Is It Better to Rent or Buy in California?

Deciding between renting and buying a home in California can be a challenging task. While the state is known for its stunning coastline, abundant opportunities, and sunny weather, the high costs associated with living in California often leave people wondering if it’s better to rent or own their homes.

The average rent in California tends to be significantly higher than the national average, with prices varying greatly depending on location, property type, and amenities. Meanwhile, buying properties in the state can be a considerable investment, due to the substantially higher home values when compared to other states. Ultimately the decision to rent or buy in California depends on an individual’s financial situation, lifestyle preferences, and future plans.

Balancing these factors requires a careful evaluation of one’s circumstances. Utilizing resources such as Rent vs Buy Calculators can also be a valuable tool to help individuals make a well-informed decision based on their unique situation. (This tool takes into account various factors like everyday costs of renting, renter’s insurance, security deposit for renting, and expenses related to owning a home. It can help you get an idea of the financial aspects involved in both renting and buying properties, allowing you to make a more informed decision based on your individual circumstances.)

Financial Considerations

Cost of Living in California

California is known for its high cost of living, which impacts both renters and homeowners alike. For those already in California (or those committed to living in California), the cost of buying should always be compared against the cost of renting. For instance, someone might think a $5,000/month mortgage is a lot. But if the alternative is to rent for $4,000, then they should re-frame the question from a $5,000 absolute cost to a $1,000 difference. A slight change in thinking, but it takes into account the alternative costs.

Non-Californians who are considering a move to California should consider the cost of living. It is essential for anyone considering a move to California to research these factors and evaluate them alongside their personal income to determine how feasible it is to live in California.

Housing Prices and Rent Rates

California has some of the highest housing prices and rent rates in the nation. On the other hand, rent rates also tend to be considerably higher than the national average, which may help offset some of the costs associated with buying a home for some individuals.

Down Payments

When considering purchasing a home in California, one must also factor in the closing costs and down payments. For first-time homebuyers, the down payment on a conventional loan can be as low as 3%. Seasoned homebuyers may need a down payment of at least 5%. FHA loans often require a 3.5% down payment, while USDA and VA loans may not require any down payment. Many homebuyers using qualified mortgage (QM) loans put 20% down, while non-QM loans typically require a down payment of 10% to 30%.

Closing Costs, Unexpected Expenses, etc.

When it comes to determining whether renting or buying is the right choice, it depends on the numbers. Renting versus buying ultimately comes down to the math – comparing not only mortgage payments and rent rates but also property taxes and other expenses. The decision is highly dependent on an individual’s personal financial situation, preferences, and long-term goals. It is always recommended that potential homeowners and renters run their own numbers or seek professional assistance to accurately assess their options.

Additional Costs and Expenses of Homeownership

When considering whether to rent or buy a home in California, it’s essential to take into account the various additional costs and expenses associated with homeownership. This section will outline several of these cost factors, covering Mortgage Insurance and Taxes, Maintenance, Utilities, and Upkeep. Renters typically save A LOT of money by not being responsible for maintenance and repairs (although they also miss out on the potential for appreciation).

Mortgage Insurance

Homebuyers who make a down payment of less than 20% are typically required to pay for private mortgage insurance (PMI). This additional cost should be factored into the monthly mortgage payment.

Hazard Insurance

Hazard insurance protects against fires, floods, etc. The annual cost often runs between $1,000-$2,000 for median priced homes in California, although the costs are rising due to the recent spate of natural disasters and fires.

Property Taxes

Property taxes are an essential expense to consider as a homeowner. In California, these taxes are often around 1.25% of the property value per year. California also has a law referred to as Prop 13, which limits property tax increases to 2% per year. This obviously keeps property taxes predictable and keeps a lid on expenses, although it is also blamed for the sky high property prices and low for sale inventory in the state. Lastly, I should note that there is a risk of Prop 13 being rolled back. I do not expect this to happen, but its been floated as an idea before and similar propositions have come up for a vote.

Maintenance

Owning a home also comes with responsibility for maintaining and repairing the property. Maintenance costs can range from regular upkeep, such as landscaping and painting, to larger expenses like roof replacements or plumbing repairs. It’s crucial for prospective homebuyers to establish a budget for repairs and unexpected expenses to ensure they can afford to maintain their investment in the long run.

