MOIC and TVPI are two popular performance metrics, especially within “alternative” investment asset classes such as real estate, private equity, and venture capital. Both are relatively easy to calculate and provide the context needed to understand performance beyond internal rates of return (or IRR, which is the default reporting metric for many private investments.

However, TVPI and MOIC are not the same. Continue reading to learn how to differentiate between TVPI vs MOIC.

MOIC

MOIC Definition

MOIC stands for Multiple On Invested Capital. It expresses returns as a multiple of investment. MOIC is typically quoted on a gross basis (so before expenses such as fees are deducted and taken into account).

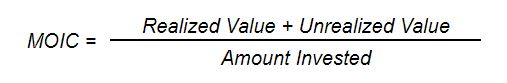

MOIC Formula

Mathematically, MOIC is expressed as an investment’s value (both realized and unrealized) divided by the amount invested.

MOIC Example

Let’s assume an investor purchases a building for $10 million. Over the next few years, the investor receives $2 million of distributions and the building appreciates in value to $13 million. In this case, the total realized value is $2 million and the total unrealized value is $13 million. The total cost was $10 million. So the MOIC would be 1.5x.

MOIC Calculation

In the above example, we get 1.5x by adding $2 million and $13 million and then dividing by $10 million.

TVPI

TVPI Definition

TVPI stands for Total Value to Paid In. It expressed return as a multiple of “paid-in capital.” Paid-in capital is the money that an investor invests (regardless of how much is actually invested), so TVPI is often used to measure the performance of fund investments. TVPI can be quoted on a gross or net of fees basis.

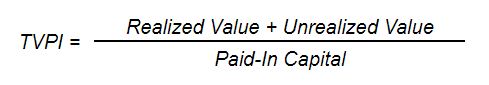

TVPI Formula

TVPI Example

Let’s assume an investor buys into a fund that buys the above building. The investor contributes $11 million. $1 million dollars goes towards fund expenses and fees. The investor receives $1.5 million of distributions and expects to receive $12.5 million from the sale of the building (after all expenses and fees are paid). In this case, the TVPI is 1.27x.

TVPI Calculation

In the above example, we get 1.27x by adding $1.5 million and $12.5 million and then dividing by $11 million.

TVPI vs MOIC: Differences

Although MOIC and TVPI appear quite similar, the main differences between the two are:

- MOIC is generally:

- Quoted on a gross basis

- Applicable to an investment

- TVPI is generally:

- Quoted on a gross or net basis

- Applicable to an investor

Despite the differences, both metrics are helpful to use when evaluating IRR. Read our posts on MOIC vs IRR or TVPI vs IRR to learn more.

The Importance of MOIC and TVPI

MOIC and TVPI occupy an important place in investing in that they are widely-used multiple-based metrics. The other common metric in private market investing is internal rate of return (IRR). Both multiple-based and IRR-based returns have strengths and weaknesses, but neither should be used in isolation. Investors wanting to understand performance should be evaluating both multiples and IRRs.

Unfortunately, many investment managers and funds only advertise IRRs (and sometimes only gross IRRs!). At best, its an non-intuitive metric that does not paint a full picture by itself. At worst, it is used to obscure low investment returns on a multiple basis. Both MOIC and TVPI are valuable tools for investors evaluating investments.