This is an evidence-based website and there is sufficient evidence that index-based investing is one of the best ways to invest… in equities. The case for index investing is much less compelling for fixed-income (aka bonds). The asset class is not well-suited for passive management, the indices have some issues, and bond index funds are exposed to some major risks.

These risks can be exacerbated if the index fund happens to be an ETF. This post is not only or necessarily a case for “why bond ETFs are bad,” but it does highlight some of the bond ETF risks that investors should consider.

Why Passive Investing Makes Less Sense for Bonds

Bonds Are Not Tax Efficient

One of the primary benefits of passive management or index investing is tax-efficiency. In short, fewer trades generally leads to less realized capital gains (resulting in lower tax liability). This low turnover approach works well for equities where appreciation is the major contributor to performance (with dividends contributing less historically). However, interest income is the major contributor to fixed-income returns with appreciation playing a minor role (if any at all). Thus, while low turnover can help equity investors turn short-term gains into long-term gains or allow capital to compound tax-deferred for longer, there is rarely such benefit for fixed-income investors.

Bond Returns Are Capped

Related to the above two issues is the attribution of returns. Within equities, a small rolling cohort of stocks is responsible for the majority of returns. There is a downside to not owning everything as returns from a minority of “winners” will more than offset losses from the majority of “losers.” Within fixed-income, future returns are more or less known as they generally consist of fixed interest payments (hence the name “fixed-income”). So there is little (if any) benefit to owning everything and there is a downside because defaults will decrease returns. Fixed-income investors should diversify enough while also avoiding the worst borrowers.

Bond Index Risks

Bond Index Construction

The construction of many fixed-income indices can also be problematic. Many indices are capitalization (“cap”) weighted. For equity indices, this means that larger companies constitute larger portions of the index. For fixed-income indices, this means that entities with the most debt constitute larger portions of the index. Of course, this is not necessarily desirable and we believe there are much better methodologies to weight portfolios.

Bond Index Fund Risks

Bonds Are Illiquid

Unlike equity markets where shares of nearly every public company trade every day, fixed-income markets are not nearly as liquid. Many fixed-income assets do not even trade on a central exchange, but rather via phone, chat, and even by appointment. On any given day, most municipal bonds do not trade at all and many do not trade for months at a time. Most high yield bonds do not trade every day nor do a large portion of investment grade bonds. Recall that an index fund’s objective is to mirror the risk and return of an index, not to maximize performance. Index funds are forced buyers and sellers; if cash comes in they must buy and they must sell if they receive redemption requests. This is not necessarily a problem for equity index funds because equities are fairly liquid. However, what happens if a fixed-income funds needs to sell into a skittish market or buy into ebullient one?

As volatility increases and liquidity declines, it is very difficult to value bonds. Fixed-income markets can and do freeze (except for forced transactions such as liquidations and distressed sellers). Being forced to sell into an illiquid market with no bids is not something anyone wants to do, but some investors are forced to do it. Imagine an index mutual fund or ETF receiving investor redemptions; those funds HAVE to sell.

Bonds Can Be Difficult To Value

How does this impact fixed-income index funds? Fixed-income fund “net asset values” (NAV) are typically derived using the “bid” (the price that someone is willing to buy a bond for, rather than the “ask” or what some is willing to sell for). So, what happens when a market is frozen and there are no bids? What happens when nobody wants to buy and everyone knows that there are forced sellers and bids are lowered to fire sale prices? Funds have difficulty pricing their holdings and valuing their portfolios, so NAVs are all over the place. Within the fixed-income ETF universe, many funds trade at deep discounts to NAV because investors do not trust the ETF’s reported NAV.

Not all ETFs are created equal, but even the largest and most liquid fixed-income ETFs are not immune from the above issues (of course, the discounts on smaller and less liquid ETFs was much larger than the examples shown above). Every product wrapper possesses a unique set of pros and cons and some suit particular asset classes better than others. We encourage investors to understand these dynamics and evaluate the risks before allocating to fixed-income ETFs.

Bond ETFs: Pros and Cons

In addition to issues that fixed-income indices and index funds face, the exchange-traded fund (ETF) wrapper can create additional problems for fixed-income investors.

