The short answer is: yes, India is an emerging market. There is a much longer answer though.

India has been classified as an emerging market since the inception of the label. It is one of largest emerging markets regardless of what metric is used.

India is the world’s largest democracy, recently became the most populous country, has economically-favorable demographics, and it presents a unique opportunity for investors seeking to capitalize on its expanding economy. Over the past decades, the country has seen significant improvements in various sectors, including manufacturing, construction, and infrastructure, leading to increased investor interest in the region. However, it also faces many challenges and has a long ways to go before it can be classified as a developed market.

India’s Status as an Emerging Market

India is considered an emerging market and has experienced an impressive growth trajectory in the past several decades. Its enormous population, robust economic growth, and abundance of young and educated working professionals make it an attractive investment destination.

Comparison with BRICS Nations

The BRICS economies—Brazil, Russia, India, China, and South Africa—are known for their rapid pace of development and growth potential. Let’s take a quick look at some key indicators:

- Economic growth: According to S&P Global Ratings, India stands out as a “star” among emerging market economies, with an estimated growth rate of 7.3% for the 2022-23 fiscal year. In contrast, China’s growth rate is both lower and declining, which occurs as economies grow and mature; countries like Brazil, Russia, and South Africa have faced varying levels of economic challenges.

- Investment destination: India’s rapidly expanding middle class and ongoing economic reforms have attracted significant foreign investments in recent years, making it a bright spot among emerging markets. This is especially true since investment flows that might have been directed to other emerging markets such as China are increasingly making their way to India. Part of this stems from trade and political frictions between China and other countries, such as the US.

- Workforce: One of India’s key advantages over other BRICS nations is its young and growing workforce. This demographic potential enables India to capitalize on the increased demand for skilled labor in various industries.

Despite these positive trends, India also faces many challenges. Like other emerging market economies, it must navigate global headwinds such as poverty, corruption, global monetary policy, slowing global growth, and elevated commodity prices.

While India still has some hurdles to overcome, it is truly emerging and its prospects for future growth remain promising (especially when compared to other BRICS nations).

Economic Drivers of India’s Growth

Several key factors have contributed to India’s growth, such as the expansion of the service sector, the investment cycle, and earnings. In this section, we will explore each of these factors in detail.

Services and Manufacturing

India’s economic growth is largely being driven by its strong services sector, which contributes over 60% to the country’s GDP now. This sector includes areas like information technology, telecommunications, and financial services. As a result, India has become a hub for outsourcing services and an attractive destination for global companies.

This is a positive shift away from overreliance on the manufacturing sector, which has driven India’s economy historically. The government has introduced several initiatives, such as the “Make in India” campaign, to boost domestic manufacturing and attract foreign investment.

Investment Cycle

The investment cycle in India has a significant impact on the nation’s economic growth. Factors such as infrastructure development, ease of doing business, and favorable regulations have all contributed to an increase in investments, both domestic and foreign, in the Indian economy. This, in turn, creates a virtuous circle of job creation, income growth, increased productivity, and higher demand, ultimately leading to further expansion of the economy. This strategy served China very well and it may work for India as well.

Household Income

Household income plays an essential role in India’s growth as its growth contributes to increased consumer spending, driving up domestic demand and fueling economic growth. With a growing middle class and a young population, the benefits of higher earnings should lead to increased consumption of goods and services.

Government Policies and Challenges

India is notorious for its bureaucracy, but regulations and corruption are both on the decline.

Regulation

The government of India has implemented various policies to boost the country’s economic growth. The introduction of the Insolvency and Bankruptcy Code has helped improve financial sector metrics over the past five years.

Indian businesses have thrived in part due to the support of government policies aimed at promoting growth and innovation. However, despite advancements in the regulatory environment, there are challenges that remain, including transparency and ease of doing business.

Infrastructure

Investing in infrastructure lies at the heart of India’s growth strategy. The government has outlined ambitious plans to enhance transportation infrastructure, which is vital for economic development. Major projects include the construction of highways, railways, and airports, which should facilitate both regional and international connectivity. As someone who has visited many times, the pace of development is dizzying.

Despite these strides, India faces significant infrastructure challenges that may hinder its progress as an emerging market. For instance, underdeveloped urban transportation systems and inadequate rural infrastructure can lead to unequal growth and limited access to opportunities. Additionally, the large-scale nature of these projects often results in ballooning costs and unforeseen delays.

