The Vanguard Consumer Discretionary Index Fund ETF (VCR) and the Fidelity MSCI Consumer Discretionary Index ETF (FDIS) are two of the largest consumer discretionary sector ETFs and two of the most popular among individual investors. Many investors compare VCR vs FDIS because they are so similar. Although the funds have some major historical differences, I expect that they will be much more similar moving forward.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

VCR and FDIS track the same index and there is no material difference between the funds. They are identical and interchangeable in my opinion.

There is a long-term performance differential, although that mainly relates to the different indices that each fund tracked and how VCR and FDIS handled changes to the underlying index. Barring further changes, performance is likely to be similar, if not identical.

The Longer Answer

Historical Performance: VCR vs FDIS

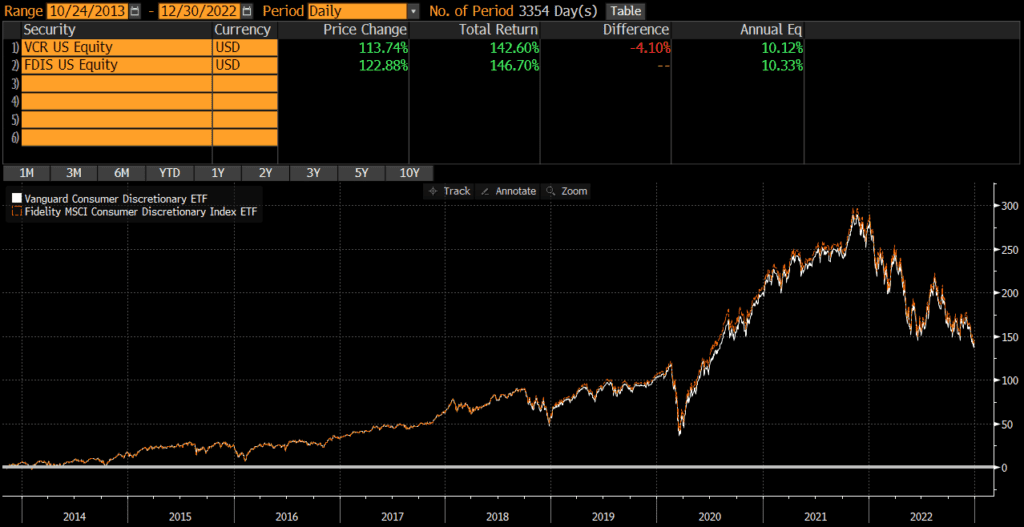

VCR was launched back in 2004, while FDIS was launched on October 21, 2013. Since then, the two funds have performed quite similarly, with an annualized difference of nearly .21% (and 4.1% cumulatively)!

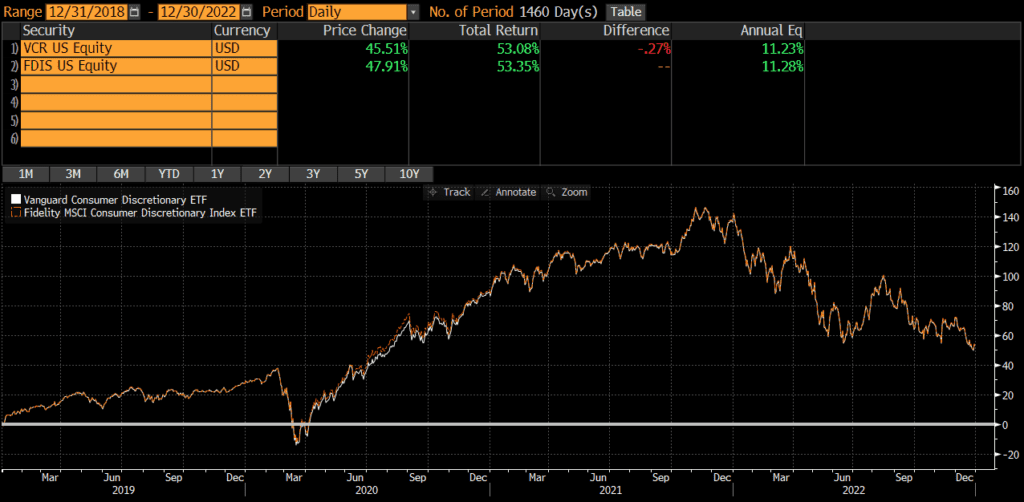

However there is more than meets the eye here. In 2018, MSCI made some changes to their classifications which impacted the consumer discretionary indices. Vanguard and Fidelity handled these changes in slightly different ways. If we track the two ETFs from the beginning of 2019, we find a smaller differential, with an annualized difference of only .05%.

Consequently, from a performance perspective, I view VGT and FTEC as identical and interchangeable.

Portfolio Exposures: VCR vs FDIS

Both VCR and FDIS track the same index, the MSCI US Investable Market Consumer Discretionary 25/50 Index. Consequently, the two funds have identical geographic, market-cap, and industry exposures.

A Note On Portfolio Construction

VCR implements a “full replication” strategy in which the fund holds stocks in the same proportions of the index. FDIS practices a representative or sampling strategy that allows holdings to deviate from the index weights a bit, but uses an algorithm to keep the risk and return relatively close to the index.

Geographic Exposure

Both VCR and FDIS hold essentially 100% stocks, so I will not dig into country exposures or market classification here. For all intents and purposes, the two funds have identical geographic exposures.

Market Cap Exposure

As mentioned above, both funds track the same index and have materially identical market cap exposures.

Sector Exposure

VCR and FDIS are consumer discretionary ETFs and so their holdings are 100% consumer discretionary stocks.

Practical Factors: VCR vs FDIS

Transaction Costs

As ETFs, both FDIS and VCR are free to trade on many platforms. Bid-ask spreads for both VCR and FDIS are extremely low and volume is sufficient to prevent most individual investors from “moving the market.” Investors looking for a mutual fund may want to read my comparison of VCR vs VCDAX (VCR’s mutual fund share class).

Expenses

FDIS has a lower expense ratio at .08%, compared to VCR’s .10%. Although VCR is 25% more expensive, we’re talking about 2 basis points. At these low levels of expense ratios, the difference doesn’t matter.

Tax Efficiency & Capital Gain Distributions

Neither VCR nor FDIS has ever made a capital gains distribution and I do not expect them to make any moving forward. In my opinion, these two funds are equally tax-efficient.

From a tax-loss harvesting perspective, investors may want to avoid using these two funds as substitutes for one another since they could be considered “substantially identical” (given that they track the same index and are identical in many ways).

Bottom Line: VCR vs FDIS

VCR and FDIS are materially identical in nearly every way. I would not spend any time comparing them or trying to decide which is better.

For further reading, checking out my comparison of VCR vs XLY (State Street’s consumer discretionary ETF).