Schwab offers two government money market mutual funds: the Schwab Government Money Fund Ultra Shares (SGUXX) and the Schwab Government Money Fund Investor Shares (SNVXX). Many investors ask about the differences between these two funds since they are two of the largest government money market mutual funds in the market today. When comparing SGUXX vs SNVXX, it is clear which fund is best for most investors.

The Short Answer

SGUXX and SNVXX are two share classes of the exact same fund! There is no need to compare SGUXX vs SNVXX because the only difference is the minimum initial investment amount and the expense ratio. Investors who can make an initial purchase of $1M or more will get a higher yield with SGUXX.

SGUXX vs SNVXX Historical Performance

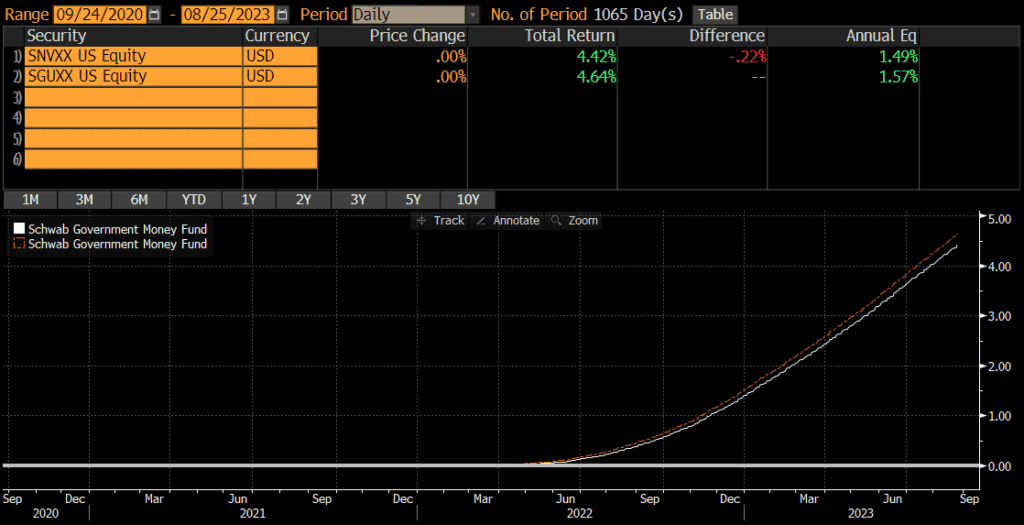

Since its inception, SGUXX has outperformed SNVXX by .08% on an annualized basis. This has compounded to a .22% cumulative difference over the past 3 years, which is relatively small. Currently the yield difference is about .15% however, so future performance may deviate further.

Current Yields for SNVXX & SGUXX

The current 7 day yield is a standardized yield metric for money market mutual funds and the 7 day yields for both SGUXX and SNVXX can be found on the fund’s webpages. See here for SNVXX and here for SGUXX.

What rate is SGUXX & SNVXX paying?

The current interest rate for SGUXX, SNVXX, and other Schwab money markets can be found on Schwab’s money market page.

SNVXX & SGUXX Details

The expense ratio is .34% for the SNVXX investor shares and .19% for the SGUXX ultra shares. Since the funds are just different share classes of the same portfolio, this difference in expenses is what accounts for the differences in yield and performance. Neither fund charges a load or 12b-1 fees.

SNVXX has no minimum investment and investors can invest as little as one cent, while SGUXX has a minimum investment of $1 million. My observation is that investors can keep SGUXX even if they sell and their balance falls below $1 million. The $1 million minimum seems to only apply to the initial purchase.

I have not checked every brokerage, but SGUXX and SNVXX is generally only available to clients of Charles Schwab.

Like most money market mutual funds, investors can sell SGUXX or SNVXX at any time.

SNVXX & SGUXX Risks

Hypothetically, an investor could lose money with SGUXX or SNVXX, but I personally do not think that is a realistic risk as I believe the fund sponsor or the federal government would intervene if that were about to happen. Technically, it is possible to lose money in SNVXX or SGUXX though.

As of June 30, 2023, the fund was composed of approximately $17 billion in the investor shares and $13 billion in ultra shares.

Is SNVXX & SGUXX FDIC Insured?

No, neither SNVXX nor SGUXX are FDIC insured.

Holdings

The two funds are share classes of the same portfolio, so the holdings are identical. The largest holding is repurchase agreements (repos) at 75.5%, followed by government agency debt at 21.6%. The vast majority of the fund’s holdings have a maturity of less than one week (87%).

High Balances

Investors allocating more than $1 million may want to consider the “ultra” share class of the fund, whose symbol is SGUXX.

Tax Considerations

SNVXX and SGUXX are government funds which means that it can invest in government-backed financial instruments. However, taxable investors may find better after-tax yields in Treasury-only (such as SNSXX or SUTXX) or municipal (muni) money market funds, which offer tax benefits that may improve investors’ after-tax yield.

Government and Treasury Money Market Funds

Most states have an income tax. However, interest from Treasuries is exempt from state tax. Therefore, investors in states with income tax may be better off with a government or a Treasury money market fund that invests a greater proportion of its assets in state tax-exempt securities (such as Treasuries).

Muni Money Market Funds

Investors subject to higher tax rates may consider municipal (muni) money market funds due to the fact the interest is typically exempt from federal income tax (and often from state tax too!).

The caveat with muni money market funds though is that the yields can move up and down A LOT. Therefore, the stated yield that an investor looks up on any given day is not necessarily indicative of the future return. To understand why, read my post on muni money market yields.

Rather than expecting a muni money market fund’s stated yield, I encourage investors to expect the trailing average yield (over the past few weeks). Generally speaking, the after tax returns of munis will only be higher than non-muni money markets for those in the highest tax brackets.

Which is Best? SGUXX or SNVXX?

Overall, SNVXX is a good investment for many situations. Those investing more than $1 million should generally go with SGUXX for the higher yield. Investors who are subject to high tax rates may want to consider other funds though.