Schwab’s UD Dividend ETF (SCHD) and JP Morgan’s Equity Premium ETF (JEPI) are two of the largest income-oriented ETFs in the marketplace today. SCHD generates income from dividend-paying stocks, while JEPI aims to generate an even higher level of income by selling calls (a covered call strategy). These are very different approaches to generating income and many investors may prefer one to the other. I will compare SCHD vs JEPI below and highlight the main differences.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

The primary difference between the funds is that SCHD is a traditional dividend-oriented fund and JEPI pursues a covered call strategy. I would never recommend JEPI to an individual investor and would personally go with SCHD every time.

The Long Answer

Historical Performance: JEPI vs SCHD

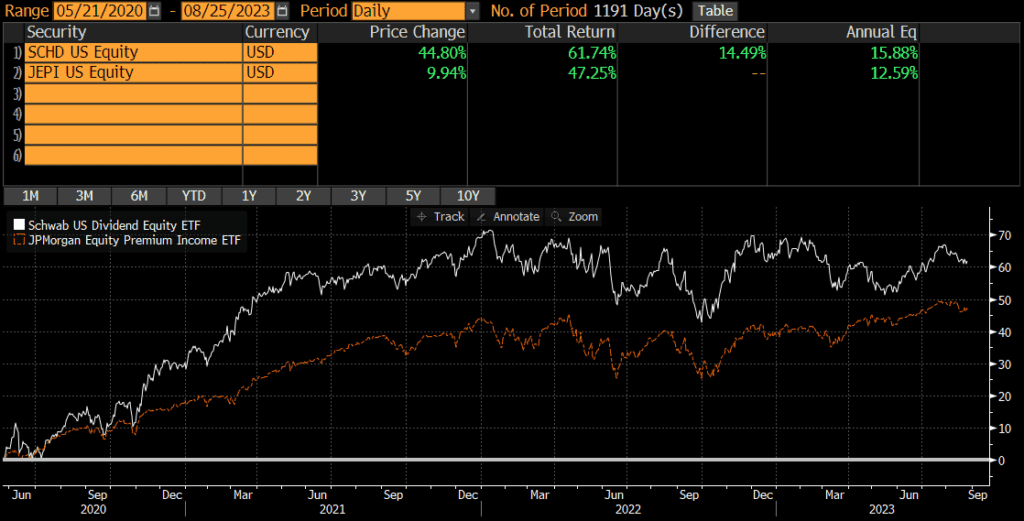

SCHD was launched in 2011, while JEPI was launched in 2020. Since JEPI’s launch, it has underperformed SCHD by 3.29% annually (and this includes all dividends, so the after-tax difference is even larger). The cumulative performance differential over these past 3.5 years is approximately 14.5%. It has not been a great start for JEPI.

Differences between JEPI vs SCHD

The main difference between SCHD and JEPI is their strategy. Both funds generally invest in the US large-cap universe of stocks and are well-diversified. SCHD tilts towards dividend-paying stocks, while JEPI does not. Instead, JEPI sell index calls against its portfolio in order to generate income. In other words, it collects call option premiums. This strategy has its pros and cons, but covered call strategies are not well understood by many individual investors.

Geographic Exposure

Both SCHD and JEPI hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical exposures.

Market Cap Exposure

SCHD and JEPI have nearly identical market cap exposures. Due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings though.

| SCHD | JEPI | |

| Large-Cap | 80% | 83% |

| Mid-Cap | 17% | 16% |

| Small-Cap | 4% | 0% |

Sector Weights

The sector weights between SCHD and JEPI are relatively similar, if we ignore the short call exposure.

| SCHD | JEPI | |

| Basic Materials | 1.96% | 3.78% |

| Consumer Cyclical | 9.45% | 8.92% |

| Financial Services | 14.97% | 12.47% |

| Real Estate | 0.00% | 3.66% |

| Communication Services | 4.37% | 5.21% |

| Energy | 9.54% | 3.01% |

| Industrials | 18.04% | 13.59% |

| Technology | 12.37% | 17.27% |

| Consumer Defensive | 12.71% | 13.04% |

| Healthcare | 16.27% | 14.23% |

| Utilities | 0.30% | 4.80% |

Expenses

The expense ratio for SCHD is .06%, while JEPI’s expense ratio is .35%. It’s a large difference in percentage terms, at nearly 6x more expensive. However, it’s “only” 29 basis points and strategy differences are a much bigger factor than differences in expenses.

Transaction Costs

ETFs are free to trade at many brokers and custodians, so both SCHD and JEPI should be free to trade in most cases. Additionally, these funds are among the largest ETFs and are very liquid. The bid-ask spread of SCHD is about .01% and JEPI is about .02%, so individual investor trades will not generally be large enough to “move” the market.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). As expected, neither JEPI nor SCHD has ever made a capital gains distribution (nor do I expect them to).

JEPI is not very tax-efficient as the premiums received from selling calls are taxed at ordinary income rates. While some investors may not mind receiving income in lieu of potential upside, this is akin to converting capital gains (from appreciation) into ordinary income. Of course, a covered call strategy will lose less money if the market declines, but covered call strategies (including JEPI) have a large tax drag.

On the other hand, SCHD is about as tax-efficient as any dividend can be.

A Note on JEPI Premium Costs

Many retail investors focus on the premiums that are received from selling calls. However, investment returns need to calculated net of costs. If an investor sells a call for $3 and buys it back for $1, the return is $2 rather than $3. Of course, if the underlying stock goes up, an investor may have to buy the call back at $5 (as an example). Premium costs vary over time, so investors may want to evaluate total return rather than just premiums received.

Final Thoughts: JEPI vs SCHD

Both SCHD and JEPI are large, popular funds sponsored and managed by two of the largest asset managers in the world. SCHD and JEPI are quite different and historical performance has reflected these differences.

In my view, SCHD is undoubtedly better for most investors. I would never recommend JEPI to an individual investor due to the poor performance of covered call strategies and the tax drag.