The iShares MSCI Emerging Markets ETF (EEM) and the iShares Core MSCI Emerging Markets ETF (IEMG) are two of the largest ETFs in existence and both are sponsored by Blackrock’s iShares. As their names suggest, EEM and IEMG are a core holding of many portfolios. Many investors compare IEMG vs EEM in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

EEM and IEMG are nearly identical is most ways, but EEM is much more expensive than IEMG. In most situations, IEMG is preferable to EEM.

The Longer Answer

These funds are nearly identical in most ways, although EEM is a much more expensive fund.

EEM and IEMG track different indices. The older EEM tracks the large-cap MSCI Emerging Markets Index, while IEMG tracks the MSCI Emerging Markets Investable Market Index (IMI) which owns more mid-caps and small-caps (see our comparison of the indices here).

History of EEM and IEMG

EEM was the first emerging markets ETF to launch, back in 2003. This first mover advantage gave it an edge in accumulating assets under management (AUM) and became the liquid vehicle of choice for traders. Even as other emerging markets ETFs launched and competitors engaged in cutting fees, EEM was able to command premium fees. However, Vanguard and other sponsors were able to begin capturing market share with ever decreasing costs. Blackrock (which owns iShares) needed to respond with a lower cost option, but did not want to sacrifice their golden goose EEM. So rather than cut EEM’s fees, they launched IEMG at a much lower fee level. Essentially, they created IEMG to compete with Vanguard without giving up the high fees that EEM was collecting.

Historical Performance: IEMG vs EEM

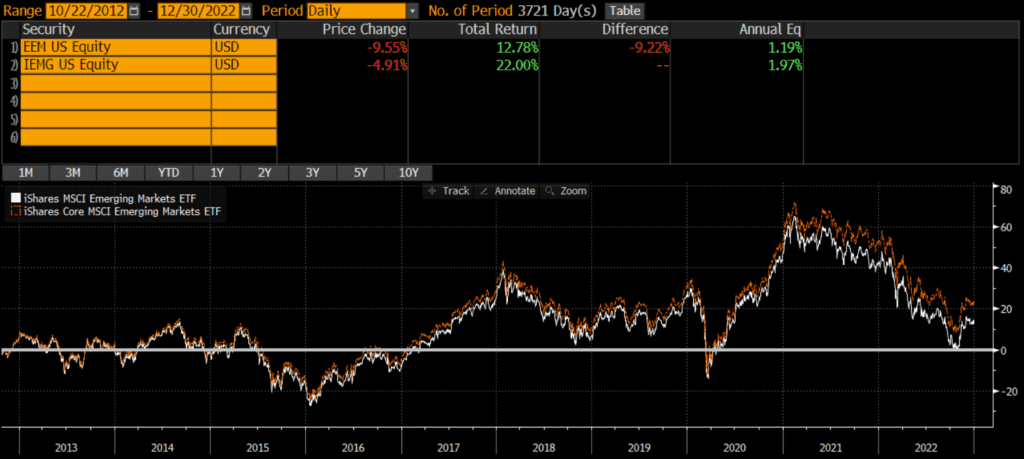

Since IEMG’s launch in October 2012, it has outperformed EEM by .78% annually! This has mostly been driven by the fee differential, which currently stands at .6%. The cumulative performance over the past 10 years is over 10%. As the below chart illustrates, the two funds move in lockstep, but the EEM’s performance is degraded by its expenses.

Differences between IEMG vs EEM

These two funds are nearly identical in every way. Beyond the expenses, the biggest difference between EEM and IEMG is the market cap exposure of the funds.

Geographic Exposure

The country exposures of the two funds appears nearly identical. Below are the top country exposures as of 12/31/2022.

| EEM | IEMG | |

| China | 32.20% | 29.21% |

| India | 14.38% | 15.45% |

| Taiwan | 13.75% | 14.48% |

| Korea | 11.27% | 11.58% |

| Brazil | 5.24% | 5.28% |

Market Cap Exposure

EEM tracks the large- and mid-cap MSCI Emerging Markets Index, while IEMG tracks the more expansive Investable Market Index (IMI) version of the index. So IEMG owns many more mid-caps and small-caps. In other words, EEM is a large-cap vehicle, while IEMG is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| EEM | IEMG | |

| Large-Cap | 91% | 79% |

| Mid-Cap | 10% | 17% |

| Small-Cap | 0% | 5% |

Sector Weights

The sector weights between EEM and IEMG are nearly identical, as of 12/31/2022.

| EEM | IEMG | |

| Financials | 22.01% | 20.44% |

| Information Technology | 18.59% | 18.18% |

| Consumer Discretionary | 14.02% | 13.62% |

| Communication | 9.85% | 9.36% |

| Materials | 8.78% | 9.10% |

| Consumer Staples | 6.41% | 7.28% |

| Industrials | 6.04% | 6.42% |

| Energy | 4.86% | 4.77% |

| Healthcare | 4.07% | 4.55% |

| Utilities | 3.04% | 3.08% |

| Real Estate | 1.94% | 2.58% |

Transaction Costs

Both EEM and IEMG are free to trade on many platforms. These are two of the largest and most liquid ETFs, so the bid-ask spreads are extremely low too.

Expenses

EEM sports an .69% expense ratio, while IEMG is a fraction of that at .09%. In other words, EEM is 7x more expensive or 60 basis points more expensive.

Tax Efficiency & Capital Gain Distributions

As with most equity ETFs, neither EEM nor IEMG makes capital gains distributions. Therefore, both funds are about as tax-efficient as can be.

Final Thoughts: IEMG vs EEM

Both EEM and IEMG are large, core funds sponsored and managed by one of the largest asset managers in the world. Additionally, their underlying portfolios are nearly identical and the two funds move in sync. However, EEM is much more expensive, so IEMG is the way to go in most situations.

EEM has a much more liquid options market, so any options-related strategies may call for EEM rather than IEMG (but I would go with IEMG in every other situation I can think of).