FNILX vs SPY

The Fidelity ZERO Large Cap Index Fund (FNILX) and the State Street SPDR S&P 500 ETF (SPY) are two of the largest index funds in existence and easily two of the most popular among individual investors. SPY and FNILX are the core of many investor portfolios and many investors compare FNILX vs SPY in order to decide which should be the foundation of their portfolio.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

FNILX and SPY are extremely similar, except for two major differences. In my view, the major difference is that FNILX can only be bought and/or owned at Fidelity (which is a non-starter for many investors, including myself even if my accounts were at Fidelity). Secondly, FNILX is a mutual fund and SPY is an ETF. This difference in structure leads to differences in taxes, tradability, etc.

FNILX is not an S&P 500 index fund and the underlying benchmark indices that these funds track are technically different (S&P 500 Index vs Fidelity US Total Investable Market Index), but they are identical is most respects. Consequently, the risk and return of FNILX and SPY is nearly identical and I consider these two funds equivalent and interchangeable.

The Longer Answer

These two funds are incredibly similar and leads some to question: is FNILX the same as SPY?

Technically, SPY is a different fund with a different structure than FNILX. But for many intents and purposes, SPY and FNILX are identical. Both funds are broad-based indices that represent the US equity markets.

Historical Performance: FNILX vs SPY

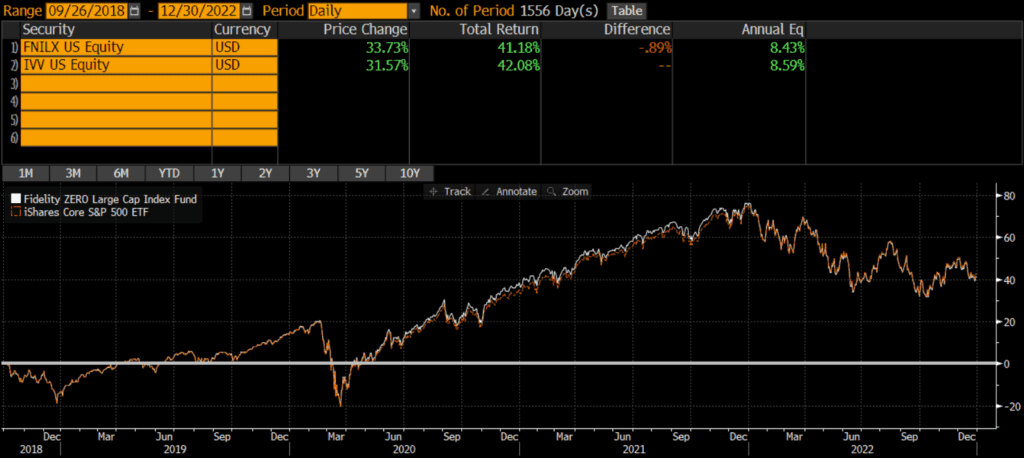

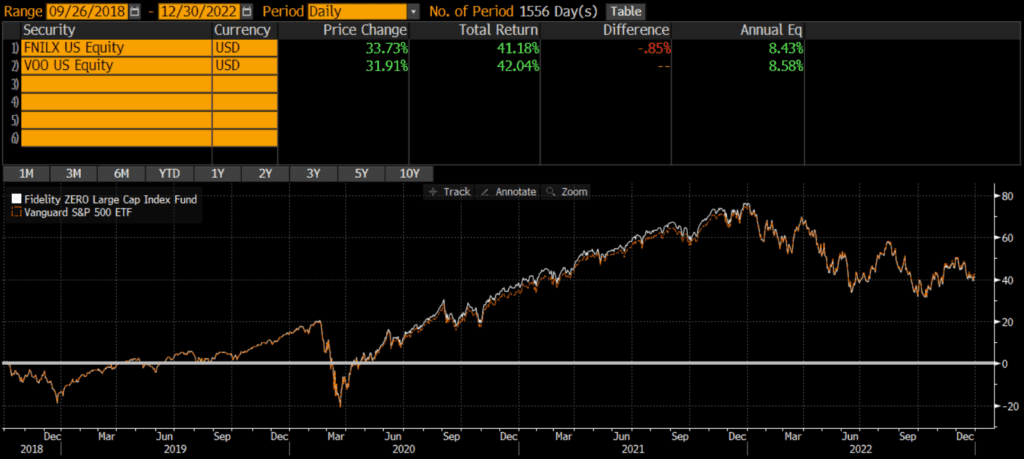

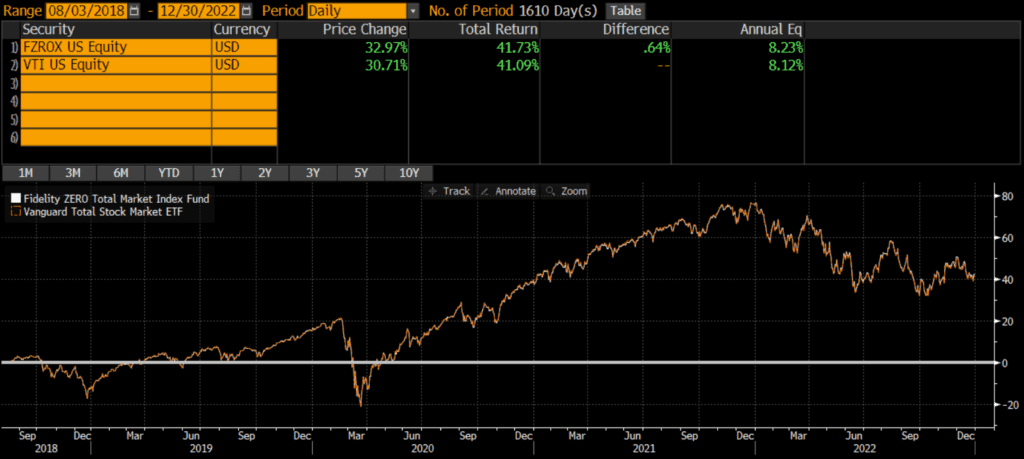

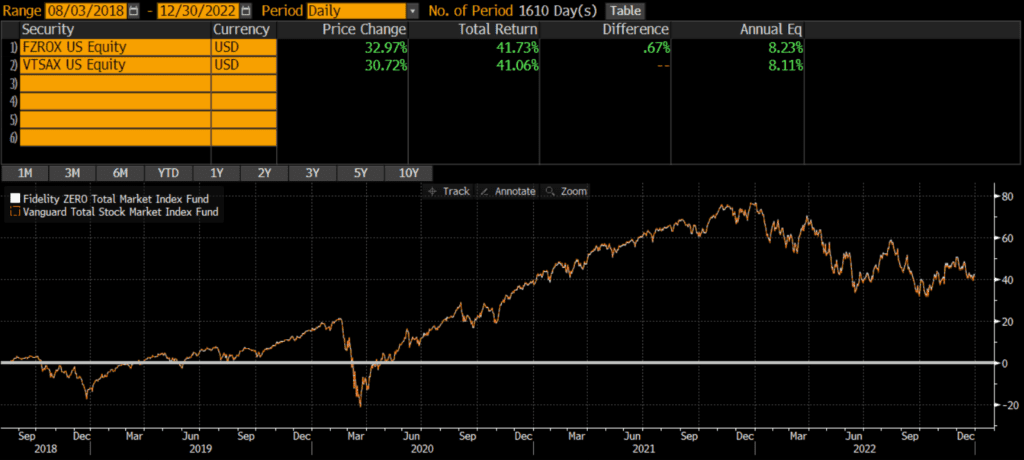

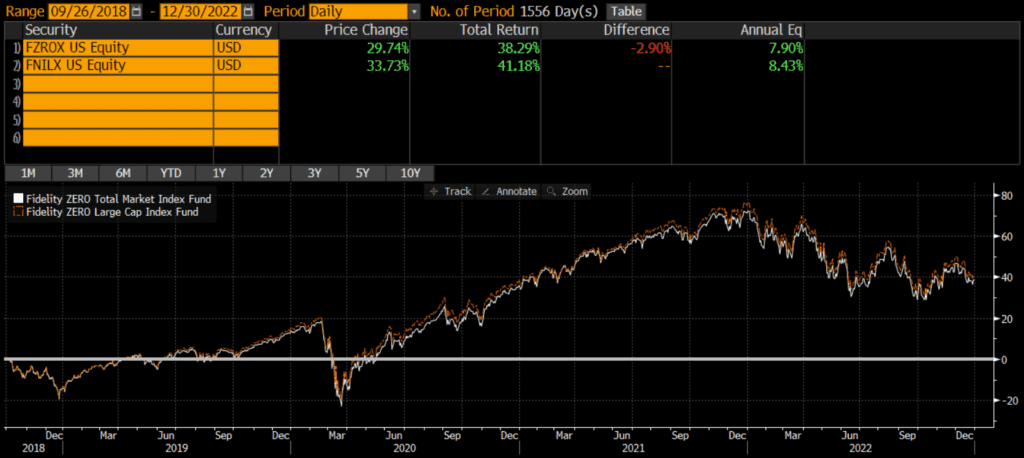

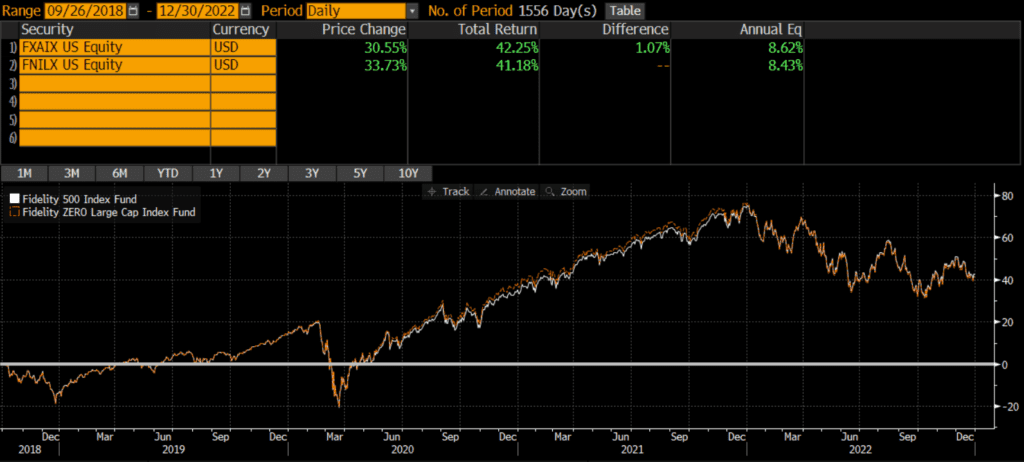

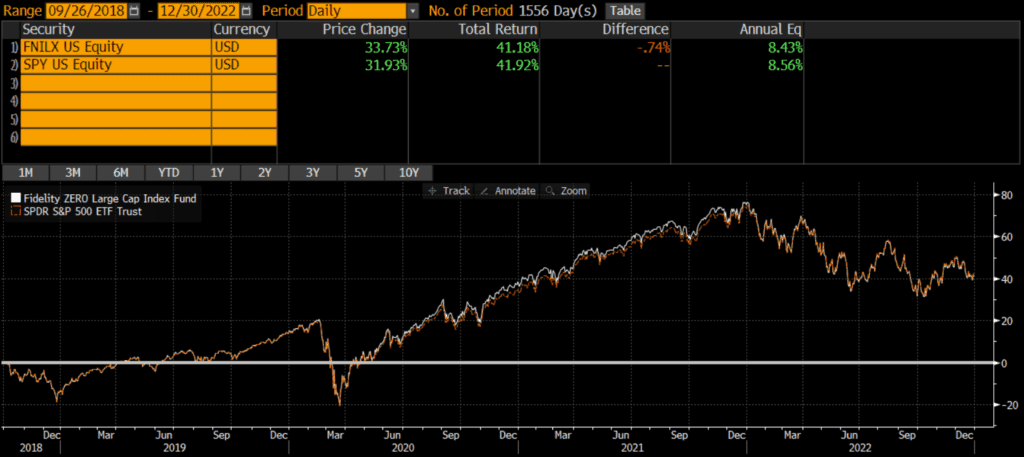

SPY was very first ETF launched (back in 1993), while FNILX was launched in September 2018. Since their common inception date in 2018, the two funds have had nearly identical performance: 8.43% vs 8.56% on an annualized basis. Over those years, the cumulative performance differential has been less than 1%!

