The Vanguard Utilities Index Fund ETF (VPU) and the Fidelity MSCI Utilities Index ETF (FUTY) are two of the largest Utilities sector ETFs and two of the most popular among individual investors. Many investors compare VPU vs FUTY because they are so similar, although differences are difficult to find.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

VPU and FUTY track the same index and there is no material difference between the funds. They are identical and interchangeable in my opinion. This conclusion is quite similar to the conclusion when comparing VPU vs XLU (the State Street utilities ETF).

The Longer Answer

Historical Performance: VPU vs FUTY

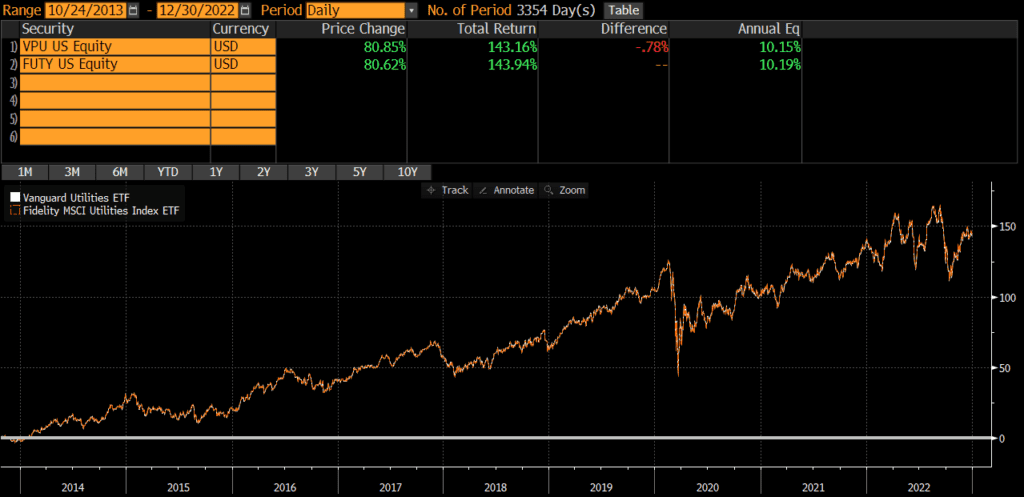

VPU was launched back in 2004, while FUTY was launched on October 21, 2013. Since then, the two funds have performed identically, with an annualized difference of only .04%! The cumulative performance differential over that timeframe has only been about .8% too! From a performance perspective, VPU and FUTY are identical and interchangeable.

Portfolio Exposures: VPU vs FUTY

Both VPU and FUTY track the same index, the MSCI US Investable Market Utilities 25/50 Index. Consequently, the two funds have identical geographic, market-cap, and industry exposures.

Geographic Exposure

Both VPU and FUTY hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical geographic exposures.

Market Cap Exposure

As mentioned above, both funds track the same index and have materially identical market cap exposures.

Sector Exposure

VPU and FUTY are Utilities ETFs and so their holdings are 100% Utilities stocks.

Practical Factors: VPU vs FUTY

Transaction Costs

As ETFs, both FUTY and VPU are free to trade on many platforms. Bid-ask spreads for both VPU and FUTY are extremely low and volume is sufficient to prevent most individual investors from “moving the market.” Those looking for a mutual fund wrapper should read my comparison of VPU vs VUIAX.

Expenses

FUTY has a lower expense ratio at .08%, compared to VPU’s .10%. Although VPU is 25% more expensive, we’re talking about 2 basis points. At these low levels of expense ratios, the difference doesn’t matter.

Tax Efficiency & Capital Gain Distributions

Neither VPU nor FUTY has ever made a capital gains distribution and I do not expect them to make any moving forward. In my opinion, these two funds are equally tax-efficient.

From a tax-loss harvesting perspective, investors may want to avoid using these two funds as substitutes for one another since they could be considered “substantially identical” (given that they track the same index and are identical in many ways).

Bottom Line: VPU vs FUTY

VPU and FUTY are identical in nearly every way. I would not spend any time comparing them or trying to decide which is better.