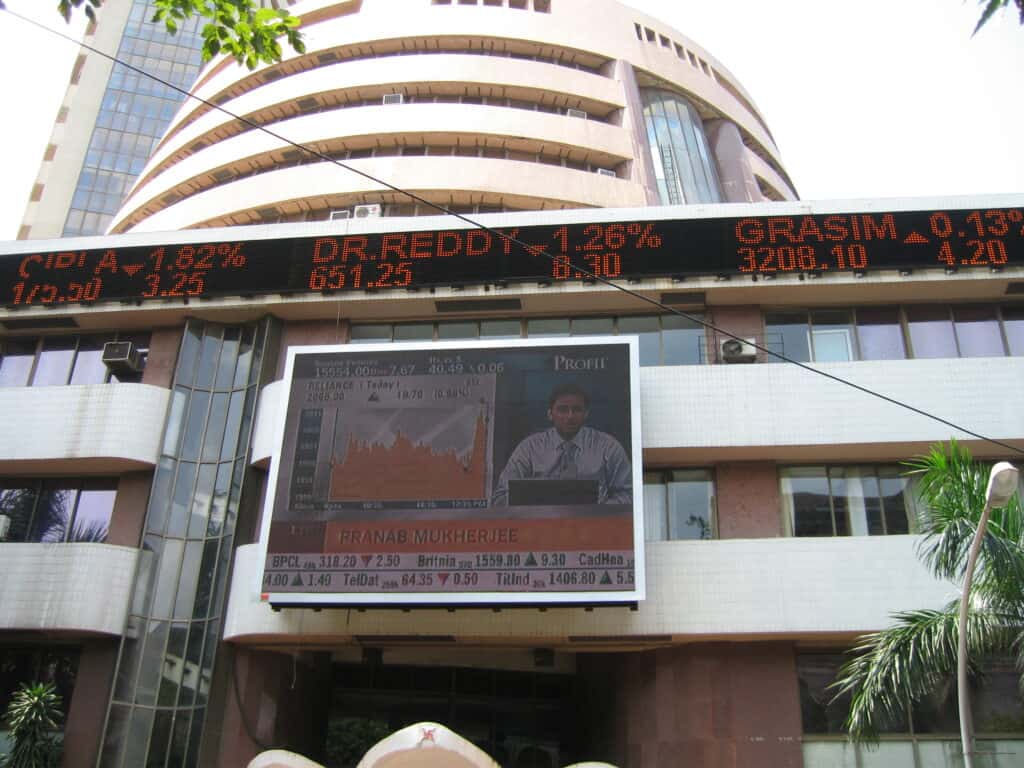

Indian Stock Market

Indices and Valuations

India has indeed been experiencing growth in its stock market, with key indices such as the Nifty and Sensex reflecting this positive trend. Indian equities have generally been a recipient of foreign investor flows. Thanks to a rising population, economic growth, and market-friendly reforms, India is frequently considered a bright spot among emerging markets1.

As investors have warmed to India, market indices have benefited and led to higher valuations for many companies. This growth has attracted various market participants, both individual and institutional, who seek to capitalize on the performance of Indian equities.

Footnotes

Impact of Covid-19 on India’s Economy

The Covid-19 pandemic had a significant effect on economies worldwide, and India was no exception. As an emerging market, India faced unique challenges during this extraordinary time. In the fourth quarter of the fiscal year 2020, India’s growth rate dropped to 3.1%, which was mainly attributed to the pandemic’s impact on the Indian economy. Despite the tough situation that India faced, the nation’s economy experienced a record rebound.

Foreign Investment in India

India has long attracted foreign direct investment (FDI), as it is considered an emerging market with a lot of potential for growth. The country’s relatively large domestic market and strong economic performance have made it a popular destination for investors worldwide.

Foreign investments have been pouring in through various channels such as exchange-traded funds (ETFs) and direct investments in sectors like coal, media, and civil aviation. In December 2020, India opened its coal mining sector for non-coal companies, allowing them to bid for coal mines, paving the way for more competition and investments in the industry.

Major financial institutions, such as the World Bank and the International Monetary Fund (IMF), have highlighted India’s potential and resilience in the face of global economic challenges. According to the World Bank, India is better positioned than other major emerging economies to navigate global headwinds due to its large domestic market and relatively low exposure to international trade. This makes India less susceptible to external economic shocks, as the local demand can cushion the impact. Economic history suggests that pivoting from an export-centric economy to one with more domestic consumption is critical to a nation’s economic development.

Technology and Environmental Factors

Digital Transformation

India is experiencing a rapid digital transformation, thanks to an increasing number of internet subscribers and the widespread availability of smartphones and high-speed connectivity. By September 2018, the country had over 560 million internet subscribers, making it the second-largest market for digital consumers. This trend is expected to continue through 2023 and beyond, providing a solid foundation for the growth of technology-driven industries and services. With a strong focus on digitization, India is making great strides in areas such as e-commerce, digital payments, online education, and telemedicine.

Embracing Green Energy

India is not only focused on technological advancements but also making conscious efforts to reduce its carbon emissions and embrace green energy solutions. Recognizing the environmental challenges and climate change impacts, the country aims to achieve a sustainable and inclusive future. India is aggressively working towards expanding its renewable energy capacities to reduce its dependence on fossil fuels and minimize emission levels. By 2030, the country plans to attain 40% of its energy from non-fossil fuel sources, thus actively contributing to global climate goals. The World Economic Forum has identified India as a key player in promoting green energy initiatives in comparison to other countries, such as Latin America and Africa. It may not all be altruistic though, as India is an energy importer and generating more energy at home will lower import costs.

Conclusion

India is firmly in the emerging market camp today, but who knows what the future holds as it is expected to be one of the top three economic powers in the world over the next 10-15 years. The growth forecast for India looks promising. The country’s economic security policy has evolved as India, Vietnam, and Indonesia seek to strike a balance between supply chain resilience and the risks posed by China. This approach allows India to harness the opportunities of global economic integration while safeguarding against potential threats. However, as the nation advances economically and becomes the third-largest consumer market by 2030, new challenges are expected to develop. Issues such as obesity, non-communicable diseases, and pollution will need to be addressed to ensure the well-being of India’s population. In short, India’s prospects are bright with positive growth forecasts and an increasing global presence. However, the nation must also navigate the challenges that come with rapid economic expansion, finding ways to foster development while ensuring a healthy and sustainable future for its citizens.