The iShares MSCI All-Country World Index ex-US ETF (ACWX) and the iShares Core MSCI All-Country World Index ex-US ETF (IXUS) are two of the largest ETFs in existence and both are sponsored by Blackrock’s iShares. As their names suggest, ACWX and IXUS are a core holding of many portfolios. Many investors compare IXUS vs ACWX in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

ACWX and IXUS are nearly identical is most ways, but ACWX is much more expensive than IXUS. In most situations, IXUS is preferable to ACWX.

The Longer Answer

These funds are nearly identical in most ways, although ACWX is a much more expensive fund.

ACWX and IXUS track different indices. The older ACWX tracks the large-cap MSCI All-Country World Index ex-US Index, while IXUS tracks the MSCI All-Country World Index ex-US Investable Market Index (IMI) which owns more mid-caps and small-caps (see our comparison of the indices here).

History of ACWX and IXUS

ACWX was one of the first (if not the first) All-Country World Index ex-US ETF to launch, back in 2008. This first mover advantage gave it an edge in accumulating assets under management (AUM) and became the liquid vehicle of choice for traders. Even as other All-Country World Index ex-US ETFs launched and competitors engaged in cutting fees, ACWX was able to command premium fees. However, Vanguard and other sponsors were able to begin capturing market share with ever decreasing costs. Blackrock (which owns iShares) needed to respond with a lower cost option, but did not want to sacrifice their golden goose ACWX. So rather than cut ACWX’s fees, they launched IXUS at a much lower fee level. Essentially, they created IXUS to compete with Vanguard without giving up the high fees that ACWX was collecting.

Historical Performance: IXUS vs ACWX

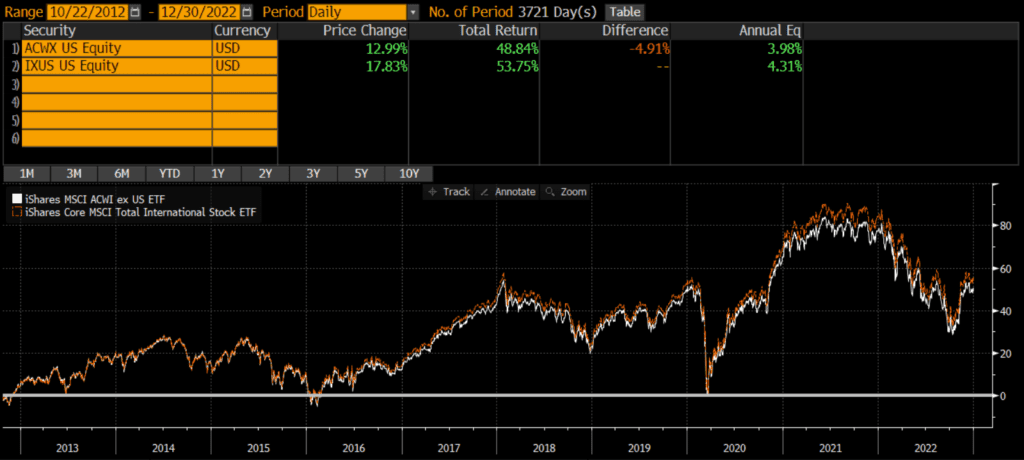

Since IXUS’s launch in October 2012, it has outperformed ACWX by .33% annually. This has mostly been driven by the fee differential, which currently stands at .25%. The cumulative performance over the past 10 years is about 5%. As the below chart illustrates, the two funds move in lockstep, but the ACWX’s performance is degraded by its expenses.

Differences between IXUS vs ACWX

These two funds are nearly identical in every way. Beyond the expenses, the biggest difference between ACWX and IXUS is the market cap exposure of the funds.

Geographic Exposure

The country exposures of the two funds appears nearly identical. Below are the top country exposures as of 12/31/2022.

| ACWX | IXUS | |

| Japan | 13.95% | 14.96% |

| United Kingdom | 9.69% | 9.74% |

| China | 9.12% | 8.19% |

| Canada | 7.71% | 7.64% |

| France | 7.57% | 6.80% |

Market Cap Exposure

ACWX tracks the large- and mid-cap MSCI All-Country World Index ex-US Index, while IXUS tracks the more expansive Investable Market Index (IMI) version of the index. So IXUS owns many more mid-caps and small-caps. In other words, ACWX is a large-cap vehicle, while IXUS is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| ACWX | IXUS | |

| Large-Cap | 87% | 75% |

| Mid-Cap | 12% | 19% |

| Small-Cap | 0% | 4% |

Sector Weights

The sector weights between ACWX and IXUS are nearly identical, as of 12/31/2022.

| ACWX | IXUS | |

| Financials | 20.99% | 19.48% |

| Industrials | 12.16% | 13.25% |

| Consumer Discretionary | 11.30% | 11.32% |

| Information Technology | 10.69% | 10.69% |

| Health Care | 9.80% | 9.45% |

| Consumer Staples | 8.88% | 8.78% |

| Materials | 8.32% | 8.51% |

| Energy | 6.02% | 5.73% |

| Communication | 5.91% | 5.59% |

| Utilities | 3.30% | 3.36% |

| Real Estate | 2.24% | 3.31% |

Transaction Costs

Both ACWX and IXUS are free to trade on many platforms. These are two of the largest and most liquid ETFs, so the bid-ask spreads are extremely low too.

Expenses

ACWX sports an .32% expense ratio, while IXUS is a fraction of that at .07%. In other words, ACWX is 5x more expensive or 25 basis points more expensive.

Tax Efficiency & Capital Gain Distributions

As with most equity ETFs, neither ACWX nor IXUS makes capital gains distributions. Therefore, both funds are about as tax-efficient as can be.

Final Thoughts: IXUS vs ACWX

Both ACWX and IXUS are large, core funds sponsored and managed by one of the largest asset managers in the world. Additionally, their underlying portfolios are nearly identical and the two funds move in sync. However, ACWX is much more expensive, so IXUS is the way to go in most situations.