Why Bond ETFs Are Bad

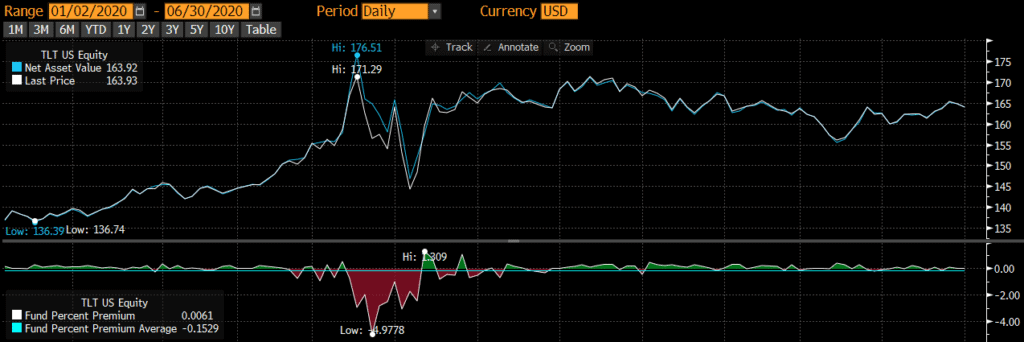

Fixed-income ETFs frequently trade at a discount to their net asset value during times of stress. One the largest and most liquid bond ETFs, iShare’s TLT, traded nearly 5% below its NAV in March 2020!

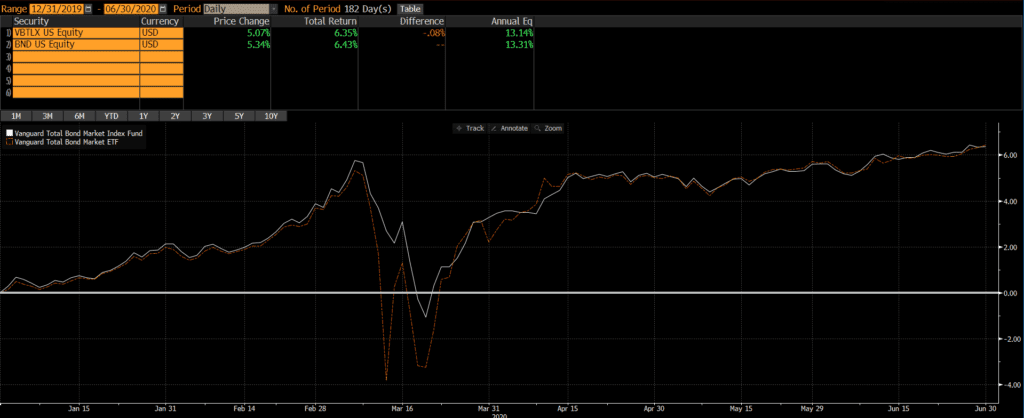

Perhaps even more interestingly, at one point in March 2020, Vanguard’s ETF BND traded more 6% below what mutual fund shares on the same portfolio traded at (many Vanguard ETFs are a share class of existing mutual fund portfolios, so those ETFs and mutual funds own the same underlying portfolio)!

Some argue that ETFs provide better price discovery and that ETF market prices are more accurate than NAVs. I am are sympathetic to this argument, but investors prefer to sell at higher prices rather than lower prices (no matter how interesting academic questions about price discovery might be). All else being equal, it is difficult for me to buy a fixed-income ETF knowing that this large risk exists (even if it realized infrequently).

Bond ETF Tax-Efficiency

Of course, a major advantage of ETFs is the tax-efficiency created by “in-kind” creations and redemptions of fund shares. This can provide a material benefit to equity investors who want to minimize turnover for tax purposes, but is of limited benefit to fixed-income investors whose returns consist primarily of interest. Additionally, many fixed-income ETFs utilize create/redeem using cash rather than in-kind securities.

When Bond ETFs Can Be Good

Despite the above, I believe there are a few use cases for Bond ETFs.

- Bond ETFs are generally more liquid than the bonds that they hold. So investors who like to trade a lot may be better off using an ETF.

- Investors who monitor markets closely and are able to sell at the first signs of market distress.

- Long-term investors who do not mind if their holdings trade at a wide discount to NAV.

- Foreign investors who may not be able to buy many US-domiciled mutual funds.

Final Thoughts

My personal view is that investors should allocate to index-based strategies for equity exposure and actively-managed strategies for fixed-income exposure due to the issues listed above. However, every investor is different and must weigh the above factors for themselves.