Utilities

Utilities are an essential expense for any living situation. For homeowners, utilities may include electricity, gas, water, sewer, and trash services. While renters often have some or all of these costs included in their monthly rent, homeowners must budget for all utility expenses on top of their mortgage payments and other costs.

To determine if renting or buying in California is the right option, it’s essential to carefully weigh these additional costs and expenses. The answer will always depend on the individual’s financial situation and long-term goals, as well as the specific numbers involved. By taking the time to evaluate all aspects thoroughly, prospective homebuyers can make an informed decision about their housing future.

Pros and Cons of Renting and Buying in California

Pros of Renting

Renting a home in California has its advantages, primarily flexibility and fewer responsibilities. One benefit of renting is that tenants can easily relocate without the time-consuming and costly process of selling or buying properties or arranging for renters. And while the average rent in California is much higher than the national average, is still cheaper than many peoples’ mortgage payments.

Another advantage is the freedom from maintenance costs, as the landlord is responsible for most property repairs. For renters, this means lower expenses and fewer responsibilities than homeowners. Furthermore, cities with strict rent control and tenant-friendly laws make renting even more appealing for long-term residents.

Pros of Buying

While renting has its merits, there are also benefits of homeownership in California. Historically, a primary benefit has been equity appreciation. Homeowners who secure a mortgage are able to essentially fix their housing costs for 30 years (or however long their mortgage is). A portion of monthly payments are credited toward principal, which builds equity in a property. Of course, any upside appreciation is captured by the homeowner.

When owning a property, individuals also have the freedom to make alterations or improvements to the space without the need for landlord permission. Moreover, some tax advantages come with homeownership, including the possibility of deducting mortgage interest and property taxes from income taxes.

Cons of Renting

Despite the flexibility offered by renting, tenants also face some drawbacks. Renters are continuously subjected to landlord approvals, meaning simple tasks like changing a room’s color or adopting a pet may become complicated bureaucratic endeavors. Dealing with another party regarding one’s home is rarely fun.

Cons of Buying

Homeownership in California comes with its financial challenges, such as the often-prohibitive initial costs of buying a property. Buyers must also budget for ongoing expenses like property taxes, insurance, and maintenance costs, which can add up quickly.

Without potential equity appreciation, renting is probably the better financial choice for many. Many people buy because they expect inflation to push rents and prices up in the future. However, is we relax this assumption, then buying is not as attractive in the long-term.

Overall, the decision of renting versus buying in California depends on various factors, including financial and non-financial considerations. Prospective residents must carefully weigh their options and thoroughly evaluate their personal situation to make the best choice for their unique circumstances.

Housing and Real Estate Market Trends

Housing Market Overview

California’s housing market has long been known for its high prices and demand. The state has experienced significant growth in recent years, with the median home price increasing in recent years. While some areas have seen more substantial price increases, there are notable variations city to city. In high-cost areas like San Jose, San Francisco, and Los Angeles, the gap between renting and buying has been larger than in other regions.

Recent Changes Due to the Pandemic

The COVID-19 pandemic had a considerable impact on the California housing market. Some trends observed during this time include:

- A shift in buyer preferences: Homebuyers have been looking for more space and amenities, leading to higher demand for suburban properties. This has contributed to price increases in more affordable, outlying suburbs and smaller metro areas.

