The Vanguard Total Stock Market ETF (symbol: VTI) is one of the largest exchange-traded funds (ETFs) in the market and widely used by both individual and institutional investors. VTI is a low-cost index fund, which tracks the CRSP US Total Market. As its name implies, it seeks to provide exposure to the broad US stock market at a very low price. The fund is the core of many portfolios and the below review of VTI will evaluate why that is.

A quick reminder that this site does NOT provide investment recommendations. Fund reviews (such as this one) are for educational purposes only and are not advice or recommendations.

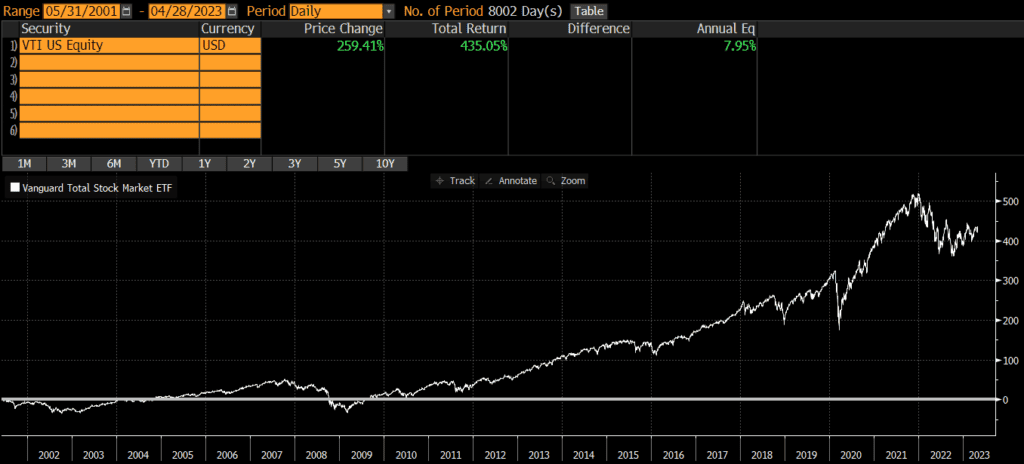

VTI Performance

The first thing most investors want to know about is performance, so we will start there. According to Bloomberg, since the fund’s inception 22 years ago, VTI has returned nearly 8% per year. Of course, this figure can go up or down and the returns in any single year are unlikely to be 8%. From 2002 through 2022 (21 years), VTI was up in 17 years and down in 4 years. The average return in the up years was 17.2%, while the average return in the down years was -20.5%.

VTI Risks

VTI owns stocks which are more volatile than cash or bonds. While the returns are higher than cash or bonds, investors need to be prepared to stomach volatility and be able to hold for the longer-term. VTI was down over 35% during both the tech crash and during the covid pandemic. Between 2007 and 2009, the fund declined by over 55%! This is not necessarily worse than other similar funds, but it is a characteristic of stocks that investors need to be aware of.

VTI Portfolio

Fund performance is ultimately driven by a fund’s holdings and exposures, so our VTI review will examine these items.

VTI Holdings

VTI (and its underlying index) is incredibly diversified, holding nearly 4,000 stocks. This represents the vast majority of the US stock market.

| VTI | CRSP US Total Market Index | |

| Number of Stocks | 3,907 | 3,890 |

VTI Country Exposures

VTI only owns US-based companies. Investors looking for international exposure may pair VTI with international ETFs or simply hold a global ETF.

VTI Market Cap Exposure

VTI is a “total market” fund which seeks to represent the entire US stock market, which is predominantly composed of large-caps. Even though the fund holds mid-caps and small-caps, performance is primarily driven by the large-cap exposure. This dynamic can be found by comparing VTI to SPY (a large-cap fund).

| VTI | |

| Large-Cap | 73% |

| Mid-Cap | 19% |

| Small-Cap | 8% |

VTI Sector Exposures

VTI is extremely diversified across sectors and mirrors the approximate weights of the broad US stock market.

| VTI | |

| Basic Materials | 2.65% |

| Consumer Cyclical | 9.77% |

| Financial Services | 13.93% |

| Real Estate | 3.51% |

| Communication Services | 6.71% |

| Energy | 5.15% |

| Industrials | 10.07% |

| Technology | 22.48% |

| Consumer Defensive | 6.98% |

| Healthcare | 15.69% |

| Utilities | 3.07% |

Expenses

No review of VTI would be complete without an in-depth look at the explicit and implicit costs of trading and holding VTI.

VTI Expense Ratio

VTI’s expense ratio of .03% is among the lowest of any total market funds. Even if another fund is free, three basis points is not a material difference in my opinion.

VTI Transaction Costs

ETFs are free to trade at many brokers and custodians, so VTI should be free to trade in most cases. Additionally, it is among the largest ETFs and is very liquid. The bid-ask spread of VTI is about .01%, so individual investor trades will not generally be large enough to impact or move the market.

VTI Tax Efficiency

Like most index funds, VTI is very tax-efficient. Unlike actively-managed funds, passively-managed index funds typically have less trading and lower turnover. This results in fewer taxable events and higher tax efficiency.

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). VTI has never made a capital gains distribution, so VTI is about as tax-efficient as any fund can be.

Investors in a high tax bracket with at least $250,000 may consider direct indexing rather than VTI, as direct indexing can potentially generate even more tax savings.

VTI Review: A Recap

The above review of VTI illustrates that VTI is a well-constructed, low-cost and tax-efficient index fund that provides diversified exposure to the broad US stock market. VTI is a great choice in many situations and a tool that I often use personally and professionally.