ONEQ vs QQQM

QQQM is a large, liquid Nasdaq 100 index ETF that many investors use (often in lieu of the larger and more expensive ETF QQQ). The NASDAQ Composite Index is one of the most popular and most-watched indices. Interestingly, QQQM does not track the NASDAQ Composite Index; QQQM tracks the Nasdaq 100 Index. In other words, “The NASDAQ” Composite Index is referred to in the news and displayed on websites/TV, while the NASDAQ 100 Index seems to be the benchmark for more investable funds and strategies. Despite their similar names, a comparison of the ONEQ vs QQQM reveals some major differences.

The ONEQ and QQQM have very different compositions, slightly different weights and exposures, and performance differences have reflected that.

A reminder that these are simply examples as this site does NOT provide investment recommendations.

Historical Performance: ONEQ vs QQQM

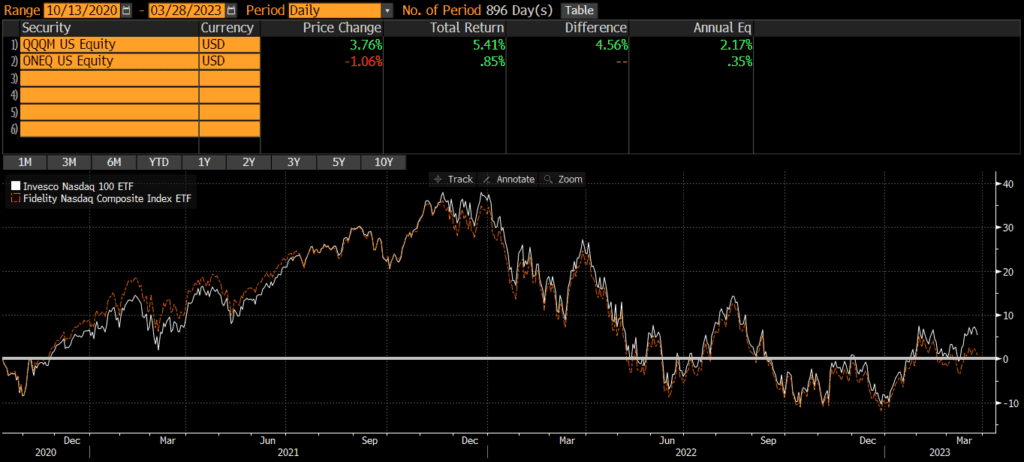

ONEQ is the older ETF with an inception date of October 1, 2003. QQQM was launched many years later in October 2020. Since that time, QQQM has outperformed ONEQ by a wide margin of nearly 2% annually. In other words, investing in QQQM would have beaten investing in “the Nasdaq” by quite a bit (over 4.5% over the past two and half years)!

Those looking to evaluate performance history before the 2000s should compare the index performance of these ETFs’ benchmarks and may want to read our post on the Nasdaq 100 vs Nasdaq Composite. Interested readers may also want to check out my post on QQQ vs QQQM or QQQ vs ONEQ. Investors looking for a mutual fund version of ONEQ should read my comparison of FNCMX vs QQQM.

Differences between ONEQ and QQQM

Overall, the two ETFs are very similar, since they are both based on the same universe of stocks. ONEQ holds approximately 1,000 stocks, while QQQM owns roughly 100 stocks. The NASDAQ site publishes the index methodologies for both the Composite and 100.

Geographic Exposure

Substantially all (95%+) of each ETF is composed of US-based companies, so I will not include the usual tables of countries, market classification, and so on.

Market Cap Exposure

QQQM holds the 100 largest stocks on the NASDAQ exchange (excluding financials), so it has a much larger weighting to large-caps than ONEQ which tracks the Composite Index. However, both ETFs use weighting methodologies based on market-cap, so large-caps dominate each ETF.

Below is an estimate of the market cap exposure as of 11/28/2022.

| ONEQ | QQQM | |

| Large Cap | 73% | 93% |

| Mid Cap | 16% | 7% |

| Small Cap | 10% | 0% |

Sector Weights

Given that ONEQ tracks a much broader index than QQQM, it is not surprising that the ONEQ owns more sectors and is less concentrated than QQQM. Below are the sector weightings of the two ETFs, as of 11/29/2022.

| ONEQ | QQQM | |

| Basic Materials | 0.39% | 0.00% |

| Consumer Cyclical | 14.17% | 14.25% |

| Financial Services | 5.53% | 0.85% |

| Real Estate | 1.23% | 0.00% |

| Communication Services | 13.18% | 15.25% |

| Energy | 0.82% | 0.00% |

| Industrials | 5.28% | 5.07% |

| Technology | 43.31% | 47.92% |

| Consumer Defensive | 5.08% | 7.22% |

| Healthcare | 9.89% | 7.96% |

| Utilities | 1.14% | 1.48% |

Final Thoughts: ONEQ vs QQQM

The decision of whether to invest in ONEQ vs QQQM comes down to whether an investor wants a more fund that is more concentrated in large-cap and tech or a more diversified portfolio. As the chart of ONEQ vs QQQM shows, QQQM has done better historically although this may not hold true moving forward (especially if tech and/or large-caps fall out of favor).