The Vanguard S&P 500 Index Fund (VFIAX) is one of the largest mutual funds in the world, with multiple share classes that go back decades. In 2018, Fidelity launched the ZERO Large Cap Index Fund (FNILX) which advertises a 0% expense ratio. Investors evaluating VFIAX vs FNILX will be hard-pressed to find many differences, but there are a few. The funds are nearly identical in every way, except for one major difference: FNILX cannot be bought or owned in non-Fidelity accounts.

A quick reminder that this site does NOT provide investment recommendations. Fund comparisons (such as this one) are not conducted to identify the “best” fund (since that will vary from investor to investor based on investor-specific factors). Rather, these fund comparison posts are designed to identify and distinguish between the fund details that matter versus the ones that don’t.

The Short Answer

There are very few differences between VFIAX and FNILX, except for the fact that FNILX cannot be bought or owned outside of Fidelity. The other major difference is that the VFIAX is quite a bit more tax-efficient.

The underlying benchmark indices that these funds track are technically different (S&P 500 Index vs Fidelity U.S. Large Cap Index), but they are identical is most respects. Consequently, the risk and return of VFIAX and FNILX is nearly identical and I consider these two funds equivalent and interchangeable.

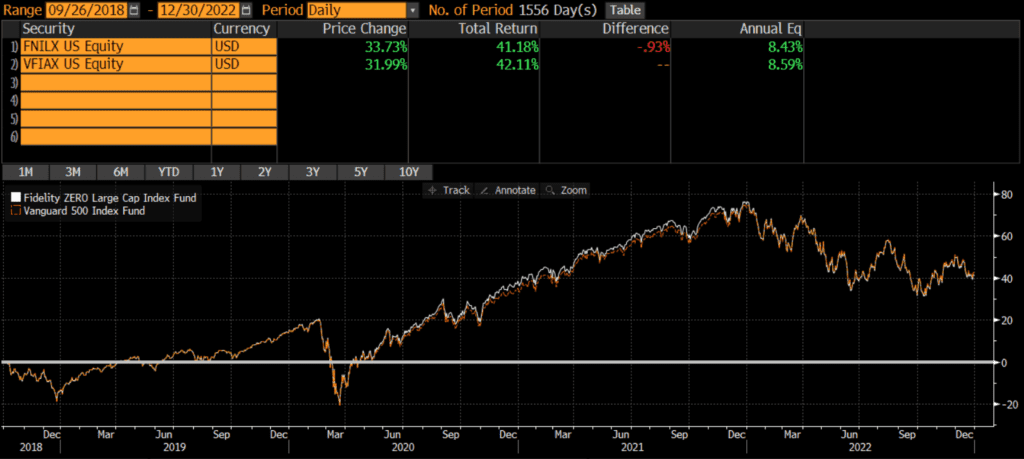

Historical Performance: VFIAX vs FNILX

VFIAX was launched in 2000, while FNILX was launched on September 13, 2018. Since that time, the fund’s have performed nearly identically: 8.43% vs 8.59% annualized. The cumulative performance difference over that time has been less than 1%.

Differences Between VFIAX and FNILX

As the above performance chart shows, the risk and return of the two funds is nearly identical. This is not surprising given the fund composition data below.

Geography

Both the FNILX and VFIAX only include stocks of US-domiciled companies.

Market Capitalization

The two funds have approximately the same number of holdings and the market cap weighting of the funds are nearly identical.

| FNILX | VFIAX | |

| Large Cap | 84% | 84% |

| Mid Cap | 16% | 16% |

| Small Cap | 0% | 0% |

Sector Weights

The sector weights of each fund are nearly identical with most sector weights within 1% of the other fund.

| FNILX | VFIAX | |

| Basic Materials | 2.41% | 2.46% |

| Consumer Cyclical | 9.95% | 9.57% |

| Financial Services | 13.69% | 13.84% |

| Real Estate | 2.64% | 2.80% |

| Communication Services | 7.53% | 7.28% |

| Energy | 5.12% | 5.23% |

| Industrials | 8.48% | 9.06% |

| Technology | 24.76% | 23.04% |

| Consumer Defensive | 7.18% | 7.61% |

| Healthcare | 15.38% | 15.92% |

| Utilities | 2.86% | 3.19% |

Factors to Consider

Tradability

In my view, the most important factor to consider when evaluating VFIAX vs FNILX is the fact that FNILX cannot be bought or owned outside of Fidelity. Personally, this is a non-starter for me as there are reasons to transfer assets to other custodians, such as transferring one’s accounts or making a donation. Some investors may not value flexibility as much, but they should be aware of this limitation.

Expenses

FNILX grabbed headlines when Fidelity announced it, due to the 0% expense ratio. While zero expenses is great, it is only .03% less than VFIAX. So ever though the difference in expenses is infinite in relative terms, its only a three basis point difference. At a certain level (such as this one), differences in expense ratios do not matter.

Transaction Costs

ETFs are free to trade at many brokers and custodians, although many still charge commissions and/or transaction fees to buy/sell mutual funds. To my knowledge, Fidelity does not participate in the pay-to-play arrangements that would allow their mutual funds to trade for free on many platforms. So if an investor account is at Vanguard, it is free to trade VFIAX. If at Fidelity, it is free to trade FNILX. Outside of Fidelity, investors cannot trade FNILX and will have to pay to trade VFIAX (unless at Vanguard). Thus, investors may want to consider using an ETF.

Tax Efficiency & Capital Gain Distributions

FXROX routinely makes capital gains distributions, while VTSAX does not make capital gains distributions (nor do I expect it to, due to Vanguard’s fund structure). Thus, VFIAX is the more tax-efficient choice. Taxable investors may want to consider ETFs which are generally more tax-efficient and can read our reviews of VFIAX vs VOO or VFIAX vs SPY.

Final Thoughts on VFIAX & FNILX

VFIAX and FNILX are nearly identical, except for the fact that FNILX can only be bought and owned at Fidelity. As mentioned above, I view this a severe limitation and would not consider FNILX for my personal portfolio.