Differences Between FNILX and SPY

Geography

Both the SPY and FNILX only include stocks of US-domiciled companies.

Market Capitalization

The two funds have a near identical number of holdings (as of 11/30/2022); SPY holds 509 securities versus FNILX’s 510 stocks. Not surprisingly, the market cap weighting of the funds are essentially identical.

| SPY | FNILX | |

| Large Cap | 84% | 84% |

| Mid Cap | 16% | 16% |

| Small Cap | 0% | 0% |

Sector Weights

The sector weights of each fund very close to one another as the below table shows.

| SPY | FNILX | |

| Basic Materials | 2.46% | 2.41% |

| Consumer Cyclical | 9.57% | 9.95% |

| Financial Services | 13.84% | 13.69% |

| Real Estate | 2.80% | 2.64% |

| Communication Services | 7.28% | 7.53% |

| Energy | 5.23% | 5.12% |

| Industrials | 9.06% | 8.48% |

| Technology | 23.04% | 24.76% |

| Consumer Defensive | 7.61% | 7.18% |

| Healthcare | 15.92% | 15.38% |

| Utilities | 3.19% | 2.86% |

Factors to Consider

Expenses

FNILX grabbed headlines when Fidelity announced it, due to the 0% expense ratio. While zero expenses is great, it is only ~.09% less than SPY. So even though the difference in expenses is infinite in relative terms, its only nine basis points. At a certain level (such as this one), differences in expense ratios do not matter. Since these portfolios are essentially identical, I would most likely lean towards SPY.

Tradability

In my view, the most important factor to consider when evaluating SPY vs FNILX is the fact that FNILX cannot be bought or owned outside of Fidelity. Personally, this is a non-starter for me as there are reasons to transfer assets to other custodians, such as transferring one’s accounts or making a donation. Some investors may not value flexibility as much, but they should be aware of this limitation.

Transaction Costs

ETFs are free to trade at many brokers and custodians, although many still charge commissions and/or transaction fees to buy/sell mutual funds. As mentioned, FNILX can only be bought and/or held at Fidelity. So if an investor account is at Fidelity, it is free to trade FNILX or SPY. However, only SPY is free to trade in non-Fidelity accounts (or even traded at all!).

There is a bid-ask spread when trading ETFs, but this spread is typically less than .01% for SPY and individual investor trades will not generally be large enough to “move” the market. In the case of SPY, individual investors should not have a problem trading.

Tax Efficiency & Capital Gain Distributions

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post).

FNILX routinely makes capital gains distributions, while SPY does not make capital gains distributions nor do I expect it to (since it is an ETF). FNILX is relatively tax-efficient since it is an index fund, but SPY is even more tax-efficient.

Tax Loss Harvesting

My personal preference is to keep a portfolio entirely mutual funds or entirely ETFs, due to the mechanics of settlement during tax loss harvesting. If an ETF has declined in value and an investor sells it, the trade and cash proceeds will not settle for two business days (T+2). That investor may want to “replace” the sold ETF immediately and attempt to buy another ETF or mutual fund simultaneously.

However, mutual funds settle on T+1 basis, so cash for the mutual purchase would be due in one business day (which is one day earlier than the cash from the ETF sale is received). This can obviously cause problems and (even though this issue can be addressed with careful planning) I find it easier to keep accounts invested in similar vehicles. In this case, if a portfolio is all mutual funds, I might consider FNILX. If all ETFs, I might lean more towards SPY.

FNILX vs SPY: The Bottom Line

FNILX and SPY are nearly identical in most respects. Personally, I would not spend too much time trying to divine which is “better” and would just choose whether a mutual fund or ETF makes more sense for my portfolio based on the above factors.

That being said, investors should not consider FNILX unless their account is at Fidelity. If my accounts were at Fidelity, I might consider FNILX in a tax-exempt or tax-deferred account. However, I would never buy FNILX in a taxable account due to the inability to transfer the assets (without realizing a potential gain) out of Fidelity if I wanted to move my accounts, donate the shares, etc.

For those asking: which is better, SPY or FNILX? I believe SPY is better than FNILX in most situations. Personally, I would never buy or recommend FNILX due to the limitations.