State Street’s SPDR S&P 500 ETF Trust (SPY) and the Fidelity Total Stock Market Index fund (FSKAX) are two of the largest funds in existence and easily two of the most popular among individual investors. SPY and FSKAX are the core of many investor portfolios and many investors compare FSKAX vs SPY in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

The main difference between SPY and FSKAX is that SPY is a large- and mid-cap ETF, while FSKAX is a total market mutual fund. Despite these differences, the total return between these two funds is nearly identical and I consider them interchangeable for all intents and purposes.

The Long Answer

Historical Performance: FSKAX vs SPY

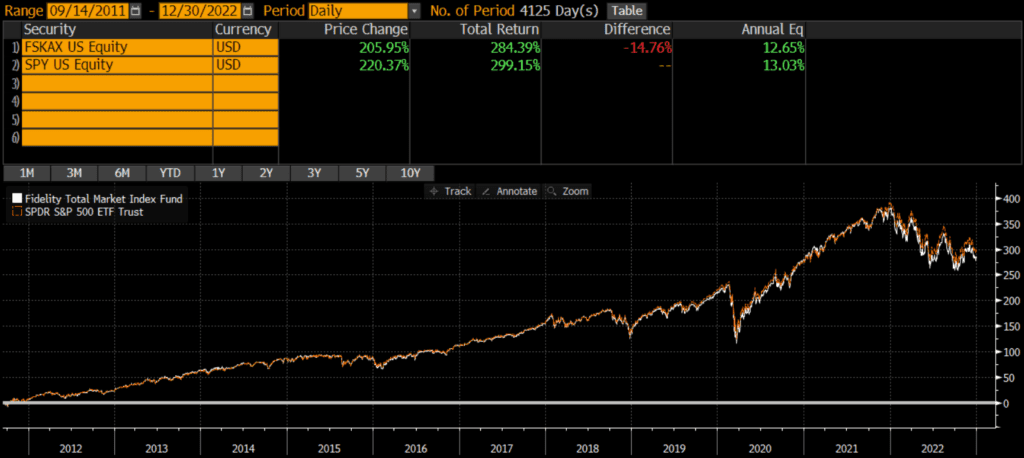

SPY was the first ETF ever launched in the US (January 1993), while FSKAX was launched on September 9, 2011 (although other shares classes of the fund existed prior to that). Since then SPY has outperformed by nearly a half percent annually. Despite variations in the size factor performance over the decades, the long-term performance between these two funds is incredibly similar. The cumulative difference in performance is only about 15% over the past 11 years.

Of course, the outperformance of SPY is reflective of large-cap stocks’ dominance over the past decade. If mid-caps and/or small-caps lead, then I suspect FSKAX would outperform.

Differences between FSKAX vs SPY

The biggest difference between SPY and FSKAX is the market cap exposure of the funds. SPY tracks the S&P 500 index which includes mostly large-caps and some mid-caps, while FSKAX covers much more of the market by including more mid-caps and small-caps.

Geographic Exposure

Both SPY and FSKAX hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For intents and purposes, the two funds have identical exposures.

Market Cap Exposure

SPY focuses on the S&P 500 index and so it mostly holds large-caps with a bit of mid-cap exposure. FSKAX tracks the broader Dow Jones U.S. Total Stock Market Index and so it owns many more mid-caps and small-caps (SPY data as of 1/6/2023, FSKAX data as of 11/30/2022). In other words, SPY is a large-cap vehicle, while FSKAX is a total market vehicle. That being said, due to market cap weighting, both funds are overwhelmingly influenced by the large-cap holdings.

| SPY | FSKAX | |

| Large-Cap | 84% | 73% |

| Mid-Cap | 16% | 19% |

| Small-Cap | 0% | 9% |

Sector Weights

The sector weights between SPY and FSKAX are nearly identical (SPY data as of 1/6/2023, FSKAX data as of 11/30/2022).

| SPY | FSKAX | |

| Basic Materials | 2.51% | 2.68% |

| Consumer Cyclical | 9.64% | 10.43% |

| Financial Services | 14.20% | 14.04% |

| Real Estate | 2.81% | 3.46% |

| Communication Services | 7.44% | 6.91% |

| Energy | 5.16% | 5.13% |

| Industrials | 9.11% | 9.58% |

| Technology | 22.62% | 23.18% |

| Consumer Defensive | 7.65% | 6.77% |

| Healthcare | 15.72% | 14.97% |

| Utilities | 3.15% | 2.87% |

Factors To Consider

Transaction Costs

ETFs are free to trade at many brokers and custodians, including Fidelity. However, many brokers and custodians still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is free to trade FSKAX or SPY. However, only SPY is free to trade in non-Fidelity accounts.

There is a bid-ask spread when trading ETFs, but this spread is typically less than .01% for SPY and individual investor trades will not generally be large enough to “move” the market. In the case of SPY, individual investors should not have a problem trading.

Tax Efficiency

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post).

FSKAX does make capital gain distributions, while SPY has not made a capital gain distribution since 1996. SPY is the more tax-efficient option in this case.

Tax Loss Harvesting

My personal preference is to keep a portfolio entirely mutual funds or entirely ETFs, due to the mechanics of settlement during tax loss harvesting. If an ETF has declined in value and an investor sells it, the trade and cash proceeds will not settle for two business days (T+2). That investor may want to “replace” the sold ETF immediately and attempt to buy another ETF or mutual fund simultaneously.

However, mutual funds settle on T+1 basis, so cash for the mutual purchase would be due in one business day (which is one day earlier than the cash from the ETF sale is received). This can obviously cause problems and (even though this issue can be addressed with careful planning) I find it easier to keep accounts invested in similar vehicles. In this case, if a portfolio is all mutual funds, I might lean more towards FSKAX. If all ETFs, I might lean more towards SPY.

Tradability

FSKAX does not have a minimum for initial or additional purchases. The minimum purchase size for SPY is typically one share, although fractional shares are becoming more common.

Investors can trade ETFs intraday, as well as in the pre-market and after-hours trading sessions. Investors can only buy/sell mutual funds once per day. This is not necessarily a major factor for long-term investors however.

Final Thoughts: FSKAX vs SPY

Both SPY and FSKAX are large, core funds sponsored and managed by State Street and Fidelity respectively. Although SPY is more of a large-cap ETF and FSKAX is a total market mutual fund, performance has been pretty close. I view these two funds as essentially interchangeable and would not spend too much energy trying to decide which one is “better.” However, there are some situations that may call for one fund versus another.