VOOG and QQQ are two of the most popular ETFs in the market. Given their popularity, many people compare VOOG vs QQQ and/or ask which fund is a better investment.

My answer to these types of questions is that VOOG and QQQ are very different and not necessarily comparable. So rather than write a long post about similarities and differences between VOOG and QQQ, I’ll provide a framework for thinking about VOOG vs QQQ.

My goal here at ThoughtfulFinance.com is to educate investors and that sometimes includes not answering the exact question that was asked, reframing questions, or providing a different type of answer. As always though, a quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors).

The Short Answer

On the surface, VOOG and QQQ look similar as they’re both large-cap growth-oriented funds. They have very different exposures, although that has not led to meaningful differences in volatility. That being said, QQQ has outperformed by a wide margin since inception. Yet, I would not use either fund as a core position, but they could be used as satellite positions.

Types of Investors

There are a few reasons that someone might want to know whether VOOG or QQQ is a better investment and I think it has a lot to do with who they are. Different types of investors have varying levels of knowledge, differing goals, and so on.

New Investors

Even though VOOG and QQQ are not necessarily comparable, individual investors may not necessarily understand that the funds are different or what differences really matter. New investors may want to just skip to the bottom of this post.

Average Investors

Some investors may understand that VOOG and QQQ are quite different, but may be interested in selecting the one that they believe will perform the best. My response to these investors is that portfolio construction should be based on a target asset allocation (based on risk tolerance, time horizon, liquidity needs, and so on). Once an allocation is selected, then investors can select the best vehicle for each slice of the portfolio allocation. If an investor decides on an asset allocation before selecting investments (as they should!), then the question of VOOG vs QQQ will never come up since they fill different roles in a portfolio.

Day Traders

There are some people who think that they can trade in and out of VOOG, QQQ, and other investments profitably. To those people, I’d say the research, evidence, and odds are stacked against you but good luck!

VOOG vs QQQ: Holdings & Exposures

VOOG and QQQ are not comparable because their underlying holdings are so different. An investor’s preference for VOOG or QQQ will depend on its role in the portfolio.

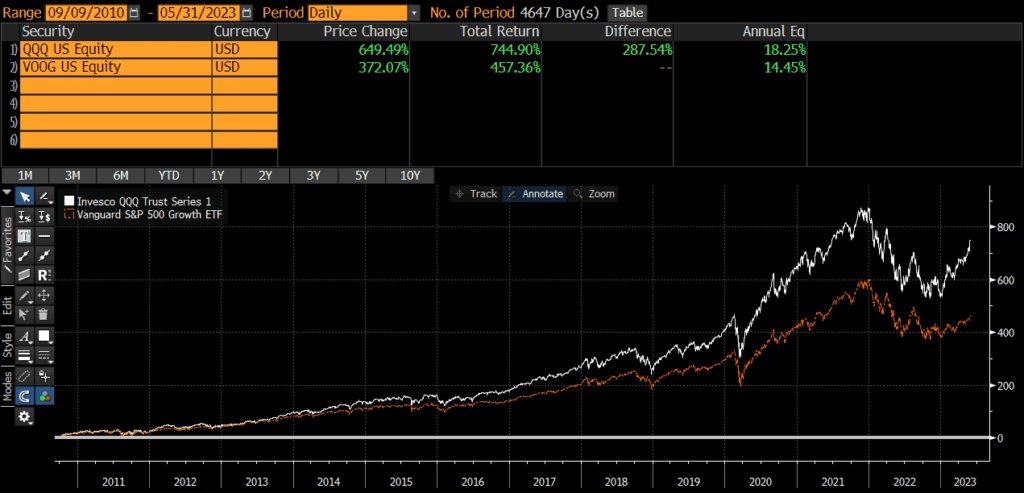

Both funds primarily hold stocks, but the composition and exposures of their holdings is very different. Although both VOOG and QQQ are large-cap growth funds, QQQ is more concentrated in terms of number of companies and sectors. However, this concentration has not necessarily hurt QQQ relative to VOOG. QQQ has underperformed VOOG in some periods, but not always. VOOG has underperformed QQQ since inception, as well as during the drawdowns of 2020 and 2022.

All of that being said, QQQ and VOOG are more volatile than a broad-based index fund such as VTI or IVV. I would never recommend VOOG or QQQ as a core portfolio holding. At best, they could be satellite or complementary positions. For further reading, see my post on VTI vs QQQ.

VOOG vs QQQ: Performance, Expenses, & Risk

I could compare VOOG and QQQ’s historical performance, expense ratios, tax-efficiency, and so on as many sites do. However, these details are only important points of comparison if the funds are comparable, so this post doesn’t include a bunch of meaningless data. Those who are still interested can check out ETF.com’s comparison tool.

Historical Performance

Since VOOG and QQQ have very different holdings and exposures, comparing historical performance is meaningless. One fund will outperform over certain time periods and the other will outperform over other time periods. I am not going to delve into a performance comparison and attribution, since we already know that the funds are very different. Readers who really want this information can check out tools like Morningstar.com.

Expenses

Again, any performance difference caused by the expense ratios of VOOG and QQQ will be dwarfed by larger differences like holdings, exposures, risk factors, etc. Expenses are very important when all else is equal, but VOOG and QQQ are not equal at all!

Risk & Volatility

The two funds are very different, but the risk and volatility has not been that different historically.

ETF Benefits

Both VOOG and QQQ are exchange-traded funds (ETFs), which do have some advantages for investors.

Tax Efficiency

ETFs are typically more tax-efficient than mutual funds, due to their ability to avoid realizing capital gains through like-kind redemptions (a process that is beyond the scope of this post). Thus, these funds are about as tax-efficient as any fund can be and either fund is appropriate in taxable accounts.

Tradability

ETFs are free to trade on many platforms and investors should have no problem trading VOOG or QQQ, which are large and liquid.

Alternative Vehicles

Investors limited to mutual funds should have no problem finding a mutual fund version of VOOG or a mutual fund version of QQQ.

Investors planning to allocate more than $250,000 may consider direct indexing rather than an ETF or mutual fund, especially if they are in a high tax bracket. Any institutional direct indexer should be able to replicate VOOG or QQQ easily.

What Would I Do: VOOG or QQQ?

In my opinion, neither VOOG nor QQQ is appropriate as a core holding for most portfolios. However, I think either QQQ or VOOG could potentially be a satellite holding for some investors. For a core holding, I’d use something like VTI (see how VTI compares to QQQ here).