VFINX vs VFIAX

The Vanguard 500 Index Fund (Admiral Shares) (symbol VFIAX) and the Vanguard 500 Index Fund (Investor Shares) (symbol VFINX) are two of the largest and most popular S&P 500 index funds. Some compare VFIAX vs VFINX not realizing that they are just two different share classes of the same portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

VFIAX and VFINX are different share classes of the same portfolio. VFINX is closed to new investors, so it is not possible to buy unless you already own VFINX.

If you already own VFINX and are considering buying more, the decision to buy VFINX or VFIAX depends on investor-specific factors (some of which are listed below). Additionally, Vanguard allows owners of many Investor Shares to convert their shares to Admiral Shares or ETF shares.

If you do not own VFINX, then both VFIAX and VOO (the ETF share class) are options.

The Longer Answer

Vanguard offers multiple shares classes for many funds. The Investor Shares are being phased out and Vanguard is pushing the Admiral Shares and the ETFs now. In other words, VFIAX and VFINX are not two funds pursuing an identical strategy; they are the same fund!

Historical Performance: VFIAX vs VFINX

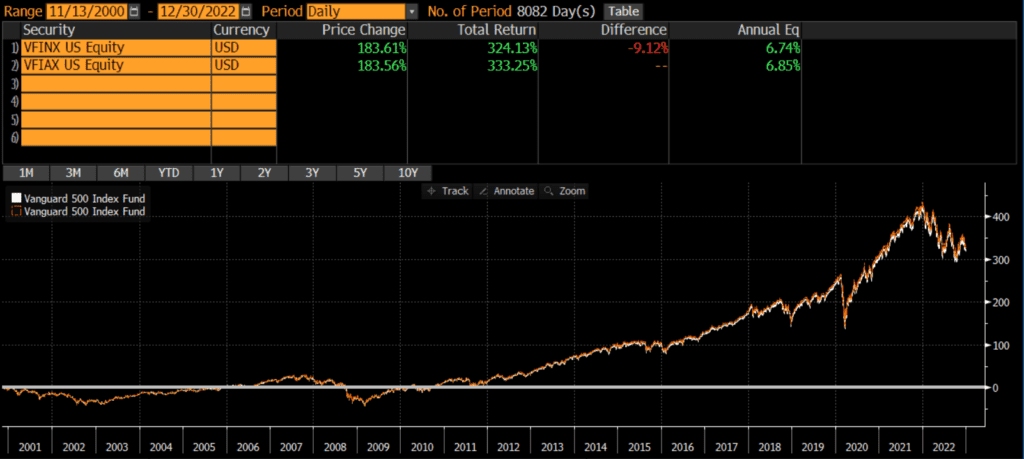

VFINX was launched back 1976, while VFIAX was launched on November 13, 2000. Since that time, performance has been nearly identical: 6.74 vs 6.85% annually. Despite changes in fees and expenses over the past 22 years, the cumulative difference in performance over that time period is only 9%! Looking at the chart of VFIAX vs VFINX below, it is obvious that they are identical.

Differences Between VFIAX and VFINX

Since the two funds are actually two share classes of the same fund, I will skip the usual comparisons here. The geographic exposures, sector weights, market cap coverage so on is identical because the two funds are shares in the same portfolio. There are some resources on the internet indicating differences, but that is incorrect because they are the same fund!

Factors to Consider

Expenses

Some investors may point out that the expense ratios between Vanguard’s Admiral Shares and Vanguard’s Investor Shares differ. This is true, but it is also reflected in the net performance chart above. At a certain level, differences in expense ratio do not matter that much. In this case, the difference in annualized performance is equal to the difference in expense ratio. Since these funds are identical, I would most likely lean towards VFIAX although getting the allocation is more important than selecting the “right” fund.

Transaction Costs

Neither fund charges purchase or redemption fees, so they should be free to trade at Vanguard. To my knowledge, Vanguard does not participate in the pay-to-play arrangements that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Vanguard, it is free to trade VFIAX or VFINX. However, there will likely be a cost to buy or sell on other platforms.

Investors planning smaller allocations or expecting a lot of transactions may want to consider VOO, the ETF share class of this strategy.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). However, since Vanguard ETFs are a share class of their mutual funds, the mutual funds are able to benefit from this feature of the ETF. In other words, both VFIAX and VFINX benefit from VOO’s tax-efficient mechanisms.

Both VFINX and VFIAX made capital gains distributions prior to VFIAX’s launch in 2000, although it has not made a capital gains distributions since then (and VFIAX has never made a cap gains distribution)! In other words, VFINX and VFIAX are equivalent in terms of tax efficiency.

Tax Loss Harvesting

Investors should probably avoid using these two funds as tax loss harvesting substitutes for one another since they would likely be considered “substantially identical.”

Tradability

As mentioned above, VFINX is closed to new investors. So unless you already own VFINX, you may want to consider VFIAX or VOO.

VFIAX does have a stated minimum initial purchase of $3,000, so that may be a factor for some investors looking to initiate a position.

The minimum purchase size for VOO is typically one share, although fractional shares are becoming more common. Investors can trade ETFs intraday, as well as in the pre-market and after-hours trading sessions. Investors can only buy/sell mutual funds once per day. This is not necessarily a major factor for long-term investors however.

Final Thoughts: VFIAX vs VFINX

VFIAX and VFINX are literally the same. However, investors should consider the above factors when deciding which one is best for them (if they are able to buy VFINX at all).