Hard Money Lending & Recessions

One of the interesting aspects of hard money lending is that returns do not necessarily correlate to the economic or business cycle and that the best times to lend are often when there is (what the cool kids call) FUD or fear, uncertainty, and doubt. Consider the below scenarios.

- When times are good, risk tolerance is high and risk aversion is low. Investor capital is plentiful and competition drives rates down as investors compete for loans. In other words, good economic times can be challenging for returns.

- When times are bad, risk aversion is high and risk tolerance is low. Capital is scarce and there is very little competition, so investors are in the drivers seat and can set rates and terms. In other words, bad economic times present great investment opportunities (although risk may be higher).

- Of course, many economic environments are not extreme. There are many years of slow growth or slow decline with a mix of promising and troubling news. Risk tolerance and risk aversion swings up and down and capital ebbs and flows. In my experience, this is one of the best times to lend as nobody is ebullient and flooding the market with capital and the economy is not collapsing and causing massive risks either.

Credit Spreads

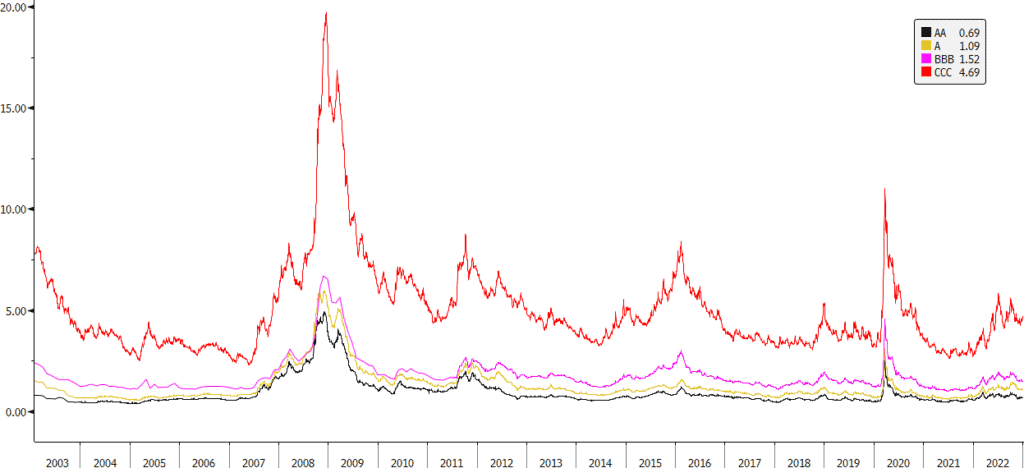

Credit spreads are a measure of how much yield (or return) investors are paid above a benchmark rate (typically US Treasury rates). As the above below chart of corporate bond credit spreads illustrates, relative returns are low when the economy and businesses are doing well and high when there is a lot of uncertainty in the market. This is a graphical representation of the bullet points above.

Below are several reasons why credit spreads may increase during times of stress.

Perceived Risk

One reason credit spreads widen during time of distress is simply due to perceived risk. If the economy and businesses are doing very well, I may lend at 5% (as an example). However, if the the economy is in a recession and businesses are challenged, then I am going to lend at a higher rate because I need to be compensated for the higher risk.

Behavioral

There may be a lot more lenders willing to lend when times are good. People may be competing to lend at 5%, so someone may start lending at 4.9%, and then 4.8% and so on. This is a concept Howard Mark’s refers to as a “race to the bottom” which he coined months before the 2007 Global Financial Crisis began. When times are tough, there may be less people willing to lend. They may not want to lend for anything less than 6%. But there are less people lending too and they may find that although they could lend at 6%, nobody is lending for less than 7%. So they lend at 7% or 6.9% or whatever rate, but it is higher than the aforementioned 5% (again, these are just illustrative examples with simplistic numbers).

Shortage of Capital

Some real estate lenders hold loans on their balance sheet. However, many lenders do not hold loans. After a loan is originated and funded, it is sold and securitized. In other words, it’s bundled with other loans and turned into a security (such as mortgage-backed security, a collateralized loan obligation, and other types of bonds) hence the term securitized.

Securitization Slows or Stops

When times are good, people take out mortgages, borrow to expand their business, and so on. Loans are being originated and securitized into a hungry market where investors snap them up quickly. When there is some volatility in the markets, the appetite for these investments dissipates and several things happen.

The securitization machine slows (or even stops) and lenders get stuck with a bunch of loans. The lenders thought that they would be able to sell the loans into the securitization market, but they’re not able to since the demand dried up. So the lenders have capital tied up in loans that they cannot sell. Until the markets start buying their loans again, the lenders do not have enough capital to make new loans. From a borrowers perspective, there are less lenders and capital available.

As an investor, my focus is to utilize balance sheet lenders (which many hard money lenders are) rather than to focus on business models that focus on originations alone. This is because the returns may dry up and capital can get trapped if/when securitizations slow.

Investors Blow Up

Many real estate lenders and investors use leverage. Some are heavily levered. When volatility hits, some of these levered players receive margin calls. In other words, their lenders tell them to repay the debt or post additional collateral. In many cases, the lenders’ lenders can take control of the assets and liquidate them (which may exacerbate the problem if liquidations drive prices down which causes additional margin calls based on mark-to-market dynamics). The net effect of all of this is that additional capital is removed from the lending ecosystem.

Again, as an investor, my focus is to utilize balance sheet lenders (with no or very little leverage) rather than levered vehicles full of securitized or syndicated assets.

Opportunity for Lenders and Investors

For hard money lenders and investors that manage risk well during the good times and have capital to deploy to when things get tough, there are many opportunities. A lack of capital means that lenders can set the following terms more easily:

- Higher rates and points

- Lower LTV

- Stronger covenants & DSCR (debt service coverage ratio)

- Longer duration (if desired)

Of course, the above opportunities are only available to those who enter periods of distress and recessions with the ability to lend. Even a balance sheet lender may be constrained due to their existing risk exposures or inability to expand their balance sheet (via either debt or equity).