The Fidelity Total Stock Market Index Fund (FSKAX) is one of the largest mutual funds in the world, with multiple share classes that go back decades. In 2018, Fidelity launched the ZERO Total Market Index Fund (FZROX) which advertises a 0% expense ratio. Investors evaluating FSKAX vs FZROX will be hard-pressed to find many differences beyond the fact that FZROX can only be owned at Fidelity. The funds are nearly identical in every way, except for one major difference: FZROX cannot be bought or owned in non-Fidelity accounts.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

There are very few differences between FSKAX and FZROX, except for the fact that FZROX cannot be bought or owned outside of Fidelity.

The underlying benchmark indices that these funds track are technically different (Dow Jones US Total Market Index vs Fidelity U.S. Total Investable Market Index), but they are identical is most respects. Consequently, the risk and return of FSKAX and FZROX is nearly identical and I consider these two funds equivalent and interchangeable.

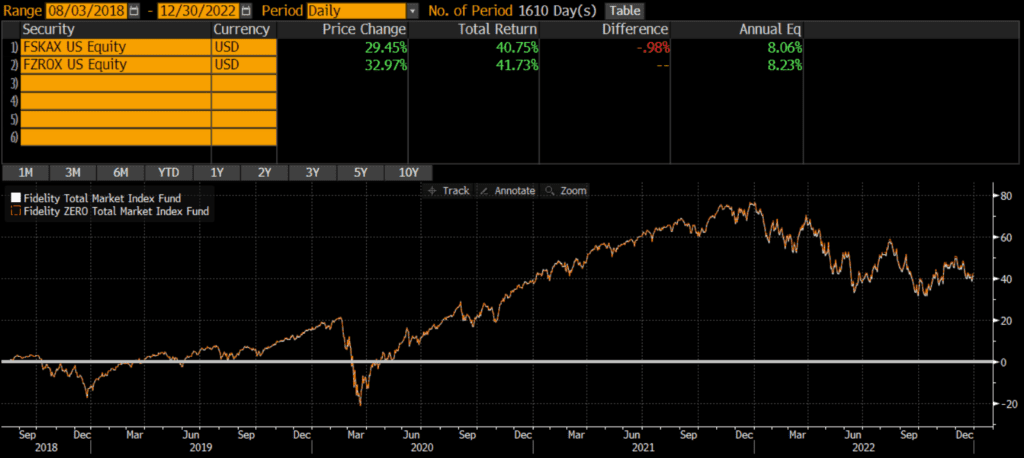

Historical Performance: FSKAX vs FZROX

FSKAX was launched in 2011 (although other share classes of the fund go back decades), while FZROX was launched on August 2, 2018. Since that time, the fund’s have performed nearly identically: 8.06% vs 8.23% annualized. The cumulative performance difference over that time has only been about 1%.

Differences Between FSKAX and FZROX

As the above performance chart shows, the risk and return of the two funds is nearly identical. This is not surprising given the fund composition data below.

Geography

Both the FZROX and FSKAX only include stocks of US-domiciled companies.

Market Capitalization

The two funds have a quite a different number of holdings (as of 11/30/2022); FZROX holds 2,822 stocks versus FSKAX’s 3,989 stocks. However, the market cap weighting of the funds are identical.

| FZROX | FSKAX | |

| Large Cap | 73% | 73% |

| Mid Cap | 19% | 19% |

| Small Cap | 9% | 9% |

Sector Weights

The sector weights of each fund are nearly identical and every single sector weight is with .05% of the other funds.

| FZROX | FSKAX | |

| Basic Materials | 2.67% | 2.66% |

| Consumer Cyclical | 10.47% | 10.43% |

| Financial Services | 14.01% | 14.04% |

| Real Estate | 3.46% | 3.46% |

| Communication Services | 6.90% | 6.91% |

| Energy | 5.14% | 5.13% |

| Industrials | 9.59% | 9.58% |

| Technology | 23.15% | 23.18% |

| Consumer Defensive | 6.79% | 6.77% |

| Healthcare | 14.95% | 14.97% |

| Utilities | 2.87% | 2.87% |

Factors to Consider

Tradability

In my view, the most important factor to consider when evaluating FSKAX vs FZROX is the fact that FZROX cannot be bought or owned outside of Fidelity. Personally, this is a non-starter for me as there are reasons to transfer assets to other custodians, such as transferring one’s accounts or making a donation. Some investors may not value flexibility as much, but they should be aware of this limitation.

Expenses

FZROX grabbed headlines when Fidelity announced it, due to the 0% expense ratio. While zero expenses is great, it is only .015% less than FSKAX. So even though the difference in expenses is infinite in relative terms, its only a basis point and a half difference. At a certain level (such as this one), differences in expense ratios do not matter.

Transaction Costs

ETFs are free to trade at many brokers and custodians, although many still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Fidelity, it is free to trade FSKAX or FZROX. Outside of Fidelity, investors cannot trade FZROX and will have to pay to trade FSKAX.

Tax Efficiency & Capital Gain Distributions

Both FSKAX and FXROX routinely makes capital gains distributions, although they are relatively small owing to the fact that they are both index funds. Taxable investors may want to consider ETFs which are generally more tax-efficient and can read our reviews of FSKAX vs VTI or VTSAX vs ITOT.

Final Thoughts on FSKAX & FZROX

These two funds are nearly identical, except for the fact that FZROX can only be bought and owned at Fidelity. As mentioned above, I view this a severe limitation and would not consider FZROX for my personal portfolio.