The Vanguard Consumer Discretionary Index Fund ETF (VCR) and State Street’s The Consumer Discretionary Select Sector SPDR Fund (XLY) are two of the largest consumer discretionary sector ETFs and two of the most popular among individual investors. Many investors compare VCR vs XLY because they are so similar. The funds are quite similar in many respects, but performance has deviated quite a bit lately.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

The primary difference between the funds is that XLY is a large-cap fund, while VCR includes mid-caps and small-caps.

The Longer Answer

Historical Performance: VCR vs XLY

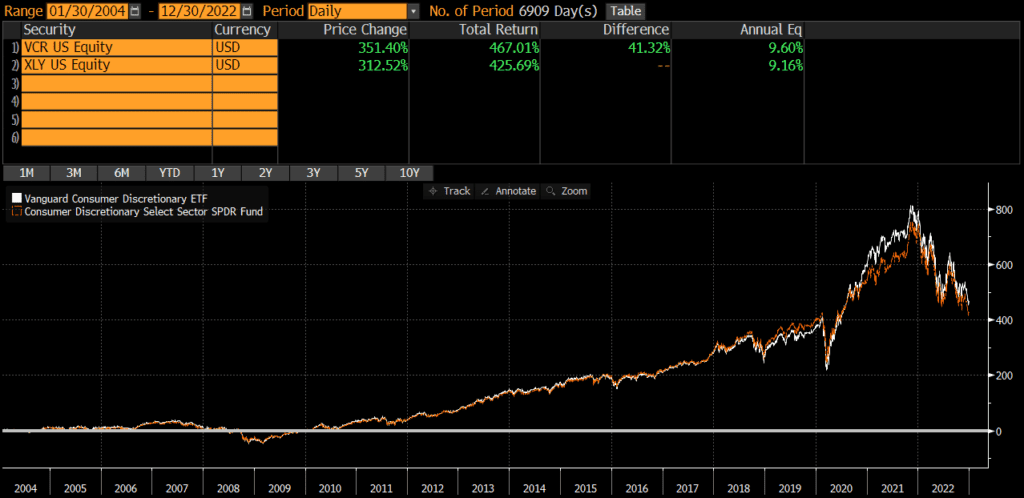

XLY was launched back in 1998, while VCR was launched in 2004. Since the VCR’s launch, the two funds have performed similarly, with an annualized difference of .46%. The cumulative performance differential over that timeframe is only 2.6%.

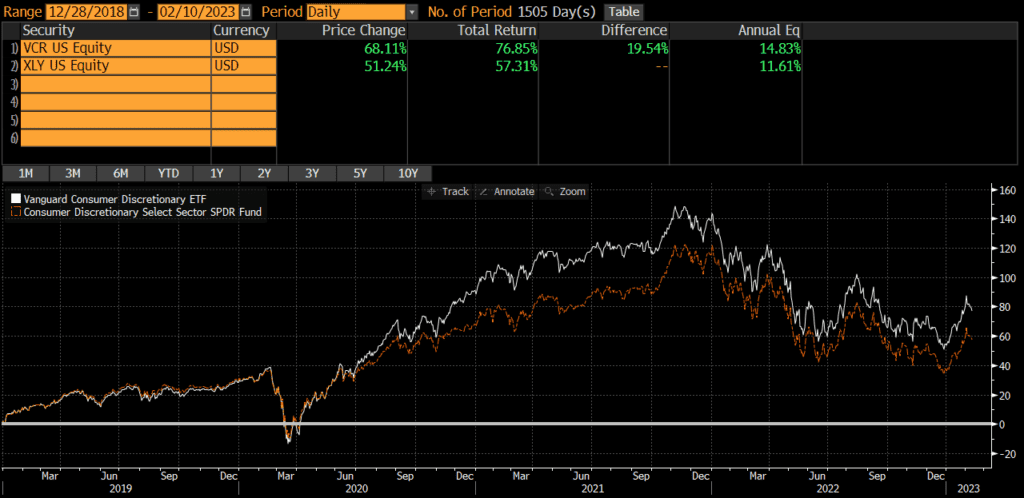

Interestingly, the funds pretty much moved in tandem until 2018 when some changes were made to indices and many index providers moved some mega-cap stocks from the tech sector to the consumer discretionary sector. Then the market environment of 2020 and 2021 caused further differences. If we look at performance from 2019 through early 2023, we find that the annualized performance difference is much wider at over 3% annually.

Portfolio Exposures: VCR vs XLY

XLY tracks the Consumer Discretionary Select Sector Index, which is essentially a sub-index of the S&P 500 (which is predominantly composed of large-caps). It has changed over the years, but the index that VCR currently tracks is includes more mid-caps and small-caps (even though it is also predominantly large-caps).

Geographic Exposure

Both VCR and XLY hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical geographic exposures.

Market Cap Exposure

As the below data illustrates, XLY primarily holds large-caps, while VCR is a bit more diversified in terms of market cap. Despite this difference, both funds are market-cap weighted and risk/return is overwhelmingly driven by the large-cap exposure.

| XLY | VCR | |

| Large Cap | 84% | 72% |

| Mid Cap | 16% | 19% |

| Small Cap | 0% | 8% |

Sector Exposure

VCR and XLY are consumer discretionary ETFs and so their holdings are 100% consumer discretionary stocks.

Practical Factors: VCR vs XLY

Transaction Costs

As ETFs, both XLY and VCR are free to trade on many platforms. Bid-ask spreads for both VCR and XLY are extremely low and volume is sufficient to prevent most individual investors from “moving the market.” Investors looking for a mutual fund may want to read my comparison of VCR vs VCDAX (VCR’s mutual fund share class).

Expenses

The expense ratio for both XLY and VCR is .10%. At these low levels of expense ratios, small differences in expense ratios does not typically matter anyways. Something to keep in mind if one fund or the other decides to reduce fees.

Tax Efficiency & Capital Gain Distributions

Neither VCR nor XLY has ever made a capital gain distribution and I do not expect either fund to make capital gains distributions moving forward (since they are ETFs). In my opinion, these two funds are equally tax-efficient.

Options Strategies

The one factor that may sway someone towards XLY is if they are managing some type of option strategy, such as covered calls. The options market for XLY is much more active than for VCR. Of course, if someone wants to trade options without triggering tax consequences in another part of their portfolio, perhaps VCR is the better pick for the non-option holding.

Bottom Line: VCR vs XLY

VCR and XLY are fairly similar in most ways and the decision to use one versus the other depends on an investor’s preference for small-caps or large-caps. I believe investors’ time is better spent evaluating and thinking through more material decisions.

For those interested in other consumer discretionary ETFs, check out my comparison of Fidelity’s consumer discretionary ETF FDIS vs VCR.