The Fidelity 500 Index Fund (symbol: FXAIX) is one of the largest mutual funds in the market. FXAIX is a low-cost index fund, which tracks the S&P 500 and seeks to provide exposure to the US stock market at a very low price. The fund is the core of many portfolios and the below review of FXAIX will evaluate why that is.

A quick reminder that this site does NOT provide investment recommendations. Fund reviews (such as this one) are for educational purposes only and are not advice or recommendations.

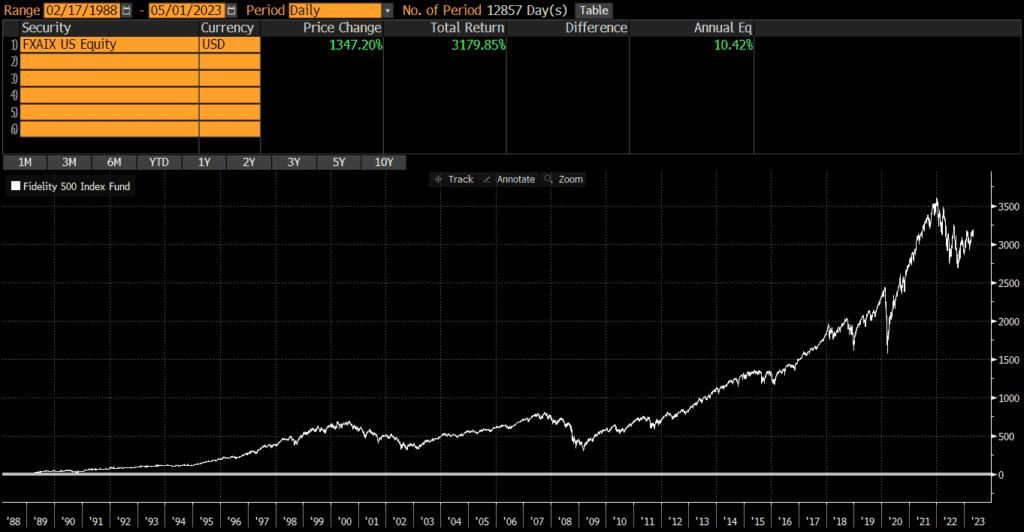

FXAIX Performance

The first thing most investors want to know about is performance, so we will start there. According to Bloomberg, since the fund’s inception 35 years ago, FXAIX has returned over 10% per year. Of course, this figure can go up or down and the returns in any single year are unlikely to be 8%. From 1990 through 2022 (32 years), FXAIX was up in 26 years and down in 6 years. The average return in the up years was 18.3%, while the average return in the down years was -17.2%.

FXAIX Risks

FXAIX owns stocks which are more volatile than cash or bonds. While the returns are higher than cash or bonds, investors need to be prepared to stomach volatility and be able to hold for the longer-term. FXAIX was down nearly 50% during the tech crash and down over 55% during the global financial crisis from 2007-2009! This is not necessarily worse than other similar funds, but it is a characteristic of stocks that investors need to be aware of.

FXAIX Portfolio

Fund performance is ultimately driven by a fund’s holdings and exposures, so our FXAIX review will examine these items.

FXAIX Holdings

FXAIX (and its underlying index) is well diversified, holding over 500 stocks that are representative of the US stock market.

| FXAIX | S&P 500 | |

| Number of Stocks | 506 | 506 |

FXAIX Country Exposures

FXAIX only owns US-based companies. Investors looking for international exposure may pair FXAIX with international funds or simply hold a global fund.

FXAIX Market Cap Exposure

FXAIX is a large-cap fund that seeks to represent the largest names in the US stock market, which are predominantly composed of large-caps. Even though the fund holds mid-caps, performance is primarily driven by the large-cap exposure.

| FXAIX | |

| Large-Cap | 84% |

| Mid-Cap | 16% |

| Small-Cap | 0% |

FXAIX Sector Exposures

FXAIX is extremely diversified across sectors and mirrors the approximate weights of the broad US stock market.

| FXAIX | |

| Basic Materials | 2.38% |

| Consumer Cyclical | 10.41% |

| Financial Services | 12.45% |

| Real Estate | 2.64% |

| Communication Services | 8.11% |

| Energy | 4.61% |

| Industrials | 8.42% |

| Technology | 26.66% |

| Consumer Defensive | 7.18% |

| Healthcare | 14.27% |

| Utilities | 2.86% |

Expenses

No review of FXAIX would be complete without an in-depth look at the explicit and implicit costs of trading and holding FXAIX.

FXAIX Expense Ratio

FXAIX’s expense ratio of .015% is among the lowest of any mutual funds. Even if another fund is free, one and a half basis points is not a material difference in my opinion.

FXAIX Transaction Costs

While ETFs are free to trade at many brokers and custodians, mutual funds often incur trading fees still. FXAIX should be free to trade in Fidelity accounts, but will likely cost money to buy or sell anywhere else. Investors planning to make small or frequent trades may want to consider using an ETF instead of a mutual fund. Readers may consider VOO or IVV.

FXAIX Tax Efficiency

Like most index funds, FXAIX is very tax-efficient. Unlike actively-managed funds, passively-managed index funds typically have less trading and lower turnover. This results in fewer taxable events and higher tax efficiency.

Investor looking for even more tax-efficiency may want to consider using an ETF, since they are typically more tax-efficient than mutual funds due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post).

Investors in a high tax bracket with at least $250,000 may consider direct indexing rather than FXAIX, as direct indexing can potentially generate even more tax savings.

FXAIX Review: A Recap

The above review of FXAIX illustrates that FXAIX is a well-constructed, low-cost and tax-efficient index fund that provides diversified exposure to the US stock market. FXAIX is a great choice in many situations if your account is at Fidelity. Personally, I would probably not consider this fund unless my account was at Fidelity.