IRR and TVPI are two popular performance metrics, especially within “alternative” investment asset classes such as real estate, private equity, and venture capital (where time-weighted returns are essentially meaningless). Both IRR and TVPI are important metrics, but neither should be used in isolation when comparing a fund’s performance; investors should always evaluate both within the context of the other.

IRR

IRR Definition

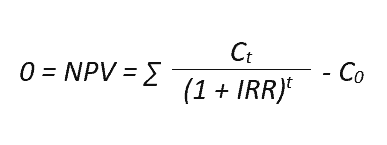

IRR stands for Internal Rate of Return. IRR is the discount rate one would need to use so that the net present value (NPV) of all future cash flows is zero. In other words, one would look at all the contributions into and distributions from an investment and then find the rate that discounts the sum to zero. IRR is not a perfect way to calculate returns, but it is one of the better metrics for many real estate, private equity, and venture capital funds (among others). IRR can be quoted on a gross or net of fees basis.

IRR Formula

Mathematically, IRR is variable than enables the sum of the NPV of cashflows to equal zero. The bad news is that the equation below is the formula used to derive IRR. The good news is that many calculators, Microsoft Excel, and Google Sheets can calculate IRR.

IRR Example & IRR Calculation

The IRR calculation is complex, but a calculator can do it relatively quickly. If I’m in rush or want to get a ballpark estimate, I’ll simply google “IRR calculator.” Microsoft Excel and Google Sheets also have IRR (if periodic cashflows) and XIRR (if non-periodic cashflows) functions.

Using an online calculator, Excel, or Sheets, we can input the below hypothetical cash flows and determine that the IRR is 42%.

| Initial Investment | $100,000 |

| Year 1 Cash Flow | $125,000 |

| Year 2 Cash Flow | $10,000 |

| Year 3 Cash Flow (final distribution) | $20,000 |

| IRR | 42% |

IRR: Pros & Cons

Pros of IRR

- One the primary reasons that IRR is the default performance reporting metric for alternative investments is that it accounts for varying amounts of capital. Many alternative investments are funded over time and distributions are also made over time.

- IRR accounts for the time value of money, unlike TVPI which does not account for time at all.

- IRR is very sensitive to several factors that (within a fund context) encourage managers to only call capital when it is needed and to return capital to investors relatively quickly. As we will see later, this can also be a negative.

Cons of IRR

Despite the above pros, IRR is not necessarily sufficient to evaluate investment performance for a few reasons.

- As illustrated in our example and mentioned in the “pros” section above, IRR is sensitive to early cash flows and small (often inconsequential) distributions early on can elevate IRR for years.

- IRR calculations begin when capital is put to work. However, it does not account for the opportunity cost of uncalled capital. Uncalled capital is often generating low(er) returns since it needs to be relatively liquid.

- On the flip side, IRR does not account for the time after capital is returned to investors. In the above example, capital was returned relatively quickly (which could be a pro or con for the investor, depending on their opportunity set available).

- Lastly, IRR’s are based on cash flows and cash flows can be changed without impacting performance. In other words, IRR can be influenced (or manipulated) relatively easily.

- Subscription lines: Funds have increasingly used “subscription lines” to defer calling investor capital. The leverage allows funds to buy assets and generate returns early on. The funds can then distribute more capital back to investors earlier. Sounds great, except the leverage has a cost and is simply in lieu of called capital (rather than in addition to). This inflates the IRR while often reducing economic returns (due to interest and administrative expenses).

- Leverage & Dividend Recaps: Assume an investor buys a building for $10 million and it generates $2 million of cash flow in the first year. The IRR would be 20%. However, if the investor decides to borrow 90% of the buildings value and pocket the proceeds, the investor has now taken $11 million out of the investment ($2 million of cash flow and $9 million of cash out refinance proceeds). The IRR jumps from 20% to 200% without any difference in economic returns (the investor may actually be worse off, since they now have to pay interest on the loan).

- Performance fees (carry, promote, incentive, etc.) are often based on IRR, even though it is not necessarily representative of actual dollar returns.

- Similar to TVPI, IRR is simply an estimate at any point before all capital has been returned to investors.

TVPI

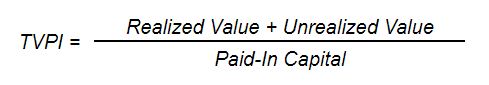

TVPI Definition

TVPI stands for Total Value to Paid In. It expressed return as a multiple of “paid-in capital.” Paid-in capital is the money that an investor invests in a fund (regardless of how much is actually invested by the fund), so TVPI is often used to measure the performance of fund investments. TVPI can be quoted on a gross or net of fees basis.

