Fidelity offers several government money market mutual funds, including the Fidelity Government Money Market Fund Premium Shares (FZCXX) and the Fidelity Government Money Market Fund (SPAXX). Many investors ask about the differences between these two funds since they are two of the largest government money market mutual funds in the market today. When comparing FZCXX vs SPAXX, it is clear which fund is best for most investors.

The Short Answer

FZCXX and SPAXX are two share classes of the exact same fund! There is no need to compare FZCXX vs SPAXX because the only difference is the minimum initial investment amount and the expense ratio. Investors who can make an initial purchase of $100,000 or more will get a higher yield with FZCXX.

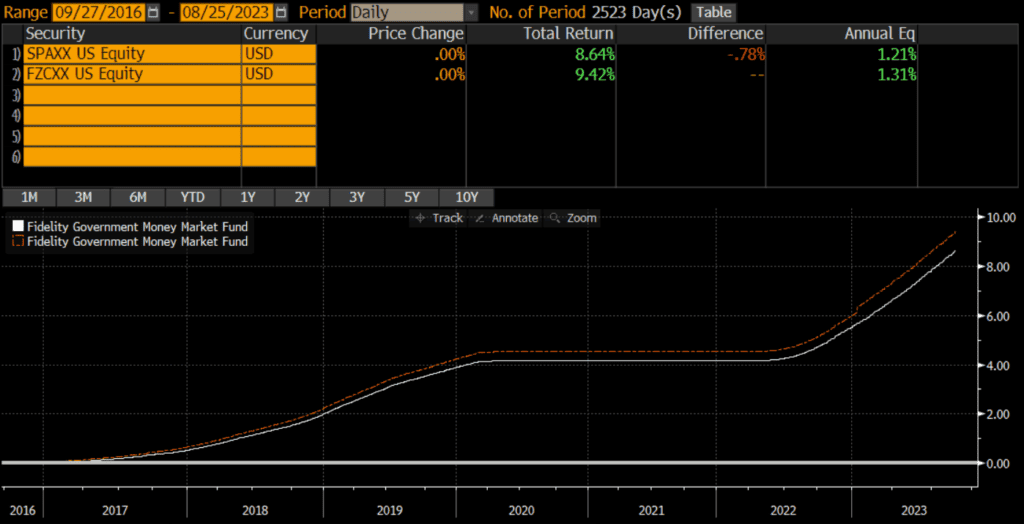

FZCXX vs SPAXX Historical Performance

Since its inception, FZCXX has outperformed SPAXX by .10% on an annualized basis. This has compounded to a .78% cumulative difference over the past 7 years, which is relatively small. Currently the yield difference is about .10%, which is consistent with the historical performance difference.

Current Yields for SPAXX & FZCXX

The current 7 day yield is a standardized yield metric for money market mutual funds and the 7 day yields for both FZCXX and SPAXX can be found on the fund’s webpages. See here for FZCXX and here for SPAXX.

What rate is FZCXX & SPAXX paying?

The current interest rate for FZCXX, SPAXX, and other Fidelity money markets can be found on Fidelity’s money market page.

SPAXX & FZCXX Details

The expense ratio is .42% for the SPAXX investor shares and .32% for the FZCXX premium shares. Since the funds are just different share classes of the same portfolio, this difference in expenses is what accounts for the differences in yield and performance. Neither fund charges a load or 12b-1 fees.

SPAXX has no minimum investment and investors can invest as little as one cent, while FZCXX has a minimum investment of $100,000. My observation is that investors can keep FZCXX even if they sell and their balance falls below $100,000. The $100,000 minimum seems to only apply to the initial purchase.

I have not checked every brokerage, but FZCXX and SPAXX is generally only available to clients of Fidelity.

Like most money market mutual funds, investors can sell FZCXX or SPAXX at any time.

SPAXX & FZCXX Risks

Hypothetically, an investor could lose money with FZCXX or SPAXX, but I personally do not think that is a realistic risk as I believe the fund sponsor or the federal government would intervene if that were about to happen. Technically, it is possible to lose money in SPAXX or FZCXX though.

As of July 31, 2023, the fund was composed of approximately $251 billion in the investor shares and $8 billion in premium shares.

IS SPAXX or FZCXX FDIC Insured?

No, neither SPAXX nor FZCXX are FDIC insured.

Holdings

The two funds are share classes of the same portfolio, so the holdings are identical. The largest holding is repurchase agreements (repos) at 63%, followed by agency debt at 18%, and Treasuries at 10%, among other asset classes. The vast majority of the fund’s holdings have a maturity of less than one week (80%).

High Balances

Investors allocating more than $100,000 may want to consider the “premium” share class of the fund, whose symbol is FZCXX.

Tax Considerations

SPAXX and FZCXX are government funds which means that they invest in government debt instruments. However, taxable investors may find better after-tax yields in Treasury or municipal (muni) money market funds, both of which offer tax benefits that may improve investors’ after-tax yield.

Government and Treasury Money Market Funds

Most states have an income tax. However, interest from Treasuries is exempt from state tax. Therefore, investors in states with income tax may be better off with a Treasury money market fund (such as SNSXX or SUTXX) that only invests in Treasuries.

Muni Money Market Funds

Investors subject to higher tax rates may consider municipal (muni) money market funds due to the fact the interest is typically exempt from federal income tax (and often from state tax too!).

The caveat with muni money market funds though is that the yields can move up and down A LOT. Therefore, the stated yield that an investor looks up on any given day is not necessarily indicative of the future return. To understand why, read my post on muni money market yields.

Rather than expecting a muni money market fund’s stated yield, I encourage investors to expect the trailing average yield (over the past few weeks). Generally speaking, the after tax returns of munis will only be higher than non-muni money markets for those in the highest tax brackets.

Which is Best? FZCXX or SPAXX?

Overall, SPAXX is a good investment for many situations (and I have used it many times). Those investing more than $100,000 should generally go with FZCXX for the higher yield. Investors who are subject to high tax rates may want to consider other funds though.