The JP Morgan Nasdaq Equity Premium ETF (symbol: JEPQ) is one of the largest covered call exchange-traded funds (ETFs) in the market and is quite popular with retail investors. JEPQ employs a covered call strategy, which attempts to generate income by selling the upside potential of its portfolio. While covered calls may make sense in certain situations, my observation is that individual investors do not typically fully understand the dynamics of the strategy or the trade-offs in terms of risk and return. Interestingly, JEPQ overlays its strategy on the Nasdaq 100 index, rather than the S&P 500 (like its big sibling JEPI). Hopefully, the below can help investors evaluate whether JEPQ is a good investment for their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund reviews (such as this one) are for educational purposes only and are not advice or recommendations.

The Short Answer

JEPQ may be a good tool in rare specific situations, but JEPQ is not a good investment for many other situations. Covered call strategies (including JEPQ) carry a specific and well-known set of tradeoffs that many investors do not necessarily fully understand or consider the implications. I would not recommend JEPQ to most investors.

JEPQ Performance

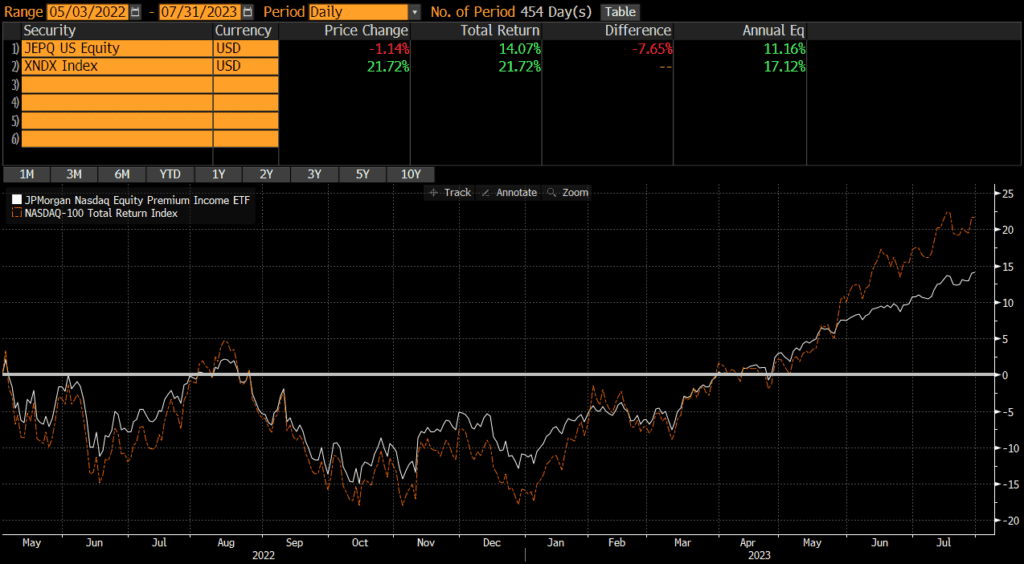

The first thing most investors want to know about is performance, so we will start there. According to Bloomberg, since the fund’s inception in mid 2022, JEPQ has returned 11.16% annualized which is below the Nasdaq 100 Index’s performance of 17.12% over the same time period. It is important to note that the Nasdaq 100 is different than the Nasdaq Composite Index.

As the JEPQ chart of historical performance below shows, JEPQ outperformed in ever so slightly in 2022 (when equity markets experienced a lot of volatility) and began to underperform in 2022 (as market rallied). This is not surprising and exactly what I would expect from a covered call fund as the strategy is to sell upside potential in exchange for cash which helps offset downside losses. So I would expect JEPQ to underperform when equity markets are doing well, outperform when equities are volatile, and generally underperform over longer time horizons (especially on an after-tax basis). I am a bit surprised that JEPQ did not perform better in 2022 given the volatility, but perhaps the fund was launched a bit too late. Overall, performance has not been impressive.

