The Schwab S&P 500 Index mutual fund (SWPPX) and the Vanguard Total Stock Market Index fund (VTSAX) are two of the largest mutual funds in existence. SWPPX and VTSAX are the core of many investor portfolios. Many investors compare SWPPX vs VTSAX in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

The main difference between SWPPX and VTSAX is that SWPPX is a large- and mid-cap fund, while VTSAX is a total market fund. Despite these differences, the total return between these two funds is nearly identical and I consider them interchangeable.

The Long Answer

Historical Performance: SWPPX vs VTSAX

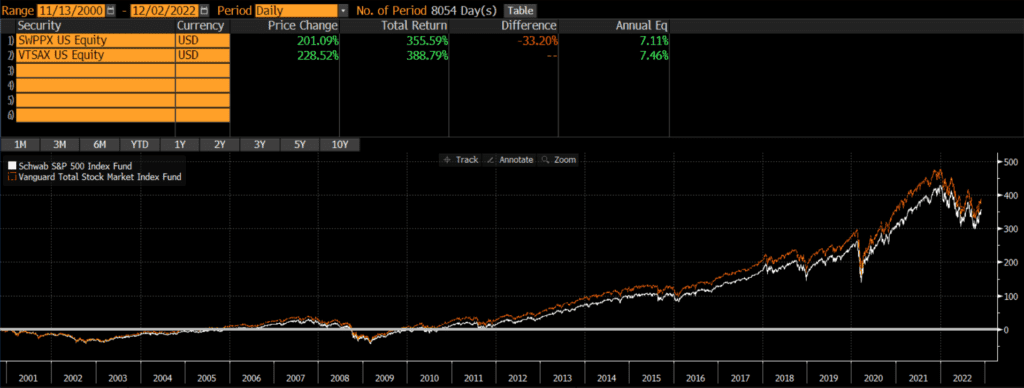

SWPPX was launched on May 19, 1997, while VTSAX was launched a year later on November 13, 2000. Since then VTSAX has outperformed by .35% annually. This is not a huge performance differential, but it does compound over time.

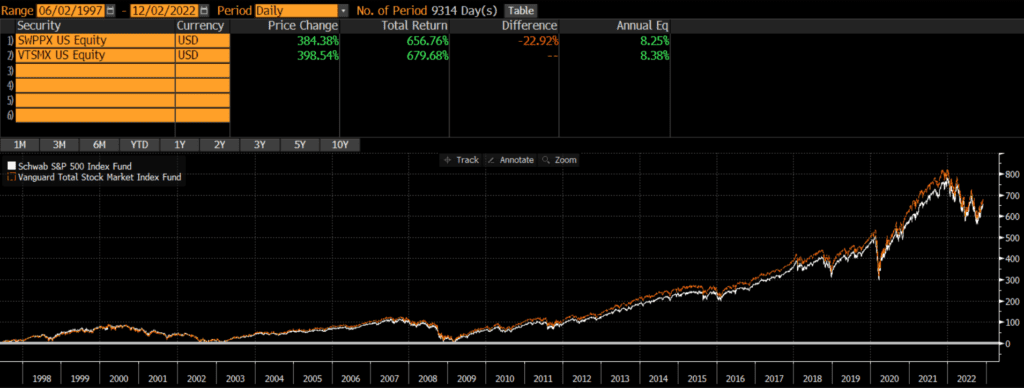

However, when we stretch the time period back a bit further by swapping the older investor share class VTSMX for VTSAX, we see that the annual performance difference narrows to about .13% annually.

The conclusion, of course, is that performance differentials can be highly time dependent. Things that look one way during one time period can looking completely different during a different time period. Nonetheless, performance is pretty similar between these two funds (or strategies if we use older share classes as proxies).

Differences between SWPPX vs VTSAX

The biggest difference between SWPPX and VTSAX is the market cap exposure of the funds. SWPPX tracks the S&P 500 index which includes mostly large-caps and some mid-caps, while VTSAX covers much more of the market by including more mid-caps and small-caps.

Geographic Exposure

Both SWPPX and VTSAX hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For intents and purposes, the two funds have identical exposures.

Market Cap Exposure

SWPPX focuses on the S&P 500 index and so it mostly holds large-caps with a bit of mid-cap exposure. VTSAX tracks the broader CRSP US Total Market Index and so it owns many more mid-caps and small-caps, as of 10/31/2022. In other words, SWPPX is a large-cap vehicle, while VTSAX is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| SWPPX | VTSAX | |

| Large-Cap | 84% | 73% |

| Mid-Cap | 17% | 19% |

| Small-Cap | 0% | 9% |

Sector Weights

The sector weights between SWPPX and VTSAX are nearly identical, as of 10/31/2022. The weights are within 1% for every single sector.

| SWPPX | VTSAX | |

| Basic Materials | 2.27% | 2.51% |

| Consumer Cyclical | 10.59% | 10.66% |

| Financial Services | 13.65% | 13.79% |

| Real Estate | 2.75% | 3.45% |

| Communication Services | 7.35% | 6.80% |

| Energy | 5.37% | 5.31% |

| Industrials | 8.68% | 9.64% |

| Technology | 23.59% | 23.06% |

| Consumer Defensive | 7.38% | 6.75% |

| Healthcare | 15.41% | 15.17% |

| Utilities | 2.96% | 2.87% |

Final Thoughts: SWPPX vs VTSAX

Both SWPPX and VTSAX are large, core funds sponsored and managed by some of the largest asset managers in the world (Schwab and Vanguard). Beyond market cap exposures, the funds appear and act very similar. Long-term performance has been nearly identical. I view these two funds as essentially interchangeable and would not spend too much energy splitting hairs to decide which one is “better.”

One consideration that might tip the scales is where the investors’ account is. Unlike ETFs, many mutual funds are still subject to trading fees and/or short-term redemption fees. So if my accounts were at Schwab, I might lean more towards SWPPX. If my accounts were at Vanguard, I might favor VTSAX. But overall, these two funds are very similar and I wouldn’t worry too much about picking the “right” one.