Fidelity offers dozens of money market mutual funds, including many government and Treasury money market funds with similar sounding names. Two of the largest funds in the marketplace today are the Fidelity Government Money Market Fund (FZCXX) and the Fidelity Treasury Only Money Market Fund (FDLXX). Comparing FZCXX vs FDLXX may be confusing because the name and fund details are nearly identical, although there is one important difference.

The Short Answer

Comparing FZCXX vs FDLXX is interesting because they are nearly identical from a risk and return perspective, but the taxation is very different. FZCXX primarily owns government-backed repurchase agreements (repos), while FDLXX owns actual Treasuries outright (which are exempt from state tax).

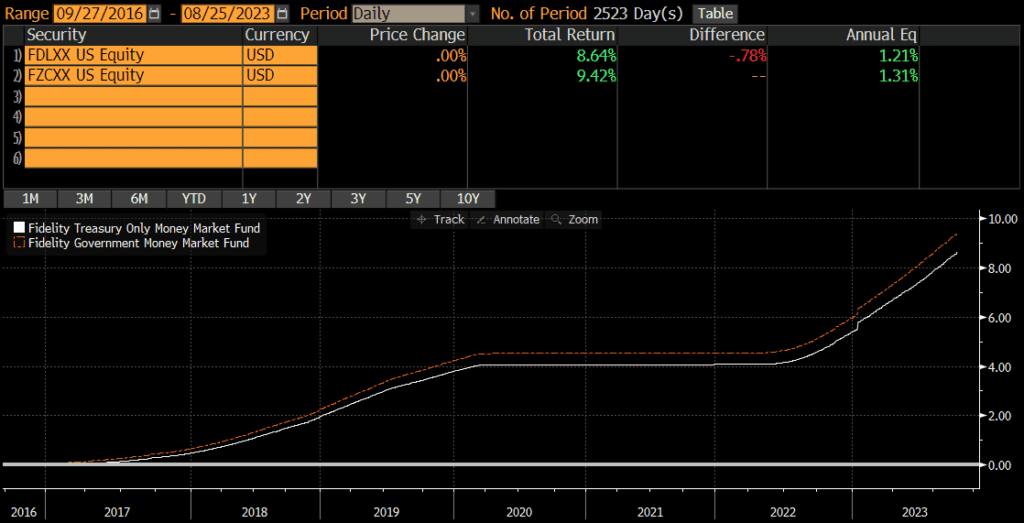

FZCXX vs FDLXX Historical Performance

Since their common inception, FZCXX has outperformed FDLXX by .10% annualized. That difference has compounded over time to a .78% cumulative difference over the past 7 years. Currently the yield difference is about .14%, so future performance may deviate further.

Current Yields for FDLXX & FZCXX

The current 7 day yield is a standardized yield metric for money market mutual funds and the 7 day yields for both FZCXX and FDLXX can be found on the fund’s webpages. See here for FZCXX and here for FDLXX.

What rate is FZCXX & FDLXX paying?

The current interest rate for FZCXX, FDLXX, and other Fidelity money markets can be found on Fidelity’s money market page.

FZCXX & FDLXX Details

The expense ratio is .42% for FDLXX and .32% for FZCXX, which accounts for the majority of the difference in yield and performance. Neither fund charges a load or 12b-1 fees.

FDLXX does not have a minimum investment and investors can invest as little as one cent, while FZCXX has a minimum investment of $100,000 although this can be waived in many situations.

I have not checked every brokerage, but FZCXX and FDLXX are generally only available to clients of Fidelity.

Like most money market mutual funds, investors can sell FZCXX or FDLXX at any time.

FZCXX vs FDLXX Risks

Hypothetically, an investor could lose money with FZCXX or FDLXX, but I personally do not think that is a realistic risk as I believe the fund sponsor or the federal government would intervene if that were about to happen. Technically, it is possible to lose money in FDLXX or FZCXX though.

As of July 31, 2023, FZCXX’s portfolio was over $275 billion, while FDLXX was nearly $5 billion.

IS FZCXX or FDLXX FDIC Insured?

No, neither FZCXX nor FDLXX are FDIC insured.

Holdings

The two funds both invest in government securities, but FDLXX only invests in Treasury securities. Most of FZCXX’s holdings are in government repurchase agreements (63%) and agency debt (18%) among other things. FDLXX holds 81% in Treasuries that it owns outright. The historical performance and yields are nearly identical because the yields of government-backed debt tends to trade together.

Tax Considerations

FZCXX is a government fund, which means that it invests in government securities. FDLXX is a Treasury fund which means that it only invest in Treasuries and related debt instruments. This means that FDLXX is much more tax-efficient for those who are subject to state taxes. Also, taxable investors may find better after-tax yields in municipal (muni) money market funds, which offer tax benefits that may improve investors’ after-tax yield.

Treasuries and Treasury Money Markets

Treasuries are treated very differently than other money market assets (including Treasury repos) for tax purposes. Income from government repos (that FZCXX owns) is subject to state income tax. Income from Treasury bonds is exempt from state income tax. Therefore, FDLXX is generally a much better choice for any investor subject to state tax.

Muni Money Market Funds

Investors subject to higher tax rates may consider municipal (muni) money market funds due to the fact the interest is typically exempt from federal income tax (and often from state tax too!).

The caveat with muni money market funds though is that the yields can move up and down A LOT. Therefore, the stated yield that an investor looks up on any given day is not necessarily indicative of the future return. To understand why, read my post on muni money market yields.

Rather than expecting a muni money market fund’s stated yield, I encourage investors to expect the trailing average yield (over the past few weeks). Generally speaking, the after tax returns of munis will only be higher than non-muni money markets for those in the highest tax brackets.

High Balances

Investors allocating more than $1 million to FDLXX may want to use the less expensive share class, whose symbol is FSIXX. Investors who cannot invest at least $100,000 in FZCXX may want to consider the more expensive share class SPAXX.

Is FZCXX or FDLXX a Better Fund?

As mentioned above, the funds are nearly identical. For investors who live in states with no state income tax or those investing in tax-deferred or tax-exempt accounts (such as IRAs, 401k’s, Roth accounts, etc), then FZCXX has a slightly higher yield. However, nearly all of FDLXX’s income is exempt from state tax, so the after-tax yield is meaningfully higher for investors subject to state taxes.