In terms of risk and drawdowns, JEPQ’s downside has been slightly more limited (as has its upside though). The peak-to-trough decline of JEPQ in 2022 was roughly 15% versus approximately 18% for the Nasdaq 100 during the same period.

JEPQ Risks

JEPQ owns stocks which are more volatile than cash or bonds. While the returns are higher than cash or bonds, investors need to be prepared to stomach volatility and be able to hold for the longer-term. JEPQ was down over 16% at one point in 2022. Interestingly, QYLD (a similar strategy that launched before 2022) was down over 24% in 2022, so there definitely is risk. This is not necessarily worse than other similar funds (over the same time period), but it is a characteristic of stocks that investors need to be aware of.

JEPQ Portfolio

Fund performance is ultimately driven by a fund’s holdings and exposures, so our JEPQ review will examine these items.

JEPQ Holdings

JEPQ (and its underlying index) is relatively well diversified in terms of number of holdings.

| JEPQ | NASDAQ 100 | |

| Number of Stocks | 88 | 100 |

JEPQ Country Exposures

JEPQ primarily owns US-based companies. Investors looking for international exposure may pair JEPQ with international ETFs or simply hold a global ETF.

JEPQ Market Cap Exposure

JEPQ is primarily a large-cap fund which seeks to represent the largest US stocks listed on the Nasdaq. Even though the fund holds some mid-caps, performance is primarily driven by the large-cap exposure.

| JEPQ | |

| Large-Cap | 93% |

| Mid-Cap | 6% |

| Small-Cap | 0% |

JEPQ Sector Exposures

Similar to the underlying Nasdaq 100 index, JEPQ is quite concentrated in terms of sectors.

| JEPQ | |

| Basic Materials | 0.00% |

| Consumer Cyclical | 13.73% |

| Financial Services | 0.90% |

| Real Estate | 0.35% |

| Communication Services | 15.25% |

| Energy | 0.37% |

| Industrials | 4.24% |

| Technology | 49.92% |

| Consumer Defensive | 6.75% |

| Healthcare | 7.04% |

| Utilities | 1.44% |

Expenses

No review of JEPQ would be complete without an in-depth look at the explicit and implicit costs of trading and holding JEPQ.

JEPQ Expense Ratio

JEPQ’s expense ratio of .35% is quite a bit higher than most domestic index ETFs, but this is to be expected for a more active strategy. Also, although it’s 10x the cost of a plain vanilla index fund, its only 30-35 basis points.

JEPQ Transaction Costs

ETFs are free to trade at many brokers and custodians, so JEPQ should be free to trade in most cases. Additionally, it is among the largest ETFs and is very liquid. The bid-ask spread of JEPQ is about .02%, so individual investor trades will not generally be large enough to impact or move the market.

JEPQ Tax Efficiency

JEPQ is not very tax-efficient as the premiums received from selling calls are taxed at ordinary income rates. While some investors may not mind receiving income in lieu of potential upside, this is akin to converting capital gains (from appreciation) into ordinary income. Of course, a covered call strategy will lose less money if the market declines, but covered call strategies (including JEPQ) have a large tax drag.

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). This is true of JEPQ as well, since it has not made any capital gains distributions to date. However, I would not necessarily say that the fund is tax efficient since covered call strategies essentially convert capital gains into ordinary income.

JEPQ Premium Costs

Many retail investors focus on the premiums that are received from selling calls. However, investment returns need to calculated net of costs. If an investor sells a call for $3 and buys it back for $1, the return is $2 rather than $3. Of course, if the underlying stock goes up, an investor may have to buy the call back at $5 (as an example). Premium costs vary over time, so investors may want to evaluate total return rather than just premiums received.

JEPQ Review: A Recap

The above review of JEPQ illustrates that JEPQ is a typical covered call strategy. It gained quite a bit of popularity and assets during the bear market of 2022, but covered call strategies are not for everyone (including yours truly). I would not personally invest in JEPQ nor would I recommend it to anyone else, unless they fully understand covered calls and the performance and tax implications.