Several people have asked me recently why the yield on muni money market funds changes so much. The answer is very simple, but its not intuitive at all and requires an understanding of how municipal money market mutual funds invest. Read on to learn why muni money market yields are so volatile and move up and down frequently.

The Short Answer

Taxable money market funds own short-term debt instruments (such as commercial paper, CDs, and so on), typically with maturities of a few days or a few weeks. However, tax-exempt muni money markets typically hold variable rate demand notes (VRDNs) or variable rate demand obligations (VRDOs). The nuances of these instruments their market dynamics is responsible for the volatile yields.

VRDOs and VRDNs

These VRDNs and VRDOs are essentially long-term debt instruments issued by municipalities. Even though the terms and maturities are long-dated, the rates reset very frequently. Thus, their duration is close to zero which makes them investable for money market funds.

Low Duration

Additionally, VRDOs have a “put” feature, which means that investors can redeem at any time. In other words, most muni funds hold very long maturities, but the rates are variable and duration is very short due to rate resets and put features.

Supply & Demand (…and Regulation)

Municipal securities and related muni money market fund yields have long been more volatile than their taxable counterparts, but that volatility has increased in recent years. Part of the reason Muni yields go up and down is supply and demand dynamics, which is partially driven by regulatory changes and concerns.

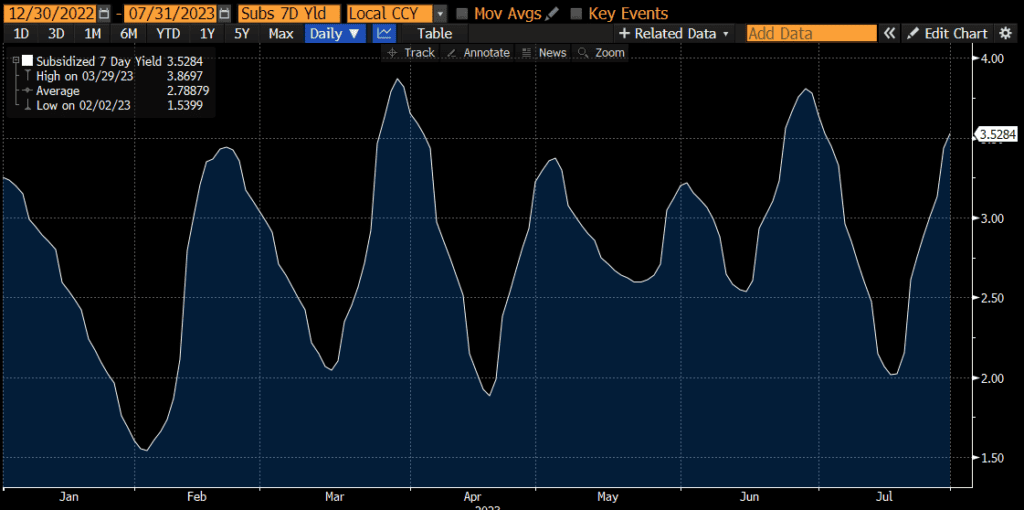

Historical Yield Chart: Muni Money Market

As example, let’s look at Schwab’s flagship muni money market fund SWTXX. Below is a chart of the fund’s subsidized 7-day yield during the first half of 2023. The yield has swung all over the place from approximately 1.5% in February to nearly 4% in March. Depending on when an investor checked the fund website, the fund either looked great or terrible. It may not be surprising that the peaks tend have corresponded with quarter-ends when fact sheets are published…

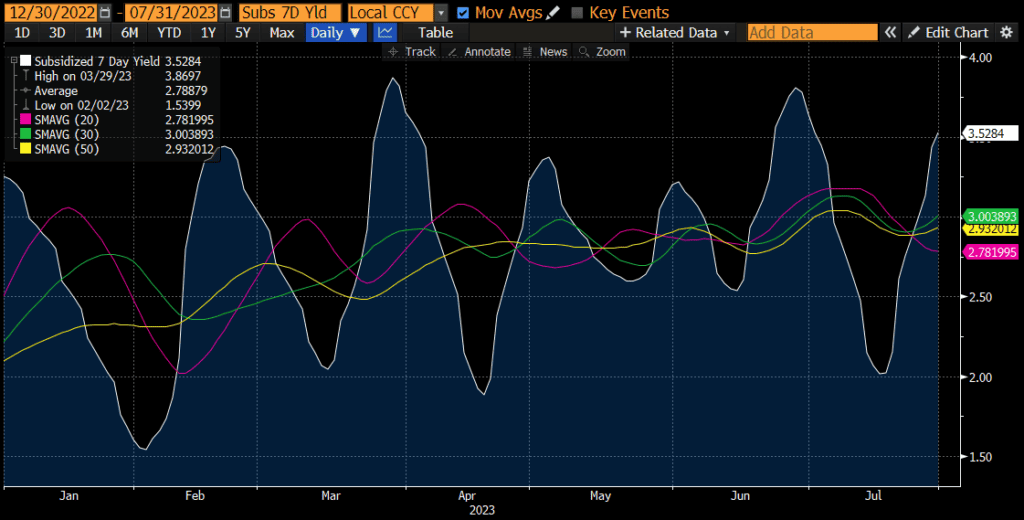

How To Invest in Muni Money Market

So what yield should investors look at and base decisions on? My approach is to assume an average yield, since we know that the stated yield on any given day is not representative of what an investor will receive. In the below chart, I’ve plotted 20-day, 30-day, and 50-day moving averages. Each moving average falls between 2.75% and 3%. I would not invest in this fund based on a 2% yield or a 4% yield (since muni yields are moving up and down so much), but I would base my decision on ~3% yield.