TVPI Formula

TVPI Example

Let’s use the above numbers (from our IRR example above) to calculate TVPI. The initial investment is $100,000. The investor receives a total of $155,000 through the life of the investment. In this case the TVPI is 1.55x.

TVPI Calculation

In the above example, we get 1.55x by adding $125,000 from Year 1, $10,000 from Year 2, and $20,000 from Year 3 and dividing by $100,000.

TVPI: Pros & Cons

Pros of TVPI

- TVPI is relatively easy to calculate (even in your head) and easily understood intuitively. Thus, a main benefit of TVPI is that conveys the actual dollar return to investors.

- In the above IRR example, the IRR is 42%. So a prospective investor may mistakenly extrapolate that their next investment would grow to approximately 286,000 over three years (assuming a 42% return compounded annually). However, the investment only grew to $155,000 over three years.

Cons of TVPI

- One of the downsides of TVPI is that it does not account for time value of money. TVPIs can grow quite large by just holding assets for a long time, so TVPI must be evaluated within the context of time.

- As an example, is a 2xTVPI or a 5x TVPI better? Nobody can say unless they know what the time periods are. If the 2x TVPI was generated in one year and the 5x TVPI over 12 years, I’d say that the 2x investment was the better one.

- Another weakness of TVPI is that it does not account for varying amounts of capital. It is quite easy to understand if capital is all invested at once. But what if capital is called/invested over time?

- For instance, assume 10% of capital is called in Year 1 and doubles. An additional 10% of capital is called in Year 2 and then the fund value doubles again. Then 80% of capital is called in Year 3 and there are no distributions or change in value through Year 5. The TVPI after five years is 1.6x. Is this good or bad return? The returns were great the first two years and terrible during the last three years (when the majority of capital was invested).

- Similar to IRR, TVPI is simply an estimate at any point before all capital has been returned to investors.

TVPI vs IRR

Similarities

TVPI and IRR are different but do have some similarities:

- Quoted on a gross or net basis (read more about gross vs net IRR).

- Are preferable to time-weighted return (TWR) in many scenarios.

- Widely used in the (alternative) investment industry.

Differences

As readers can glean from the above, there are some important differences between TVPI and IRR:

- IRR represents the time value of money, but TVPI represents the multiple of money.

- IRR is relatively sensitive to inputs (and easier to engineer/manipulate); it is more difficult to do this with TVPI.

- IRRs are generally higher early in an investment’s life; TVPI is generally higher later in an investment’s life.

Using TVPI and IRR Together

Both TVPI and IRR have strengths and weaknesses, but neither should be used in isolation. Unfortunately, many investment managers and funds only advertise IRR or TVPI but not both. Investors wanting to understand performance should be evaluating both TVPI, IRR, and other factors such as leverage, pacing, etc.

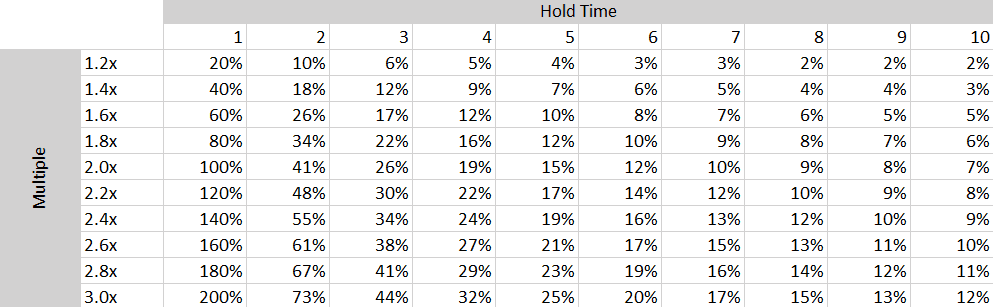

One resource that may be helpful is the below table, which models the relationship between IRRs, multiples (such as TVPI), and hold time. Of course, each investment is unique with caveats, so this table may or may not hold in each case but I find it is a good general resource.

As an investor, one of the first things I do when evaluating a fund is to ensure that I have IRR and TVPI data as well as an understanding of the size/pacing of capital calls and distributions. If this information is not provided initially, I will ask for it and most managers can provide it relatively quickly. But I will not make an investment without looking at and understanding both IRR and TVPI.