The Fidelity S&P 500 Index Fund (FXAIX) and the Vanguard S&P 500 Index Fund (VFIAX) are two of the largest S&P 500 index mutual funds in existence and easily two of the most popular among individual investors. Both FXAIX and VFIAX track the well-known S&P 500 index and form the core of many investor portfolios. Many investors compare FXAIX vs VFIAX in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

There are not many differences between FXAIX and VFIAX. Therefore, investors should consider factors beyond the underlying portfolios (which are essentially identical) in order to decide which fund is best for them.

The Long Answer

Historical Performance: FXAIX vs VFIAX

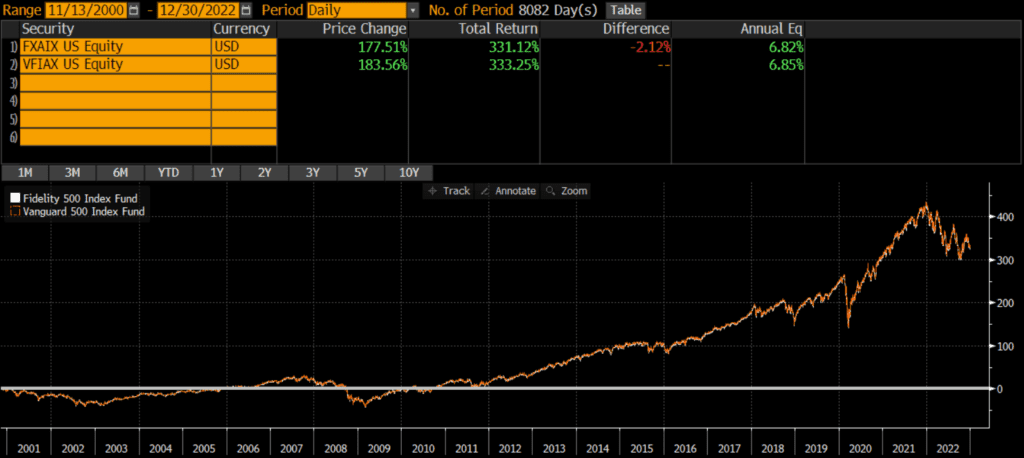

FXAIX was launched on February 17, 1988, while VFIAX was launched on November 13, 2000. Since then the two funds have performed identically, with a difference of just .03% annually! The cumulative performance difference between these two funds has been less than 2% (over a two decade timeframe)! Thus, from a performance perspective, I would consider these two funds interchangeable.

Differences between FXAIX vs VFIAX

Both FXAIX and VFIAX track the S&P 500, so I will not delve into differences in geographic exposures, sector weights, or market cap coverage. For all intents and purposes, the portfolios are identical with 504 stocks each. The S&P 500 has more than 500 stocks because of the index constituents have multiple share classes of stock (such as GOOG and GOOGL).

Factors to Consider

Expenses

Some investors may point out that the expense ratios between FXAIX and VFIAX differ. This is true, but it is also reflected in the net performance chart above. At a certain level, differences in expense ratio do not matter that much. In this case, the difference in annualized performance is equal to the difference in expense ratio. Since these funds are identical, I would most likely lean towards VFIAX although getting the allocation is more important than selecting the “right” fund.

Transaction Costs

Many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements (with their competitor custodians) that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is generally free to trade FXAIX.

Similarly, Vanguard does not participate in pay-to-play arrangements, so VFIAX trades are likely to incur a fee at any custodian besides Vanguard.

Investors looking for free trades may want to consider an S&P 500 ETF, such as VOO, SPY, SPLG, or IVV.

Tax Efficiency & Capital Gain Distributions

FXAIX has made capital gains distributions in the past and I would expect this to continue in future. VFIAX has not made a capital gain distribution since 2000 and I do not expect it to in the future due to the way that Vanguard structures its ETFs. Thus, tax-sensitive investors may favor VFIAX or an S&P 500 ETF.

Tax Loss Harvesting

Investors may want to avoid using these two funds as tax loss harvesting substitutes for one another since they could be considered “substantially identical.”

Tradability

FXAIX does not have a stated minimum for purchases, although some brokerages (especially competitors of Fidelity) impose minimums. The minimum purchase size for VFIAX is $3,000, regardless of where it is bought or sold.

Final Thoughts: FXAIX vs VFIAX

Both FXAIX and VFIAX are large, core funds sponsored and managed by Fidelity and Vanguard respectively. Performance has been nearly identical. I view these two funds as essentially interchangeable and would not spend too much energy trying to decide which one is “better.”

However, there are some situations that may call for one fund versus another. So I might select FXAIX or VFIAX solely based on where my account is held and whether I’m investing taxable vs retirement dollars. Despite these considerations, these two funds are very similar for all intents and purposes.