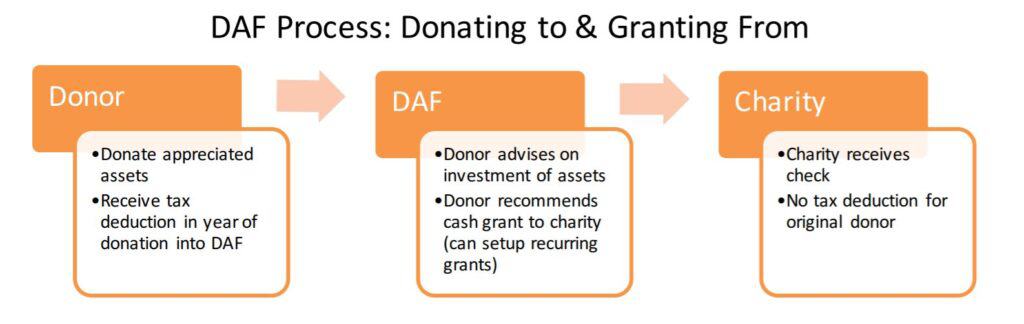

An important tax planning and charitable giving tool is the Donor-Advised Fund (DAF). There are hundreds of DAFs offered by non-profits, community and corporate foundations, and so on. The below is a primer of what donor-advised funds are and how donor-advised funds work.

What Are Donor Advised Funds?

DAFs are sponsored by 501(c)(3) non-profit organizations, donations:

- are irrevocable

- may be tax-deductible

However, DAFs are “donor-advised,” which means that donors may continue to direct:

- investment decisions

- grant recommendations

How Do Donor Advised Funds Work?

DAFs offer several important planning advantages.

Tax Benefits of DAFs

Donors receive an income tax deduction when assets are donated into the DAF, but may continue to “advise” the DAF on investments and grants. Effectively, this means that donors can still direct how the assets are invested and granted.

Timing Benefits of DAFs

The assets can remain in the DAF indefinitely before being granted out to the final 501(c)(3) non-profit. Thus, a donor can donate assets this year, but does not need to decide on the final non-profit recipient this year. The donor can decide where to direct the grant next year or in 10 years or beyond.

Other Benefits of DAFs

- Many DAFs can accept complex assets (such as real estate or business interests) that smaller non-profits are unable to handle.

- If anonymity is desired, grants can simply be reported under the DAF and not from the original donor.

- Once donated, assets can be sold without incurring capital gains tax and/or any future growth is tax-free.

Flexibility of DAFs

Investment considerations and tax planning often determine how and when to maximize the tax value of donations. However, these factors may not align with the charities that one supports. For instance, what if a charity is unable to accept stock options? Or perhaps a charity could use more recurring monthly donations rather than yet-another-lump-sum donation in December? A DAF is a great vehicle that can solve for these and other challenges.

Donor-Advised Fund FAQs

Below are some common concerns that a DAF can help address.

I want to donate before the end of this year, but don’t know where to give (yet).

You can take a charitable contribution tax deduction in the year that you contribute assets into the DAF. Thus, you can contribute into a donor-advised fund (and take the tax deduction) this year, but donate from it in future years. The benefit is that you can give without rushing to decide exactly where it will all be going. The assets within the donor-advised fund can be invested in the meanwhile.

I want to sell an asset that has appreciated a lot, but do not want to get hit with capital gains tax.

If you plan on making charitable contributions, consider donating appreciated assets. When you donate a publicly-traded investment (like a stock, bond, or fund), you can deduct the market value of the donation on your tax return. Additionally, since you never sell it, you never realize any capital gains or associated tax liability. That is the main benefit of donating appreciated assets.

I’d like to donate appreciated assets, but I’m not sure if the organizations that I support accept donations of securities.

Most donor-advised funds can accept non-cash contributions and many can even accept complex assets like real estate, business interests, and so on. If the organizations that you support do not accept securities or if its an onerous process to transfer them in, you can donate appreciated assets into the DAF, sell them inside the DAF, and then donate out to the organization in cash.

What DAF should I use?

This site does not provide recommendations, but here are some well-known DAFs:

- Custodian -sponsored DAFs:

- Vanguard Charitable

- Schwab Charitable

- Fidelity Charitable

- Open architecture DAFs (which generally work with any custodians and allow for personalized investment management):

- Renaissance Charitable Foundation

- American Endowment Foundation

- Niche DAFs:

- Impact Assets (impact Investing)

- Silicon Valley Community Foundation (geography-based)

- National Christian Foundation (faith-based)

If you are thinking about making charitable contributions now or in the future, a donor-advised fund could be a valuable tool for you.