MOIC is a common metric in performance reporting for private equity, venture capital, real estate, and other private investments. It is a valuable tool, but it is insufficient in and of itself. It is important to understand how the MOIC figure is generated as well as look at other return metrics such as IRR, TVPI, CoC, and so on.

MOIC Definition

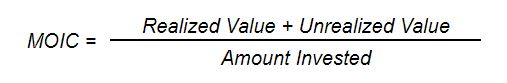

MOIC stands for Multiple On Invested Capital. It expressed return as a multiple of invested capital. Invested capital typically refers to the amount of money that is actually invested (by a fund, typically), so MOIC is often used to measure the performance of private investments. MOIC can be quoted on a gross or net of fees basis.

MOIC Formula

MOIC Example

Let’s assume an investor purchases a building for $10 million. Over the next few years, the investor receives $2 million of distributions and the building appreciates in value to $13 million. In this case, the total realized value is $2 million and the total unrealized value is $13 million. The total cost was $10 million. So the MOIC would be 1.5x.

MOIC Calculation

In the above example, we get 1.5x by adding $2 million and $13 million and then dividing by $10 million.

Shortfalls of MOIC

MOIC is an immensely useful metric for evaluating private equity investments. However, MOIC does have some limitations as well.

MOIC Does Not Consider Time

The first major problem with MOIC is that it does not consider time. We do not know whether an investment with a 2x MOIC is good or bad. It the investment was 2 years ago, the 2x MOIC is great performance. If the investment was made 15 years ago, the 2x MOIC looks rather low.

MOIC Does Not Consider Time Value of Money

Even if two private equity funds are identical in terms of total MOIC and time invested, there can be major differences in return. Consider two different five-year funds, Fund A and Fund B. Both funds have generated a 1.6x MOIC on their investments. Yet, this is insufficient to know which fund performed better.

Lets assume Fund A called 100% of capital immediately. After two years, it returned 130% of that amount back to investors and an additional 30% at the end of the five year period. This is a 1.6x net MOIC.

Alternatively, consider Fund B which also called 100% of capital immediately. It made no distributions for five years and then returned 160% of capital back to investors. This is also a 1.6x net MOIC.

Even though the two funds have generated the same MOIC from their investments, Fund A clearly performed better than Fund B. Investors could have taken the initial distribution from Fund A and reinvested it for the remaining years, whereas investors in Fund B had a total return of 1.6x.

While MOIC is important, time matters and the time value of money matters. This is why investors should never only look at MOIC. They should also look at IRR and/or understand the timing of the cashflows that generated the MOIC figure. Read my summary on MOIC vs IRR.

MOIC May Not Represent Investor Returns

The IC in MOIC stands for invested capital, which technically means capital that the fund invested. But MOIC is often calculated at the asset level and reported gross of fees. Investors may want to compare MOIC to TVPI to get a better read on investor returns.

Impact of Recycling on MOIC

A private equity fund will commonly be receiving distributions from the assets that it owns at the same time that it is calling capital from investors. Consider a $100 million fund that receives a $5 million distribution and simultaneously needs to make a $5 million investment. A popular tactic is to use the proceeds to fund the capital call (rather than distributing the $5 million and then issuing a capital call for them to send it back). In this case, the Multiple (numerator) is increasing and the Invested Capital (denominator) is increasing, but the investor has not contributed any more cash. So the Cash-on-Cash (CoC) return is higher than what the MOIC indicates. Many funds market their “Max Out Of Pocket” exposure, which is another way of saying what percent of an investor’s commitment they end up actually contributing (once recycling is accounted for).

Recallable Distributions (and other shenanigans)

Some private equity funds may distribute capital back to investors very early and classify it as a recallable distribution, meaning that it can be called again. The impact on MOIC is that it reduces the denominator, so MOIC numbers increase. Funds may also make distributions early on (even if they are going to recall it again) because it can permanently increase the IRR metrics. I’m not a huge fan of these recallable distributions, but they are out there and it is important to understand how they can impact MOIC and other performance metrics. The main point here is that fund can play (what I consider) games by re-classifying cash flows.