The Fidelity ZERO Large Cap Index mutual fund (FNILX) and the Fidelity ZERO Total Market Index fund (FZROX) are two of the largest mutual funds in existence. FNILX and FZROX are the core of many investor portfolios. Many investors compare FNILX vs FZROX in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

What is the difference between FNILX and FZROX?

The main difference between FNILX and FZROX is that FNILX is a large- and mid-cap fund, while FZROX is a total market fund. Despite these differences, the total return between these two funds is pretty close.

Secondly, and perhaps most importantly, both funds can only be bought and owned in Fidelity accounts. Due to this limitation, I would never buy or recommend either of these funds.

The Long Answer

Historical Performance: FNILX vs FZROX

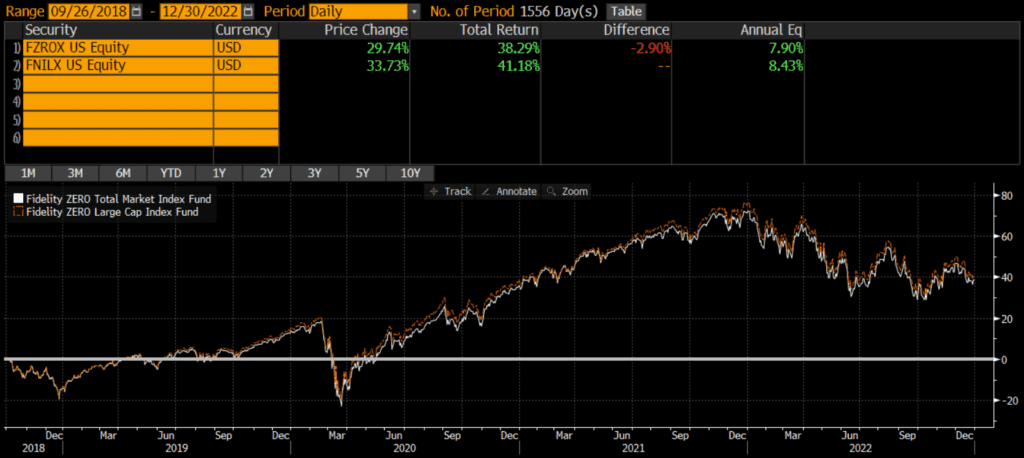

Both FNILX and FZROX were launched in 2018. Since their common inception, FNILX has outperformed by about a half percent annually. This is not a huge performance differential, but it does compound over time. The cumulative difference between the two funds since common inception is approximately 3%.

Of course, the outperformance of FNILX is reflective of large-cap stocks’ dominance over the past five years. If mid-caps and/or small-caps lead, then I suspect FZROX would outperform.

Differences between FNILX vs FZROX

The biggest difference between FNILX and FZROX is the market cap exposure of the funds. FNILX tracks the S&P 500 index which includes mostly large-caps and some mid-caps, while FZROX covers much more of the market by including more mid-caps and small-caps.

Geographic Exposure

Both FNILX and FZROX hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For intents and purposes, the two funds have identical exposures.

Market Cap Exposure

FNILX focuses on the S&P 500 index and so it mostly holds large-caps with a bit of mid-cap exposure. FZROX tracks the broader Dow Jones U.S. Total Stock Market Index and so it owns many more mid-caps and small-caps (as of 11/30/2022). In other words, FNILX is a large-cap vehicle, while FZROX is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| FNILX | FZROX | |

| Large-Cap | 83% | 73% |

| Mid-Cap | 16% | 19% |

| Small-Cap | 0% | 9% |

Sector Weights

The sector weights between FNILX and FZROX are nearly identical, as of 11/30/2022. The weights are within 1% for every single sector.

| FNILX | FZROX | |

| Basic Materials | 2.40% | 2.67% |

| Consumer Cyclical | 10.16% | 10.47% |

| Financial Services | 13.80% | 14.01% |

| Real Estate | 2.77% | 3.46% |

| Communication Services | 7.46% | 6.90% |

| Energy | 5.12% | 5.14% |

| Industrials | 8.86% | 9.59% |

| Technology | 23.72% | 23.15% |

| Consumer Defensive | 7.40% | 6.79% |

| Healthcare | 15.31% | 14.95% |

| Utilities | 2.99% | 2.87% |

Factors to Consider

Tradability

In my view, the most important factor to consider when evaluating FNILX vs FZROX is that neither can be bought or owned outside of Fidelity. Personally, this is a non-starter for me as there are reasons to transfer assets to other custodians, such as transferring one’s accounts or making a donation. Some investors may not value flexibility as much, but they should be aware of this limitation.

Transaction Costs

Many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements (with their competitor custodians) that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is generally free to trade FNILX or FZROX. Other custodians will not allow FNILX or FZROX trades at all!

It is worth noting that neither fund has a minimum for initial or additional investments. That being said, investors looking for free trades may want to consider an a total market ETF or large-cap ETF, rather than FZROX or FNILX.

Expenses

Both FZROX and FNILX grabbed headlines when Fidelity announced it, due to the 0% expense ratio. While zero expenses is great, it is only a few basis points less than similar mutual funds and ETFs. So even though the difference in expenses is infinite in relative terms, its only a few basis points. At a certain level (such as this one), differences in expense ratios do not matter.

Tax Efficiency & Capital Gain Distributions

Both funds have made capital gains distributions in the past and will likely make them in the future. It is not possible to say which one will be more tax-efficient in the future. As index funds, the tax drag on both funds is very low. However, tax-sensitive taxable investors may want to consider using an ETF in lieu of either of these funds.

Final Thoughts: FNILX vs FZROX

Both FNILX and FZROX are large, core funds sponsored and managed by one of the largest asset managers in the world (Fidelity). Beyond market cap exposures, the funds appear and act very similar. Long-term performance has been nearly identical. I view these two funds as essentially interchangeable and would not spend too much energy splitting hairs to decide which one is “better.”

Should I invest in FZROX or FNILX?

I do not believe either fund is appropriate for most investors, except in limited situations. Anyone looking at either of these funds should take a look at these funds competitors, such as VSTAX, SWPPX, VTI, ITOT, and so on.

Investors should not consider either fund unless their account is at Fidelity, as they cannot even buy them. If my accounts were at Fidelity, I might consider the funds in a tax-exempt or tax-deferred account. However, I would never buy them in a taxable account due to the inability to transfer the assets (without realizing a potential gain) out of Fidelity if I wanted to move my accounts, donate the shares, etc.