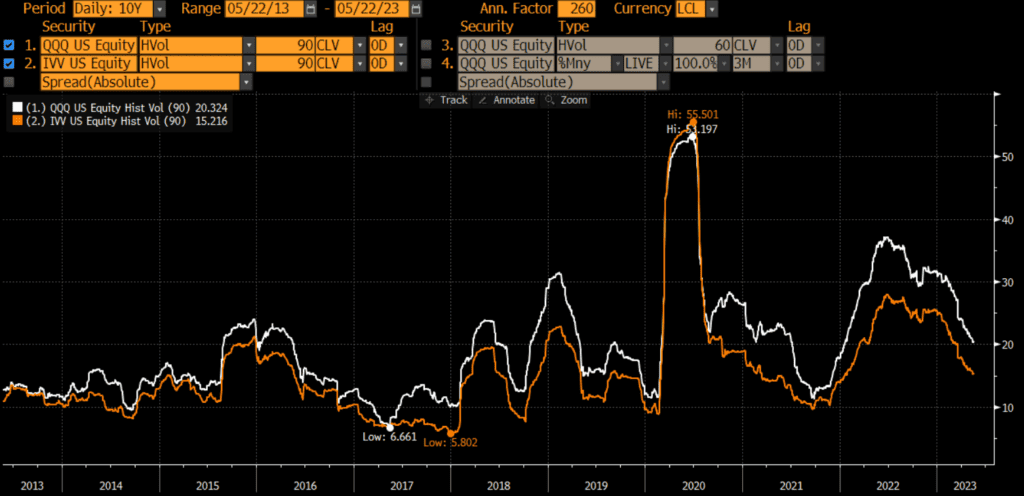

QQQ is riskier than IVV, measured by both realized volatility and drawdowns. This is because QQQ is more concentrated and less diversified. This is true both for realized volatility (see below) and maximum drawdowns. QQQ does not always underperform during market stress, but the lack of diversification leaves it vulnerable (such as the dot com crash when it lost over 80% of its value).

ETF Benefits

Both IVV and QQQ are exchange-traded funds (ETFs), which do have some advantages for investors.

Tax Efficiency

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). Thus, these funds are about as tax-efficient as any fund can be and either fund is appropriate in taxable accounts.

Tradability

ETFs are free to trade on many platforms and investors should have no problem trading IVV or QQQ, which are large and liquid.

Alternative Vehicles

Investors limited to mutual funds should have no problem finding a mutual fund version of IVV or a mutual fund version of QQQ.

Investors planning to allocate more than $250,000 may consider direct indexing rather than an ETF or mutual fund, especially if they are in a high tax bracket. Any institutional direct indexer should be able to replicate IVV or QQQ easily.

What Would I Do: IVV or QQQ?

In my opinion, IVV is an appropriate core holding for most portfolios, while QQQ is not. However, I think QQQ could potentially be a satellite holding for some investors.