Comparing Muni Money Market Funds

The volatile yields of muni money market funds can make selecting one a more challenging task. Investors need to do a bit of homework beyond simply selecting a muni fund with the highest yield. Below are some examples:

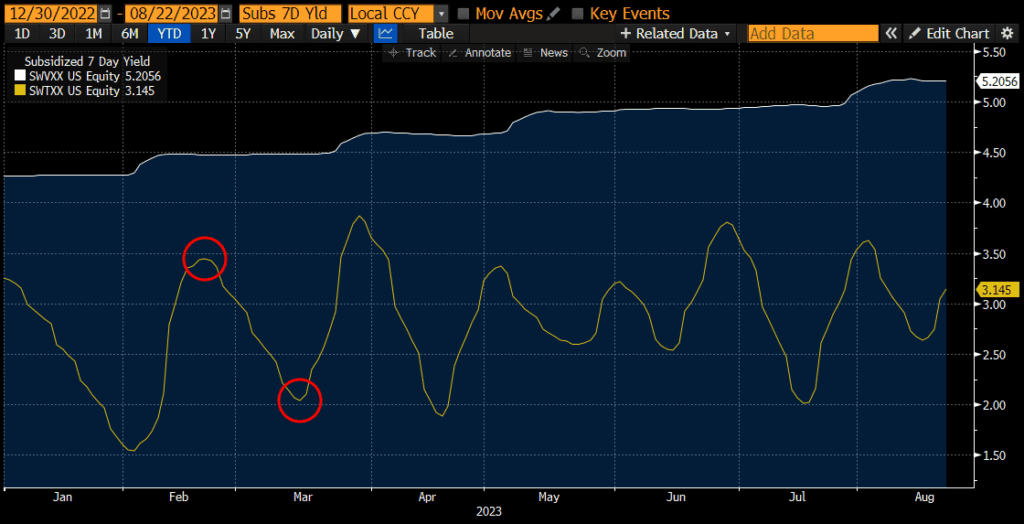

Muni Yield vs Taxable Yield

Taxable money market yields are reflective of market rates and tend to move more gradually based on the broader level of rates in the economy. This is of course influenced by policy rates, benchmark rates, and other factors, but the end result is more gradual changes in rates (compared to muni money markets).

In the below example, we can see that the muni money market (SWTXX) yield is relatively close to the taxable (SWVXX) yield as of late February (and the tax-equivalent muni yield was higher for many investors). However, the muni yield (and the tax-equivalent muni yield) was much lower than the taxable yield by mid-March. So finding the better after-tax yield is largely a function of when an investor observes the yield data. Again, I would review the average yield and then adjust for the tax benefit (rather than just calculating the tax benefit on any given day’s yield).

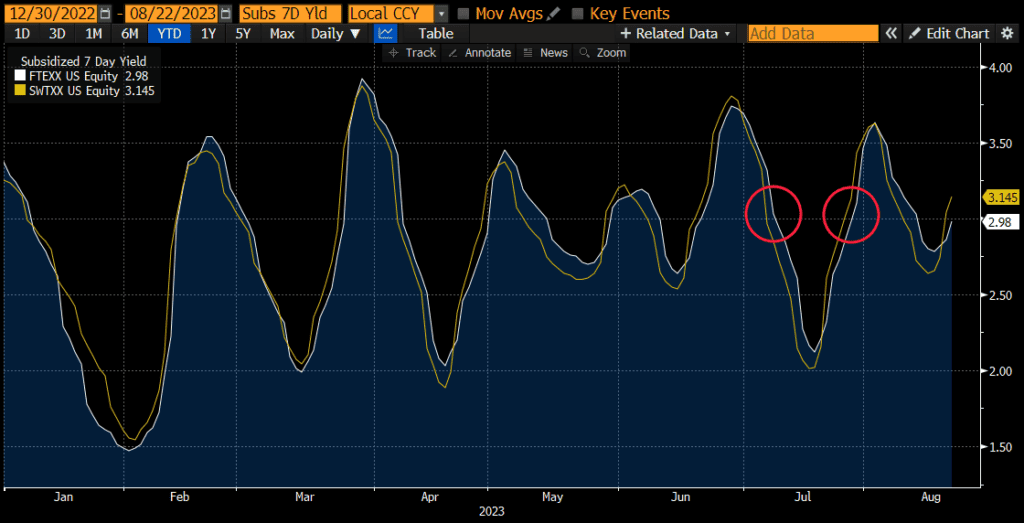

Muni Yield vs Muni Yield

Comparing muni money market funds can be challenging because the muni yields are so volatile. Rather than comparing a volatile yield to a more gradually changing yield, one must compare two volatile yields to one another.

Consider the below example of SWTXX (a Schwab muni money market) vs FTEXX (a Fidelity muni money market). If one checked yields in early July, then FTEXX was the higher yielding fund. If one checked in late July, then SWTXX was the higher yielding fund. So which one should investors select? Personally, I would compare the moving averages and go with the fund that has the highest yield on average.

Bottom Line

The bottom line is that muni money market yields are quite volatile and the stated yield that investors find on a fund website is not indicative of the return that they will receive (since muni yields move up and down so much). My approach is to find the yield history, calculate an average yield or estimate the future yield, and then make a decision. Even investing in cash equivalents can be as much art as science!