The Schwab S&P 500 Index mutual fund (SWPPX) and the Fidelity Total Stock Market Index fund (FSKAX) are two of the largest mutual funds in existence. SWPPX and FSKAX are the core of many investor portfolios. Many investors compare SWPPX vs FSKAX in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

The main difference between SWPPX and FSKAX is that SWPPX is a large- and mid-cap fund, while FSKAX is a total market fund. Despite these differences, the total return between these two funds is pretty close.

The Long Answer

Historical Performance: SWPPX vs FSKAX

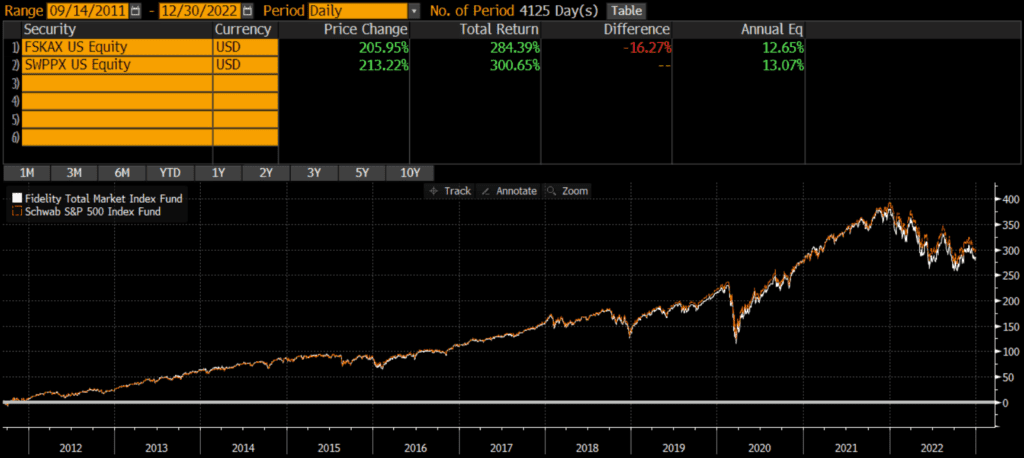

SWPPX was launched on May 19, 1997, while FSKAX was launched a year later on September 8, 2011 (although other shares classes of the fund existed prior to that). Since then, SWPPX has outperformed by about a half percent annually. This is not a huge performance differential, but it does compound over time. The cumulative difference between the two funds since common inception is just over 16%.

Of course, the outperformance of SWPPX is reflective of large-cap stocks’ dominance over the past decade. If mid-caps and/or small-caps lead, then I suspect FSKAX would outperform.

Differences between SWPPX vs FSKAX

The biggest difference between SWPPX and FSKAX is the market cap exposure of the funds. SWPPX tracks the S&P 500 index which includes mostly large-caps and some mid-caps, while FSKAX covers much more of the market by including more mid-caps and small-caps.

Geographic Exposure

Both SWPPX and FSKAX hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For intents and purposes, the two funds have identical exposures.

Market Cap Exposure

SWPPX focuses on the S&P 500 index and so it mostly holds large-caps with a bit of mid-cap exposure. FSKAX tracks the broader Dow Jones U.S. Total Stock Market Index and so it owns many more mid-caps and small-caps (as of 11/30/2022). In other words, SWPPX is a large-cap vehicle, while FSKAX is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| SWPPX | FSKAX | |

| Large-Cap | 83% | 73% |

| Mid-Cap | 16% | 19% |

| Small-Cap | 0% | 9% |

Sector Weights

The sector weights between SWPPX and FSKAX are nearly identical, as of 11/30/2022. The weights are within 1% for every single sector.

| SWPPX | FSKAX | |

| Basic Materials | 2.40% | 2.68% |

| Consumer Cyclical | 10.16% | 10.43% |

| Financial Services | 13.80% | 14.04% |

| Real Estate | 2.77% | 3.46% |

| Communication Services | 7.46% | 6.91% |

| Energy | 5.12% | 5.13% |

| Industrials | 8.86% | 9.58% |

| Technology | 23.72% | 23.18% |

| Consumer Defensive | 7.40% | 6.77% |

| Healthcare | 15.31% | 14.97% |

| Utilities | 2.99% | 2.87% |

Transaction Costs

Many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, neither Fidelity nor Schwab participates in the pay-to-play arrangements (with their competitor custodians) that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is generally free to trade FXAIX; similarly, SWPPX is generally free to trade at Schwab.

It is worth noting that neither fund has a minimum for initial or additional investments. That being said, investors looking for free trades may want to consider an a total market ETF or large-cap ETF, rather than FSKAX or SWPPX.

Expenses

Some investors may point out that the expense ratios between FSKAX and SWPPX differ. This is true, but it is also reflected in the net performance chart above. At a certain level, differences in expense ratio do not matter that much. In this case, the difference in expenses is fractions of a hundredth of a percent, so no need to compare or split hairs.

Tax Efficiency & Capital Gain Distributions

Both funds have made capital gains distributions in the past and will likely make them in the future. It is not possible to say which one will be more tax-efficient in the future. As index funds, the tax drag on both funds is very low. However, tax-sensitive taxable investors may want to consider using an ETF in lieu of either of these funds.

Final Thoughts: SWPPX vs FSKAX

Both SWPPX and FSKAX are large, core funds sponsored and managed by some of the largest asset managers in the world (Schwab and Fidelity). Beyond market cap exposures, the funds appear and act very similar. Long-term performance has been nearly identical. I view these two funds as essentially interchangeable and would not spend too much energy splitting hairs to decide which one is “better.”

One consideration that might tip the scales is where the investors’ account is. Unlike ETFs, many mutual funds are still subject to trading fees and/or short-term redemption fees. So if my accounts were at Schwab, I might lean more towards SWPPX. If my accounts were at Fidelity, I might favor FSKAX. But overall, these two funds are very similar and I wouldn’t worry too much about picking the “right” one.