The Global X S&P 500 Covered Call ETF (symbol: XYLD) is one of the largest covered call exchange-traded funds (ETFs) in the market and is quite popular with retail investors. XYLD employs a covered call strategy, which attempts to generate income by selling the upside potential of its portfolio. While covered calls may make sense in certain situations, my observation is that individual investors do not typically fully understand the dynamics of the strategy or the trade-offs in terms of risk and return. Hopefully, the below can help investors evaluate whether XYLD is a good investment for their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund reviews (such as this one) are for educational purposes only and are not advice or recommendations.

The Short Answer

XYLD may be a good tool in very specific situations, but XYLD is not a good investment for many other situations. Covered call strategies (including XYLD) carry a specific and well-known set of tradeoffs that many investors do not necessarily fully understand or consider the implications. I would not recommend XYLD to most investors.

XYLD Performance

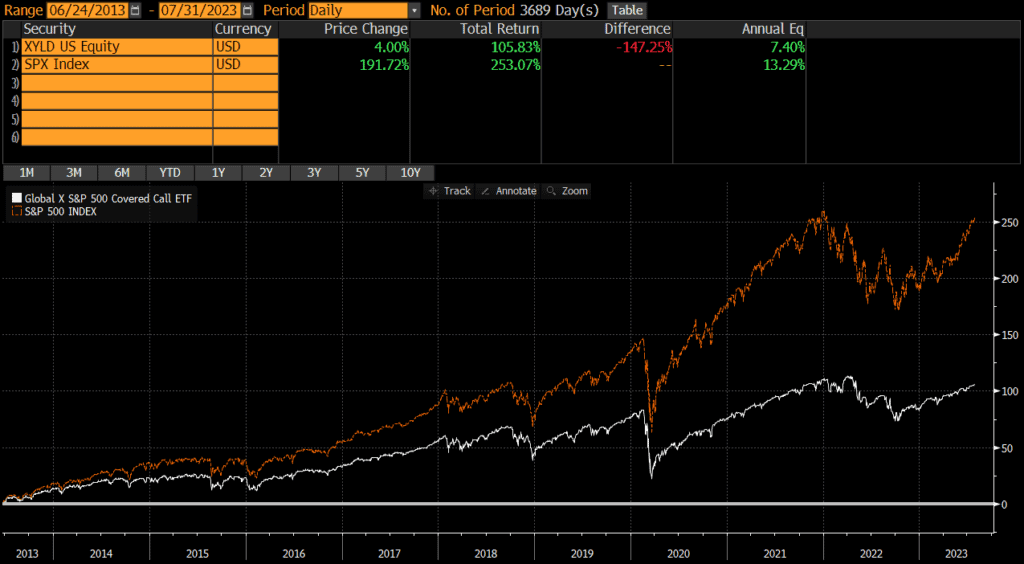

The first thing most investors want to know about is performance, so we will start there. According to Bloomberg, since the fund’s inception in mid 2013, XYLD has returned 7.40% per year which is WAY below the S&P 500’s performance of 13.29% over the same time period.

As the XYLD chart of historical performance below shows, XYLD has dramatically underperformed the S&P 500 over time. XYLD outperformed in 2022, when equity markets experienced a lot of volatility, but began to underperform again in 2022. As of this writing, the total return of the two similar (although XYLD is much less tax-efficient). This is not surprising and exactly what I would expect from a covered call fund as the strategy is to sell upside potential in exchange for cash which helps offset downside losses. So I would expect XYLD to underperform when equity markets are doing well, outperform when equities are volatile, and generally underperform over longer time horizons (especially on an after-tax basis).

In terms of risk and drawdowns, XYLD’s downside has been more limited (as has its upside though). The peak-to-trough decline of the S&P 500 total return in 2022 was roughly 23% while XYLD’s total return was down “only” 17%. That being said, the S&P’s prior outperformance meant that it still performed much better even thought it had larger decline in 2022 (see first chart). My view is that writing covered calls does not provide that much (if any) downside protection because of the general underperformance relative to the underlying. This is not necessarily intrinsically good or bad, but investors should be aware.

XYLD Risks

XYLD owns stocks which are more volatile than cash or bonds. While the returns are higher than cash or bonds, investors need to be prepared to stomach volatility and be able to hold for the longer-term. XYLD was down over 17% at one point in 2022. This is not necessarily worse than other similar funds, but it is a characteristic of stocks that investors need to be aware of.

XYLD Portfolio

Fund performance is ultimately driven by a fund’s holdings and exposures, so our XYLD review will examine these items.

XYLD Holdings

XYLD (and its underlying index) is relatively well diversified, holding over 500 stocks. This represents the large-cap segment of the US stock market.

| XYLD | S&P 500 | |

| Number of Stocks | 506 | 503 |

XYLD Country Exposures

XYLD only owns US-based companies. Investors looking for international exposure may pair XYLD with international ETFs or simply hold a global ETF.

XYLD Market Cap Exposure

XYLD is primarily a large-cap fund which seeks to represent the largest US stocks. Even though the fund holds some mid-caps, performance is primarily driven by the large-cap exposure.

| XYLD | |

| Large-Cap | 82% |

| Mid-Cap | 17% |

| Small-Cap | 0% |

XYLD Sector Exposures

XYLD is extremely diversified across sectors and mirrors the approximate weights of the broad US stock market.

| XYLD | |

| Basic Materials | 2.27% |

| Consumer Cyclical | 10.68% |

| Financial Services | 12.28% |

| Real Estate | 2.48% |

| Communication Services | 8.62% |

| Energy | 4.32% |

| Industrials | 8.37% |

| Technology | 28.53% |

| Consumer Defensive | 6.63% |

| Healthcare | 13.30% |

| Utilities | 2.53% |

Expenses

No review of XYLD would be complete without an in-depth look at the explicit and implicit costs of trading and holding XYLD.

XYLD Expense Ratio

XYLD’s expense ratio of .60% is quite a bit higher than most domestic index ETFs, but this is to be expected for a more active strategy.

XYLD Transaction Costs

ETFs are free to trade at many brokers and custodians, so XYLD should be free to trade in most cases. Additionally, it is among the largest ETFs and is very liquid. The bid-ask spread of XYLD is about .02%, so individual investor trades will not generally be large enough to impact or move the market.

XYLD Tax Efficiency

XYLD is not very tax-efficient as the premiums received from selling calls are taxed at ordinary income rates. While some investors may not mind receiving income in lieu of potential upside, this is akin to converting capital gains (from appreciation) into ordinary income. Of course, a covered call strategy will lose less money if the market declines, but covered call strategies (including XYLD) have a large tax drag.

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). However XYLD has made capital gains distributions and I would not necessarily say that the fund is tax efficient since covered call strategies essentially convert capital gains into ordinary income.

XYLD Premium Costs

Many retail investors focus on the premiums that are received from selling calls. However, investment returns need to calculated net of costs. If an investor sells a call for $3 and buys it back for $1, the return is $2 rather than $3. Of course, if the underlying stock goes up, an investor may have to buy the call back at $5 (as an example). Premium costs vary over time, so investors may want to evaluate total return rather than just premiums received.

XYLD Review: A Recap

The above review of XYLD illustrates that XYLD is a typical covered call strategy. But covered call strategies are not for everyone (including yours truly). I would not personally invest in XYLD nor would I recommend it to anyone else, unless they fully understand covered calls and the performance and tax implications.