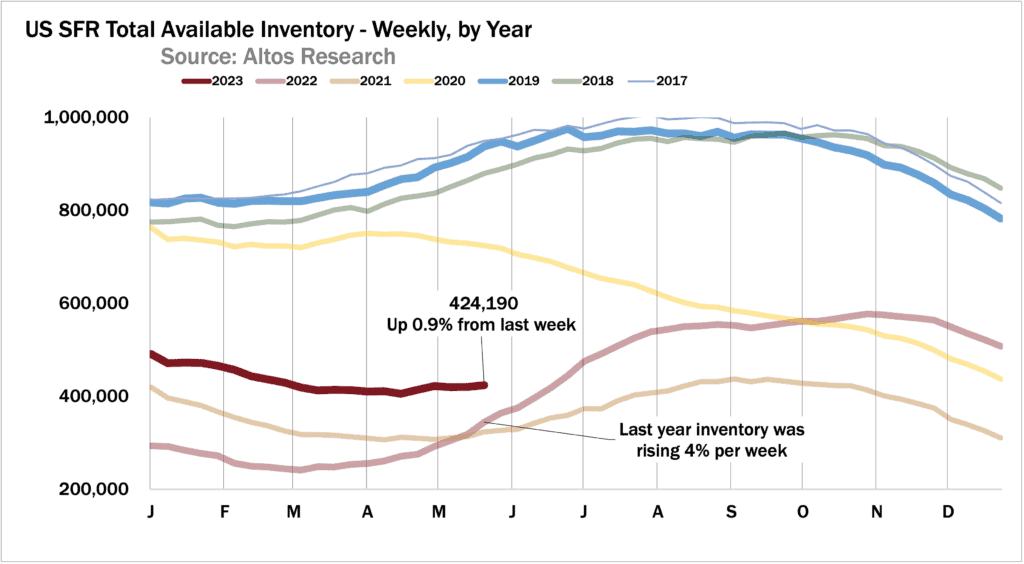

- A drop in the number of homes sold: The California housing market saw a 37.5% decrease in the number of homes sold in September 2022 compared to the previous year. The decline in inventory has pushed prices even higher.

These changes have made the decision to rent or buy in California much more complex, although they probably tilt the scales more towards renting. Every city and neighborhood is different, so it’s essential for potential buyers and renters to work closely with a knowledgeable real estate agent who can provide guidance and assistance in evaluating their options based on the latest trends and data.

Long-term Financial Implications

Home Ownership and Equity Growth

When considering buying a home in California, one of the key aspects to examine is the potential for equity growth. Historically, home prices in the US have risen, allowing homeowners to build equity over time. In California, the housing market has followed a similar trend, with home prices increasing in many regions.

However, it is essential to remember that past trends may not always predict the future. Several factors, such as the local economy, job market, supply and demand, and lender policies, can influence home prices. Consequently, it is crucial to analyze your specific situation and the housing market in your desired location before deciding to buy.

Investments and Stock Market

Another long-term financial factor to consider when deciding between renting or buying in California is the potential return on investment (ROI) from other financial opportunities, such as stock, real estate investments, and so on. In some cases, investing in stocks or other financial assets can result in a higher ROI than purchasing a home.

To determine which option is more favorable, compare the possible returns from investing in the stock market to the potential equity growth in your desired property. It is important to evaluate the risk, potential reward, and liquidity of these investments.

When it comes to deciding whether to rent or buy in California, the answer often depends on the numbers. Carefully analyzing the potential equity growth of a property, comparing ROI of alternative investments, and considering your personal financial situation can help inform your decision. Keep in mind that the future may not always mirror the past, so it is crucial to be cautious and consider various scenarios.

Personal Factors to Consider

When deciding whether to rent or buy in California, it’s okay to take non-financial personal factors into account too!

Career and Job Stability

One of the most important aspects to consider is your career and job stability. Moving frequently for work can impact your choice between renting and buying. If your career requires you to relocate often or you anticipate changing jobs in the near future, renting may be a more suitable option for you.

It’s crucial to remember that buying a home involves upfront costs like down payments, closing costs, and moving expenses. Renting provides more flexibility, as you can easily move without worrying about selling a property or breaking a mortgage.

Financial Goals

Another critical factor to consider is your financial goals. Before deciding on renting or buying, you should assess your current savings, debt level, and future financial plans. Buying a home in California may require a larger down payment and higher monthly mortgage payments, which might conflict with other financial goals or require careful budgeting. Consider whether your financial goals align with the costs and benefits of renting versus buying, as well as your ability to manage the ongoing expenses associated with homeownership.

Lifestyle Preferences

Lastly, think about your lifestyle preferences and how they relate to your living situation. Owning a home provides more autonomy in terms of decorating, renovating, and customizing your living space. Homeownership can also offer a sense of stability and permanence. This can be especially important if you have school-age children and staying at the same school or within the same district is important.

On the other hand, renting may be better suited for those who prefer flexibility, minimal responsibility for property maintenance, and the ability to change apartments or neighborhoods more easily. You should also consider proximity to schools, work, and recreational activities that are important to you.