The MSCI EAFE Index and the MSCI World ex-USA Index are two popular (and nearly identical) indices that many index portfolios are benchmarked to. The historical performance of EAFE vs World ex-USA is nearly identical, despite some differences in country exposure.

A quick note that investors cannot invest directly in an index. These unmanaged indexes do not reflect management fees and transaction costs that are associated with an investable vehicle, such as the iShares EAFE ETF (symbol: EFA). A reminder that this is simply an example as this site does NOT provide investment recommendations.

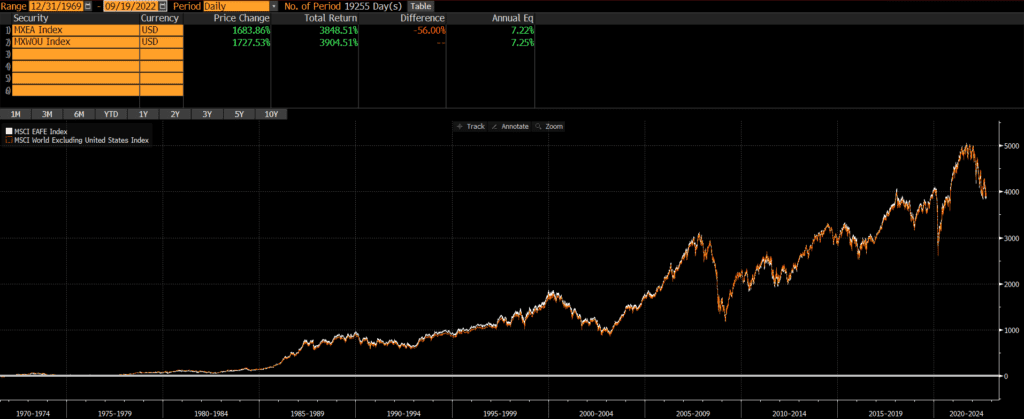

Historical Performance: MSCI World ex-USA Index vs MSCI EAFE Index

Returns since inception of the indices in 1970 have been nearly identical. Over the past 52 years, the annualized performance differs by only .03%!

The MSCI World ex-USA Index includes exposure to stocks in developed markets around the globe, except for the US. MSCI’s EAFE Index stands for Europe, Australasia, and Far East and it covers developed markets in those regions such as the UK, Australia, and Japan. However, it does not include North America, so stocks from both the US and Canada are absent from the index.

Current Index Composition: MSCI EAFE vs MSCI World ex-USA

These two indices are nearly identical, so I will not include all of the usual comparison tables in this post.

- The biggest difference is that Canada which makes up roughly 11.5% of the MSCI World ex-USA Index, while EAFE does not include it.

- Both MSCI World ex-USA and MSCI EAFE only own developed markets and do not own any emerging markets.

- Even thought both indices are broad-based in terms of market capitalizations, both are market cap weighted and heavily tilted towards large-cap stocks.

- Additionally, the MSCI EAFE and MSCI World ex-USA have nearly identical sector weights.

- The number of constituents stocks is similar too. MSCI EAFE has 779 stocks while MSCI World ex-USA has 887 stocks.

Composition Differences

Geography

The two indices are both extremely broad and have good coverage of developed markets, while both exclude emerging markets. The primary difference is the exposure to Canada.

Country Exposures

There are some slight differences in country weights between the two indices, although the largest difference is the exposure to Canada. Below is summary of the top country weights in each index, as of 9/30/2022.

| MSCI EAFE Index | MSCI World ex-USA Index | |

| Japan | 22.63% | 19.99% |

| United Kingdom | 15.54% | 13.72% |

| Canada | 0% | 11.67% |

| France | 11.31% | 9.99% |

| Switzerland | 10.75% | 9.50% |

Source: ThoughtfulFinance.com, MSCI

Market Cap

As of 9/30/2022, the market cap exposures of the two indices are nearly identical. The average constituent market cap of each index is approximately $15 billion, while the median of each is about $7 billion.

Sectors

The sector exposures between the indices are nearly identical, as of September 20, 2022.

| MSCI EAFE Index | MSCI World ex-USA Index | |

| Financials | 17.60% | 19.88% |

| Industrials | 15.04% | 14.65% |

| Healthcare | 13.53% | 11.96% |

| Consumer Discretionary | 11.28% | 10.39% |

| Consumer Staples | 11.26% | 10.50% |

| Information Technology | 7.92% | 7.64% |

| Materials | 7.48% | 7.93% |

| Energy | 4.93% | 6.53% |

| Communication Services | 4.82% | 4.55% |

| Utilities | 3.37% | 3.44% |

| Real Estate | 2.27% | 2.52% |

Source: ThoughtfulFinance.com, MSCI

Concluding Thoughts

These two indices are nearly identical in terms of performance and sector exposure. There is a difference in geographic exposure (primarily Canada). Investors cannot invest in indices directly and should do their own research before deciding to invest in a strategy or fund that tracks either index. With such a small performance difference though, the costs of investable index strategies may be a larger consideration than which benchmark to select. Sometimes benchmark selection matters quite a bit, although that does not appear to be the case between these two indices.

Further Reading

Investors who would like exposure to Canada, may want to consider reading our comparison of MSCI ACWI vs MSCI World. Both indices include exposure to Canada.

Additionally, investors who wish to only exclude US exposure, but maintain exposure to Canada and emerging markets may want to review our comparison of MSCI ACWI ex-USA vs MSCI EAFE.